Large Caps continued to press Thursday's advantage with gains to send indices towards recent swing highs.

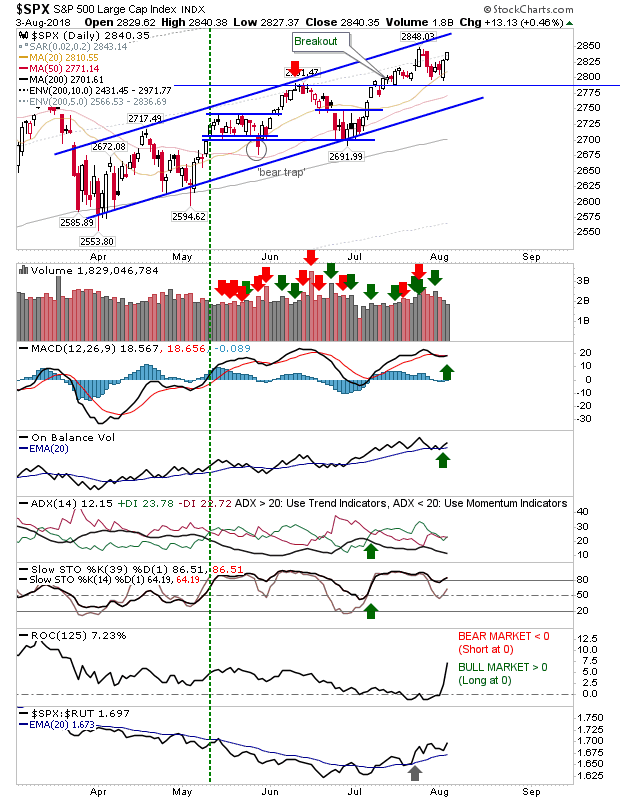

The S&P 500 remains on course to reach channel resistance and post new highs with technicals net bullish and relative performance in the ascendancy against Small Caps.

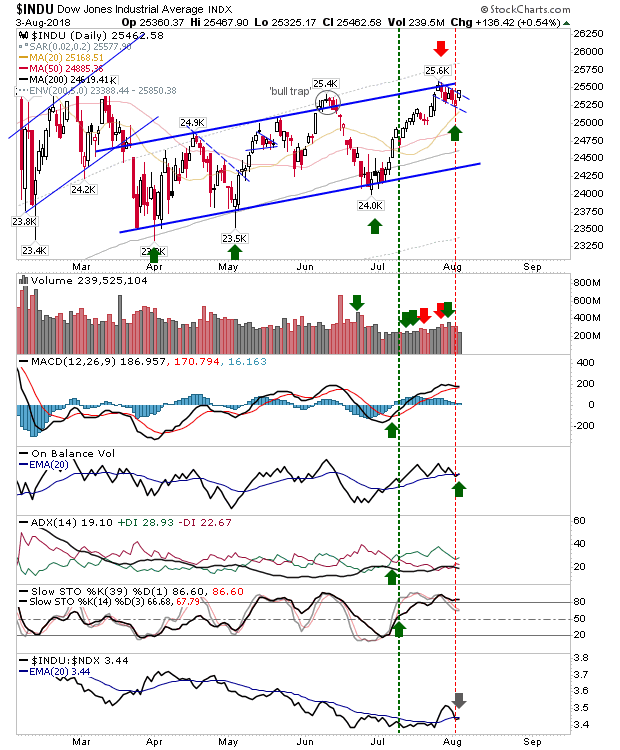

The Dow Jones Industrial Average doesn't have the same lead out but has shaped a small bull flag off its 20-day MA but just below rising channel resistance. There was a 'buy' trigger for On-Balance-Volume to go with Friday's advance although the index did lose a little ground against the Nasdaq 100.

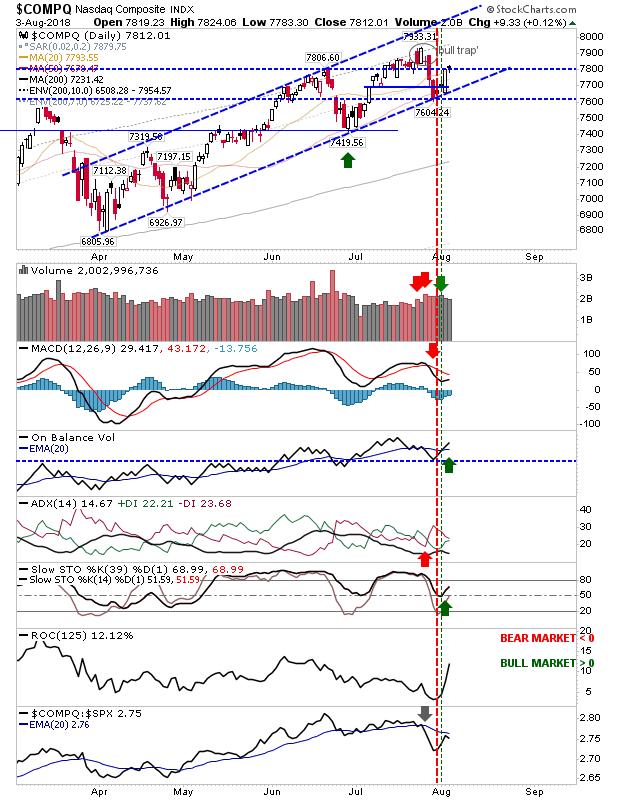

There was little to say about either Tech index. The NASDAQ Composite lingered just below a challenge of its 'bull trap' on mixed technicals.

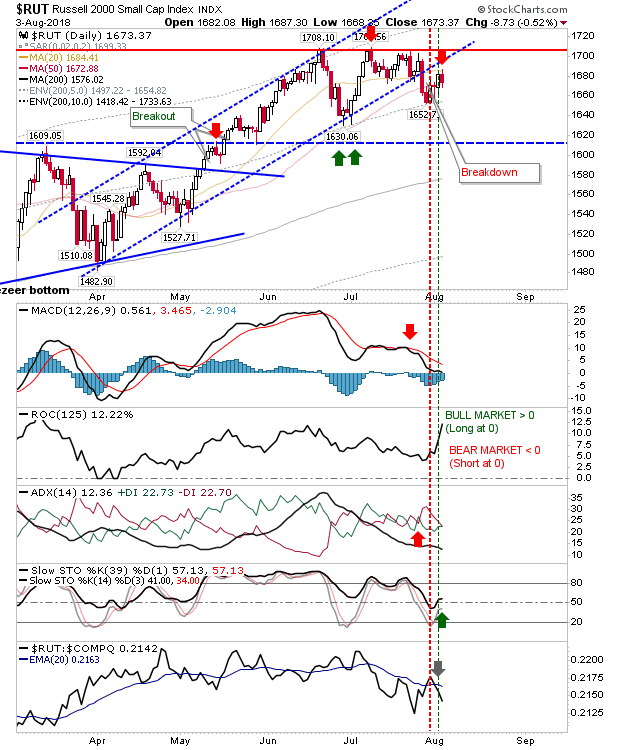

The Russell 2000 was the only index to finish lower. The index is struggling to make its way back inside the April-July rising channel in addition to remaining pegged by the 1,710 double top. I have marked this as a provisional short play with a stop above 1,690.

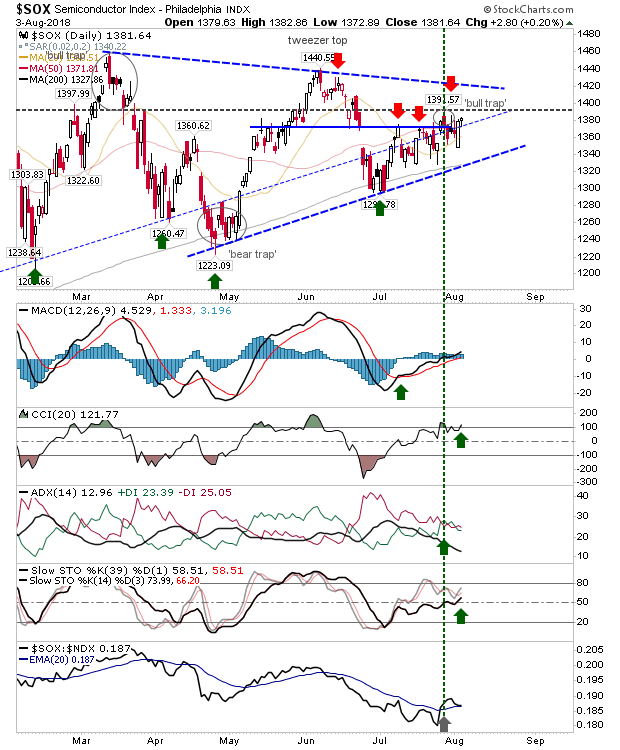

The Philadelphia Semiconductor Index continues to scrap things out as the index works its way towards an apex of a 5-month triangle.

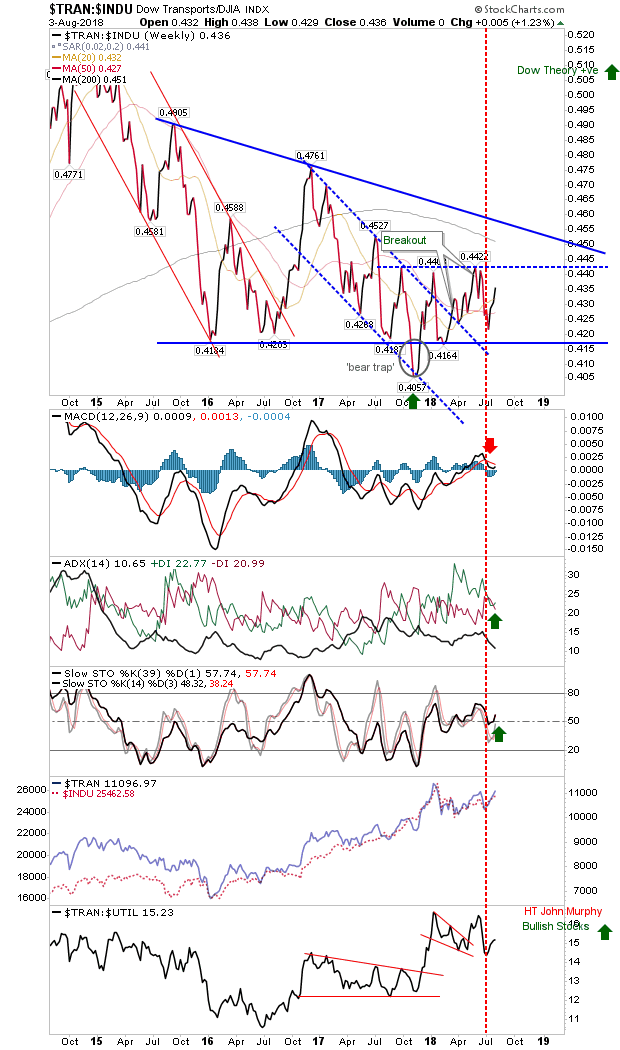

Of the breadth metrics, the one which I'm watching closest is the relationship between the Dow Jones Industrial Average and the Dow Jones Transportation Index. The ratio is running inside a tight range after an extended period of flat performance (going back to the start of 2016). This is a 'wait-and-see' approach but should this break in the direction of the prior trend (down) it will be a long-term bearish influence on the broader market; i.e. weak transports => lower produced goods to ship => weaker economy.

For tomorrow, shorts can look to the Russell 2000 with a stop above 1,690. Longs can look to the mini-flag breakout in the Dow Jones Industrial Average with a stop below 25,200. Investors can stay on the sidelines and not put new money to work.