Thursday April 13: Five things the markets are talking about

Capital markets were heading into an Easter holiday stupor before President Trump “intentionally ” shook things up in a press conference late Wednesday afternoon.

Trump said that a strong U.S dollar would ultimately hurt their economy and that he prefers a low interest rate policy. The President also reversed his position on China, saying he will not label the Asian nation a currency “manipulator.” In another reversal, he said he likes and respects Fed Chair Yellen, and that it’s too soon to comment on whether he might re-nominate her at the end of her term in 2018.

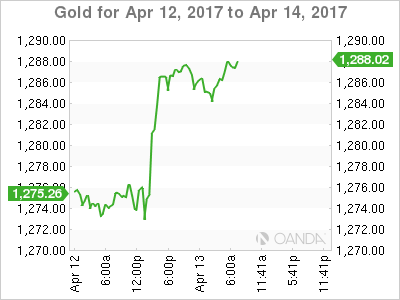

The dollar has since plunged on his jawboning; gold has rallied to five-month highs, while U.S treasury yields have fallen to five-month lows.

Note: Most financial markets are closed on Friday for the Good Friday holiday, and today’s trading volumes are expected to be much lighter than usual.

1. Global stocks see mixed results

In Japan, equities crashed to new four-month low overnight as the yen (¥108.76) spiked to new yearly highs on Trump’s currency jawboning. The Nikkei 225 share average ended -0.7% lower, while the broader Topix fell -0.8%, paring an earlier drop of -1.4%.

Note: The Topix has the second-worst performance among developed markets this year, with a loss of -3.3%.

Down-under, Sydney’s S&P/ASX 200 dropped -0.7%, falling for the first time in five days as commodity producers led declines. In Singapore, the FTSE Straits Times Singapore Index lost -0.7%, while in Hong Kong, the Hang Seng fell -0.3%, after earlier rising +0.3%.

In China, stocks inched higher as investors continued to bet on stocks that could benefit from Beijing’s plan to build a vast new economic zone, though gains were capped by fears that policy tightening will crimp economic growth. The blue-chip CSI 300 Net TR USD index rose +0.2%, while the Shanghai Composite Index added +0.1%.

In Europe, equity indices are trading lower ahead of the long Easter weekend amid ongoing geopolitical tensions. Banking stocks are leading the losses in the Eurostoxx, while energy stocks are trading lower in the FTSE 100.

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.6% at 3,451, FTSE -0.5% at 7,312, DAX -0.3% at 12,113, CAC 40 -0.5% at 5,076, IBEX 35 -0.6% at 10,303, FTSE MIB -0.9% at 19,832, SMI -0.4% at 8,631, S&P 500 Futures -0.1%

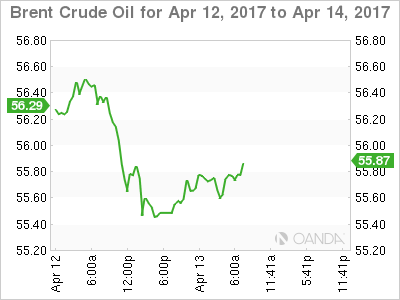

2. Oil little changed amid rising U.S. output, Gold higher

Crude oil futures are largely unchanged overnight, with the market torn between rising U.S production and the output cuts being made by OPEC.

Brent crude futures are flat at +$55.86 a barrel, U.S West Texas Intermediate (WTI) crude futures are down -6c at +$53.05 a barrel.

Yesterday’s weekly inventory report had something for everyone. Preliminary U.S production estimates in the EIA report suggested that domestic output is still climbing – stockpiles at Cushing, Oklahoma, rose +276k barrels in the week ended April 7.

Nevertheless, the headline print showed an unexpected drop in overall U.S inventories, which fell last week by -2.2m barrels as imports declined by -717k barrels a day.

Note: The IEA Monthly Report noted that the oil market was already very close to balance. They have trimmed 2017 global oil demand growth from +1.4m bpd to +1.32m bpd and raised non-OPEC oil supply growth forecast from +400k bpd to +485k bpd, while OPEC member production declined from +32.0m to +31.68m, compliance of +99% vs. +91% m/m.

Gold (+0.2% to +$1,287.98) has rallied to a five-month peak overnight amid rising tensions over U.S relations with Russia and North Korea. Prices are also being supported by the “big” dollars slide.

The “bulls” are eyeing the psychological +$1,300 handle now that the market has penetrated the previous strong resistance point above +$1,280.

3. Global yields fall on Trump rhetoric

Yields on high-rated Eurozone government bonds have fallen to multi-month lows ahead of the U.S open after Trump said he would prefer the Fed to keep interest rates low.

Tracking U.S Treasuries lower, investors have piled into German, Dutch and Finnish debt.

This morning, the German 10-Year Bund yield hit its lowest level since early January at +0.181%, down -2 bps. Both Dutch and Finnish debt gave up -2 and -3 bps respectively.

Trump’s comments cast doubt on the future pace of Fed rate hikes, and the benchmark U.S Treasury yield dropped a further -5 bps to +2.22%, its lowest level in almost five-months.

Geopolitical and French Presidential election risks have seen the yield on 10-year Bunds fall over -30 bps from its mid-March peak of +0.51% and U.S 10’s move from +2.60% to +2.22%.

Note: The gap between French and German 10-year borrowing costs, an indicator of concerns over the election, is at +71.4 bps, +4 points off one-month highs hit earlier this week.

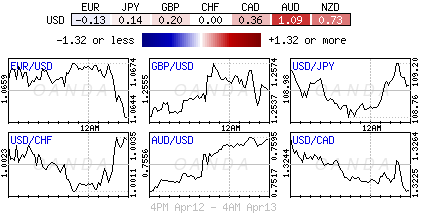

4. The “Big” dollar takes a dive

President Trump’s interview yesterday now sows doubts about the Fed’s determination to ‘normalise’ its monetary policy sufficiently quickly. This is bad news for the dollar.

Trumps jawboning saw the dollar print fresh lows across the board yesterday and in the overnight session the USD has managed to retrace a small fraction of its losses.

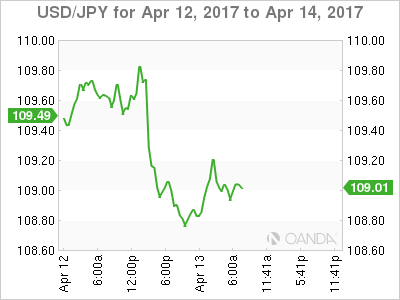

USD/JPY hit a five-month lows in Asia at ¥108.71 and now trades atop its softest level since Trump won the U.S election in Nov. Uncertainty before the French presidential elections is also causing the EUR to give up some of its gains, last down -0.1% at €1.0655.

The Chinese Yuan (CNH) is firmer now that Trump seems to have backed off from his campaign pledge to label China a currency manipulator. The People’s Bank of China (PBoC) has guided the yuan (¥6.8651 a +0.4%) to its biggest one-day advance against the dollar in nearly three-months.

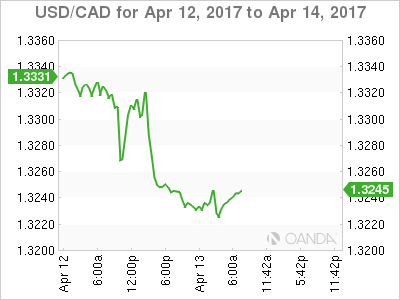

Commodity currencies are firmer as well, aided by the weak USD and geo-political concerns. The CAD (C$1.3244) hit a 6-week high after the BoC turned less dovish at its rate decision yesterday.The AUD (A$0.7578) is being supported by stronger jobs data (see below).

5. China trade rebounds, Aussie employment surges

Data overnight showed that China’s Trade Balance rebounded to a surplus after last month’s surprise deficit.

Exports (in CNY terms) were well above consensus at +22.3% vs. +8.0%e. Imports also beat at +26.3% vs. +15.0%e, and even Crude Oil prices saw an uncharacteristic bounce on China trade with a +20c rise as Mar. imports of +9.24m bpd registered a record high.

China Customs noted that trade is improving as global demand recovers, but also warned that import growth may slow in Q2.

Note: The PBoC has resumed its open market operations after a two-week pause with a ¥110B injection.

In Australia, their employment data also reversed last month’s negative surprise. Despite the unemployment rate remaining at +5.9%, net jobs gains recorded a 16-month high at +60.9K vs. +20.3Ke. The participation rate also rose to an eight-month high of +64.8% vs. +64.6%e.