Overnight and early trading

The sharemarket bounced higher at the open, supported by strong gains in the miners. The S&P/ASX200 was up 0.45% at 5687.6 at 10.20am. The big four banks were mixed but will be closely watched after having been heavily sold off recently.

The S&P 500 Index ground out a new record high on Thursday, as stocks gained broadly in quiet trading.

The broad market index added 4.97 points, or 0.2%, to 2130.82, surpassing its last record reached on Monday. The Dow Jones Industrial Average gained 0.34 points to 18285.74, still 0.1% shy of its Monday record of 18312.39.

The Nasdaq Composite Index rose 19.05 points, or 0.4%, to 5090.79, but stopped just short of its April 24 record of 5092.09. The gains came on the back of quiet trading in stocks, as major benchmarks have hugged a narrow range all week.

This week is on pace to be the slowest in stock trading since the week of New Year’s Day. Through to Wednesday, an average of 5.76 billion shares have changed hands. Daily volume this year has been averaging about 6.6 billion shares.

European stocks recovered from losses, giving a lift to US shares. Germany’s DAX gained 0.1%, its third gain in four sessions. France’s CAC 40 rose 0.3%.

In commodity markets, gold futures fell 0.4% to $1204.40 an ounce. Crude-oil futures rose 3% to $60.72 a barrel.

Local markets

- The S&P/ASX 200 Index futures contract rose 0.3% to 5,685 with futures relative to estimated fair value suggesting an early gain of 0.3%.

- Bank of New York Australia ADR Index +1.1% with BHP Billiton (LONDON:BLT) ADR +0.6% and Rio Tinto (LONDON:RIO) ADR +0.8%

- Spot gold shed 0.3% to $1,206 with very little volatility since midnight. Gold stocks: NCM, NST, AQG, EVN, KCN, RMS, SLR

- Crude oil continued its rebound from yesterday with WTI and Brent both up 2.6% and 1.2% to $60.73 and $66.53 respectively. End user demand appears to have been stronger as inventories in the US decline. Anticipation in the US of record travel in 10 years is expected over this Memorial Day according to AAA. Oil stocks: WPL, STO, SEA, BPT, OSH, HZN, DLS, AWE, KAR, ORG, SXY

- Iron ore rose 1.4% to $57.91 on physical demand. Baltic Dry Index showed overall demand remains weak and we expect the iron ore price not to sustain any "strength". Iron ore stocks: FMG, BHP, GBG, GRR, MGX, RIO, ARI, BCI, SDL

- Base metals were mixed. Copper showed the largest movement, up 0.8% to $6,265 as inventory drawdown at the LME is on target for the largest in nine months. Rising aluminium stocks have weighed on the lightweight metal, down 0.3% to $1,776. An expectation is for aluminium prices to continue to be soft. Flash PMI in China of sub 50, as well as the removed export tax on some (potential to be all) aluminium products will add to global supply in the months to come. Copper stocks: PNA, OZL, SFR; Nickel stocks: WSA, SIR; Aluminium stocks: AWC

- Cardno (CDD): Undisclosed investor offers to buy 16.6m shares at AUD 2.60 each, a 10.2% premium to last close; doesn’t currently plan to make the bid, according to deal terms seen by Bloomberg

- Echo Entertainment (EGP): Plans AUD 100m Star renovation

- NAB (NAB): Gets approval for second branch in China

- Perpetual (PPT): Says tactically selling South32 (S32) shares

- Qantas (QAN): Vietnam Jetstar Pacific earns first profit since 2008. Note: Qantas has 30% stake in company

- OZ Minerals (OZL), Evolution (EVN), Independence (IGO): Companies expected to bid for Barrick’s Cowal mine; Barrick said not to accept anything under $600m, final bids due today

- Ex-dividend: No shares go ex-dividend today

Data points

Friday

- JPN: Monetary Policy Statement, BOJ Press Conference (Time tba)

- EUR German Ifo Business Climate

- ECB President Draghi Speaks: Due to speak at the ECB Forum on Central Banking titled "Inflation and Unemployment in Europe" in Portugal

- MPC Member Shafik Speaks: Due to speak at the Association of Corporate Treasuries conference, in Manchester

- US CPI m/m, Core CPI m/m

- ECB President Draghi, BOE Governor Carney Speaks and BoJ Governor Kuroda Speaks: Due to participate in a panel discussion at the ECB Forum on Central Banking titled "Inflation and Unemployment in Europe" in Portugal

Current ASX Trades

- AMP Limited: Entered long position on February 6 at AUD 6.10. First profit target was reached on February 18 at AUD 6.49 (+6.4%) and second profit target is at AUD 7.12 (+16.7%). Third and final profit target is at AUD 8.00 (+31%) which remains in place. Stop loss trailed to entry price of AUD 6.10.

Broker Upgrades

- BHP (BHP): Cut to market perform at BMO Capital Markets

Broker Downgrades

- South32 (S32): Rated new market perform at BMO Capital; rated new conviction buy at Goldman

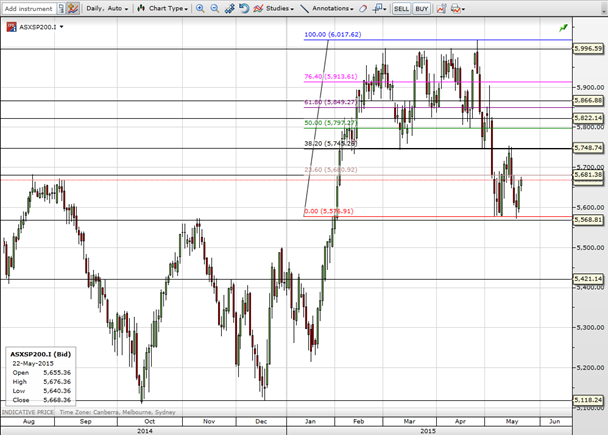

ASXSP200.I

ASXSP200 extended gains as S&P500 closed at a record high after weak economic figures (existing home sales and Philly Fed manufacturing index) indicated that US rate hike is expected to be delayed. The rally ended just five points from the resistance level at 5,681 and we need to see a clear break out above this level to see further upside momentum towards the next key resistance level 5,745.

AUDUSD

Despite disappointing US data, AUDUSD could not find decent strength and it traded in a relatively tight range between 0.7867 and 0.7912. The US dollar is showing signs of weakness but tonight’s US CPI (10:30pm) and some key speeches from Draghi (6pm) and Yellen (3am) are likely to have major impacts on the near-term direction of the US dollar. 0.7850 remains as a key support level and the resistance level is at 0.7933.