NASDAQ turns negative

US stock indices closed sharply lower on Monday on rising trade war fears after China imposed its own penalties for US imports Sunday. The S&P 500 dropped 2.2% to 2581 led by technology stocks. All eleven main sectors ended lower. The Dow Jones Industrial fell 1.9% to 23644.19. The NASDAQ Composite tumbled 2.7% to 6870, turning negative for the year. The dollar strengthened slightly: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up less than 0.1% to 89.99. Stock indices futures indicate mixed openings today.

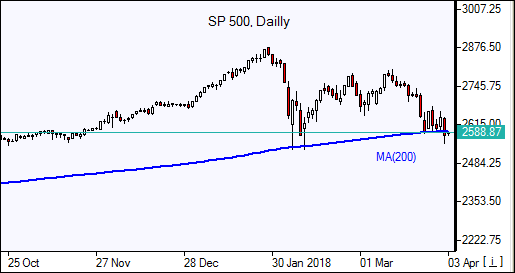

Trade war concerns were intensified after China announced tariffs on about 130 US goods coming into effect Monday. The SP 500 closed below its 200-day moving average for the first time since June 2016.

Mostly positive economic news was not sufficient to neutralize the negative impact of China tariff news: US manufacturing sector expansion continued in March. The Markit manufacturing purchasing managers index hit a three-year high of 55.6, up from 55.3 in February. The ISM manufacturing index came in at 59.3, compared with a previous monthly reading of 60.8. A reading of 50 or above indicates improving conditions. Construction spending, meanwhile, inched up 0.1% in February to a seasonally adjusted annual rate of $1.27 trillion.

European markets reopen lower

European stocks were closed for Easter Monday. The euro’s turned lower against the dollar while British Pound’s rise gains against the dollar accelerated. The STOXX Europe 600 had ended 0.4% higher Thursday ahead of Easter holidays, closing the month with 2.3% loss. The DAX 30 , France’s CAC 40 and UK’s FTSE 100 opened 0.5% -0.8% lower today.

Asian indices fall

Asian stocks are retreating today tracking losses on Wall Street overnight after China imposed import duties on $3 billion worth of US agricultural products. Nikkei lost 0.5% to 21283.50 despite a yen slide against the dollar. Chinese stocks are lower: the Shanghai Composite Index is down 0.9% and Hong Kong’s Hang Seng is 0.1% lower. Australia’s ASX All Ordinaries is down 0.1% with Australian dollar gaining against the US dollar as the Reserve Bank of Australia kept its key rate on hold at 1.5%.

Brent rising

Brent futures prices are higher today after closing lower Monday. Prices fell sharply yesterday: June Brent crude settled 2.5% lower at $67.64 a barrel on Monday.