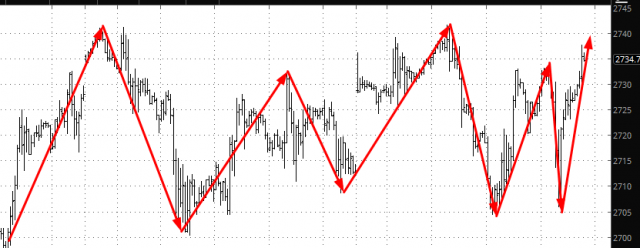

Well, the past couple of weeks all by themselves have played havoc with bulls and bears alike. Big drops and big recoveries have taken place back to back, and as I am typing this on Thursday evening, the ‘on again/off again’ Korea Peace Lovefest is back “on.” Over a span of two weeks, the market has been absolutely trapped inside a relatively tiny 35 point range.

In all this crazy madness, the bulls have never dropped the ball. Indeed, as we approach the end of the fifth month of this year, it seems quite clear the bulls remain absolutely and fully in control. Observe the Dow Composite and how the moving averages have been silky smooth without a single crossover.

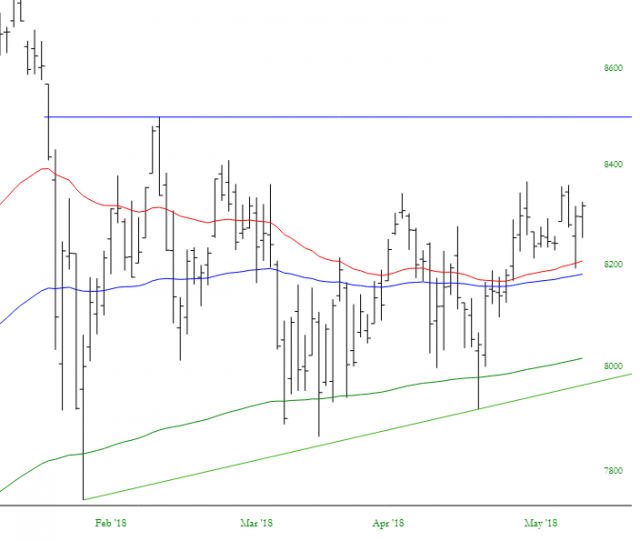

Much the same can be same for the NASDAQ Composite. All it really has to do at this point is get past that gap (purple line) to fuel the bullish fire.

The Dow Industrials, in spite of being about 1500 points below its record high, has cleanly broken above its triangle pattern.

The the NASDAQ 100, similar to its Composite brother, merely has to fill and push above its gap. If this North Korea news sticks (and what Kim Jung Un has to do with Netflix (NASDAQ:NFLX) earnings is beyond me), it could be very easy.

One index that hasn’t had to work as hard is the Russell 2000 small caps, which completed its own breakout recently and has successfully tested this bullish breakout.

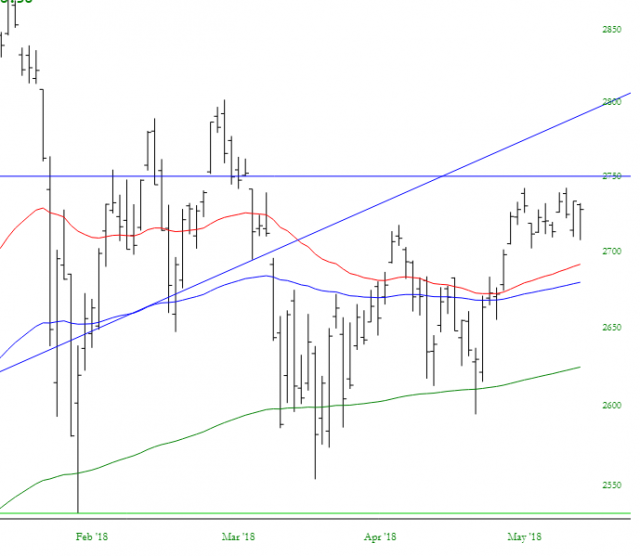

And perhaps the most visible of all is the S&P 500, where that magic number of 2750 is still the one to keep in mind.

Just about the ONLY area that remains plausibly bearish are interest-sensitive items like bonds, real estate, and – – as shown below – – the Dow Utilities. Unlike anything else on this page, they (a) are in a clear downtrend (b) have bearish crossovers on the moving averages (c) are cleanly up against a resistance point – – specifically, the 50-day exponential moving average.

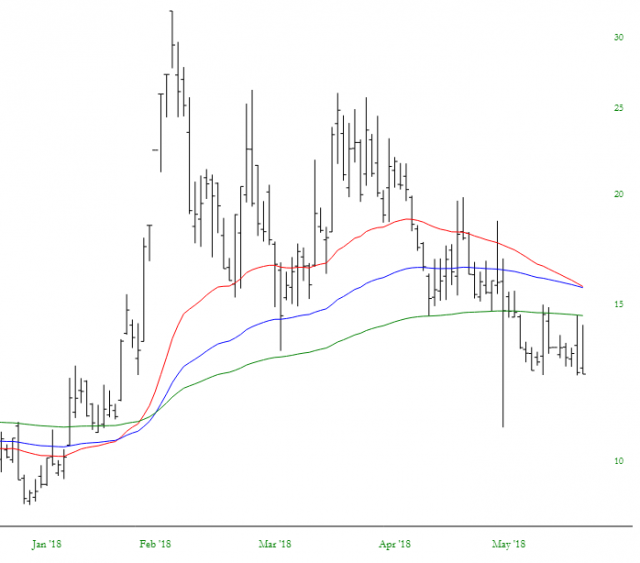

Oh, there is one more “bearish” thing, but it actually isn’t good for the bears at all: volatility. Having roared above the 30s just a few months ago, we have now returned the suffocating, snooze-inducing sub-teens zone. Yes, folks, we have a 12 on the VIX again. Enjoy!