Technology leads US equities rebound

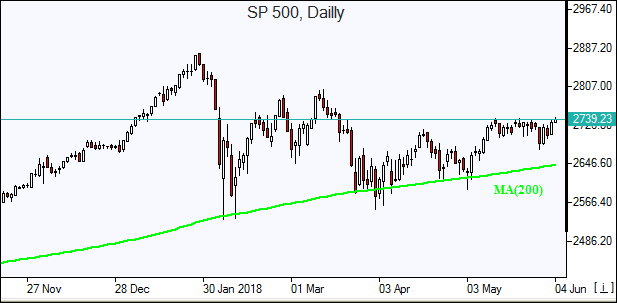

US markets recovered Friday on upbeat May jobs report and economic data. S&P 500 rose 1.1% to 2734.62, ending 0.5% up for the week. Dow Jones industrial average added 0.9% to 24635.21. The NASDAQ Composite jumped 1.5% to 7554.33. The dollar strengthened as the US created 223,000 new jobs in May, above an expected 190,000: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 94.196 but is lower currently. Stock index futures indicate higher openings today.

European stocks extend weekly losses

European stock indices ended higher Friday led by Italian and Spanish stocks following ebbing political uncertainty. The euro fell against the dollar while the British Pound climbed, and both currencies are rising currently. The Stoxx Europe 600 Index rose 1%, however ending 1.1% lower for the week. The DAX 30 gained 1% to 12724.27. France’s CAC 40 rose 1.2% and UK’s FTSE 100 edged 0.3% higher to 7701.77. Markets opened 0.3% - 0.9% higher today.

Asian markets rising

Asian stock indices are gaining today as strong US nonfarm payroll report bolstered global growth perspectives. Nikkei ended 1.4% higher at 22475.94 helped by continued yen weakness against the dollar. Chinese stocks are gaining against the backgrowud of China’s warning trade agreements are off if tariffs are imposed: the Shanghai Composite Index is up 0.5% while Hong Kong’s Hang Seng is 1.5% higher. Australia’s ASX All Ordinaries is up 0.6% despite accelerated rise in Australian dollar against the greenback.

Brent rises

Brent futures prices are moving higher today. Prices fell Friday on rising US crude oil output as Baker Hughes reported the number of active US rigs drilling for oil was up 2 at 861 last week. Brent for August settlement lost 1% to close at $76.79 a barrel Friday.