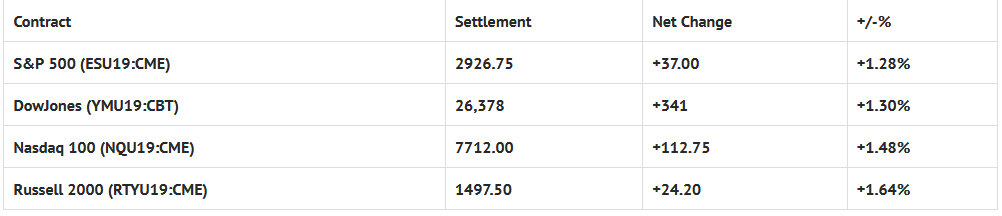

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Composite +0.08%, Hang Seng -0.16%, Nikkei +1.19%

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Personal Income and Outlays 8:30 AM ET, Chicago PMI 9:45 AM ET, Consumer Sentiment 10:00 AM ET, the Baker-Hughes Rig Count 1:00 PM ET, and Farm Prices 3:00 PM ET.

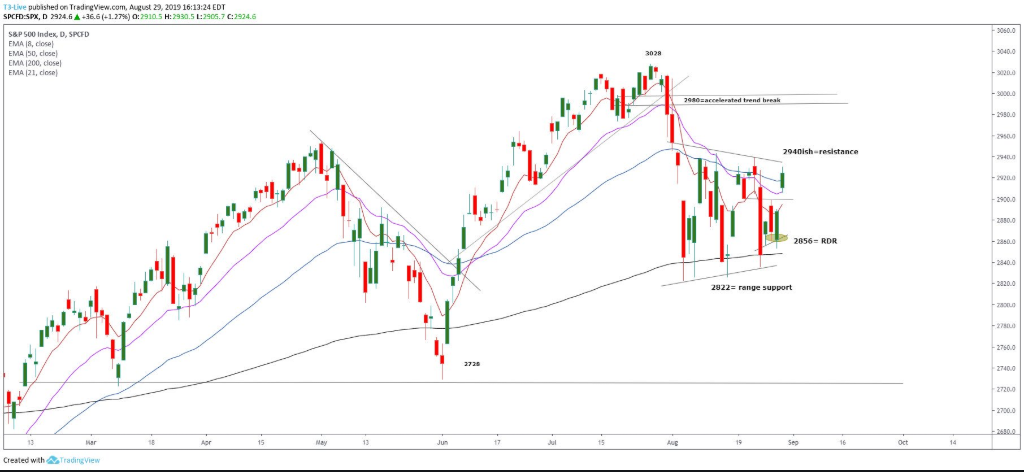

S&P 500 Futures: Trade War Rip

Chart courtesy of Scott Redler @RedDogT3 – Just like that. The power of reclaiming levels. $spx did a RDR as buyers reclaimed 2856 Wednesday. Had some power yesterday with with a broad based rally as high as 2924. Today $spx futures+18 to put it around the major resistance zone at 2940. I’d trim Longs here, not add.

During Wednesday nights Globex session, the S&P 500 futures (ESU19:CME) printed a low at 2875.25, then rallied to print a high at 2919.75 when news out of China indicated they would not immediately retaliate against Trump’s latest tariff increases. The ESU then went on to open Thursday’s regular trading hours (RTH) at 2916.50, up +26.75 handles.

After the 8:30 CT bell, the futures initially rallied to print a new high at 2925.50, before heading lower to do some back-and-fill, printing an RTH low at 2905.25. From there, it was a slow choppy grind higher for the rest of the day, with the ES eventually topping out at 2930.75.

When the MiM reveal came out showing $1.02 billion to buy MOC, the futures were hovering around the highs, and would go on to print 2924.75 on the 3:00 cash close, and 2926.75on the 3:15 futures close, up +37.00 handles.