Main US stock indices log third straight gain

US stocks extended gains on Thursday with all three main indices advancing three sessions in a row as trade war fears eased. Dow Jones Industrial Average gained 1% to 24505. The S&P 500 gained 0.7% to 2663 with ten of the 11 main sectors finishing higher. The NASDAQ Composite added 0.5% to 7077. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 90.41. Stock indices futures indicate lower openings today.

US and China tariff plans headlines have been the cause in volatility upshot recently after US President Donald Trump ordered drawing of tariffs on Chinese goods totaling $50 billion. Following China’s countermeasures targeting 103 categories of US goods totaling $50 billion in US exports including soybeans and airplanes, markets calmed on possibility of a negotiated settlement of the trade dispute as US and China mentioned they were ready to conduct talks on matters of mutual interest.

However, President Trump said he was considering imposing tariffs on an additional $100 billion in imports from China, citing China’s ‘unfair retaliation’ of $50 billion in US tariffs. Economic data were mixed: Initial US jobless claims jumped by 24,000 to 242,000. And the US trade deficit rose 1.6% in February. Today, March employment growth is expected to come in at a slower pace, after a strong start to 2018.

DAX leads European indices rally

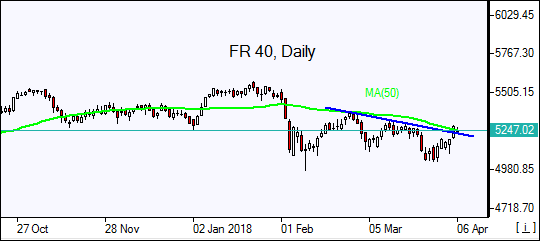

European stocks ended sharply higher on Thursday led by rally in auto maker and bank shares. Both the euro and British Pound turned lower against the dollar. The STOXX Europe 600 index jumped 2.4%. Germany’s DAX 30 outperformed rallying 2.9% to 12305.19. France’s CAC 40 soared 2.6% and UK’s FTSE 100 jumped 2.4% to 7199.50. Indices opened 0.2% - 0.7% lower today.

Weak economic data were shrugged off: euro-zone’s composite purchasing managers index slipped to 55.2 in March. A reading above 50 signals expansion. And retail sales in the region and German factory orders rose less than expected in February. UK data showed Markit’s services PMI fell to 21.7, the lowest reading since Brexit referendum.

Hang Seng leads Asian indices gains

Asian stocks are mixed today after investor optimism was undermined by President Trump’s threat to impose additional $100 billion of Chinese imports. Japan's Nikkei fell 0.3% to 21581.50 despite continued yen weakening against the dollar. Chinese stocks are mixed as China responded saying it would counter US protectionism “to the end, and at any cost”: the Shanghai Composite is 0.2% lower and Hong Kong’s Hang Seng is up 1.1% as it catches up on markets Thursday gains after reopening following a holiday.

Brent slips

Brent futures prices advanced yesterday as concerns about global trade war abated. They are edging lower today after Trump said he considers imposing additional $100 billion tariffs on Chinese imports. Prices rose yesterday: Brent for June settlement gained 0.5% to close at $68.33 a barrel on Thursday.