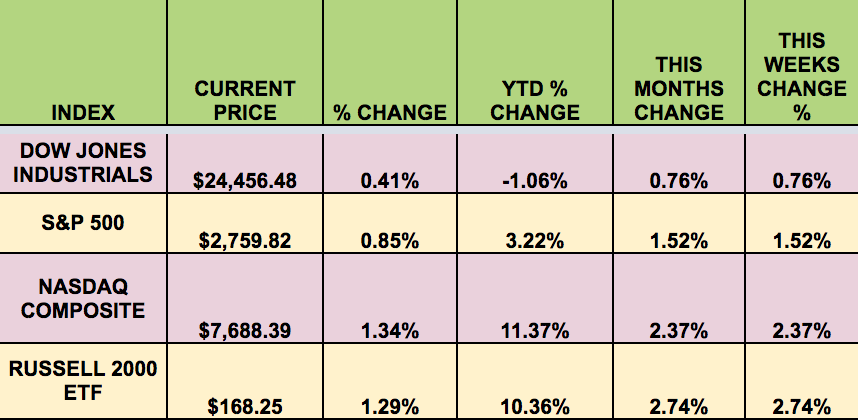

Markets: It was an up week for the market, as a good payrolls report on Friday helped investors to shrug off escalating trade war battles. The Russell 2000 small caps led, which makes sense, considering that there are more small US companies which don’t rely on international trade.

U.S. government bond yields fell on Friday to their lowest level since late January, extending their pullback for the week, after the economy added more jobs than forecast in June. Yields fall when bond prices rise.

However, a rise in unemployment to 4% from 3.8% may suggest there was more slack in the labor market than investors had thought and hence more room for wages and inflation to climb.

The United States and China slapped tit-for-tat duties on $34 billion worth of each other’s imports on Friday, with Beijing accusing Washington of triggering the “largest-scale trade war” as the world’s two biggest economies sharply escalated their conflict. There are so many moving parts in the supply chain … And information about exactly what’s impacted and what alternative sources for supply are, are not always clear. So I’d be very cautious in how this is played. It’s easy to say every motorcycle sold in Europe is going to be $2,000 costlier to Europeans. But others are much more opaque. Economists expect the manufacturing sector to bear the brunt of the tit-for-tat tariffs, through a slowdown in hiring and capital expenditure. (Reuters)

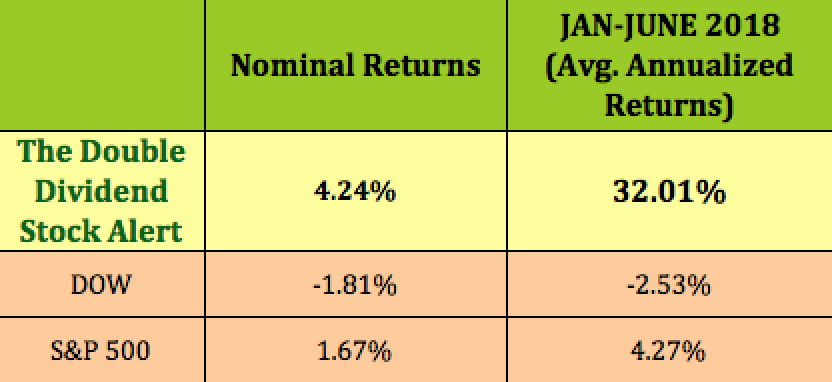

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: LOAN, CIO, CNSL, MN, PMT.

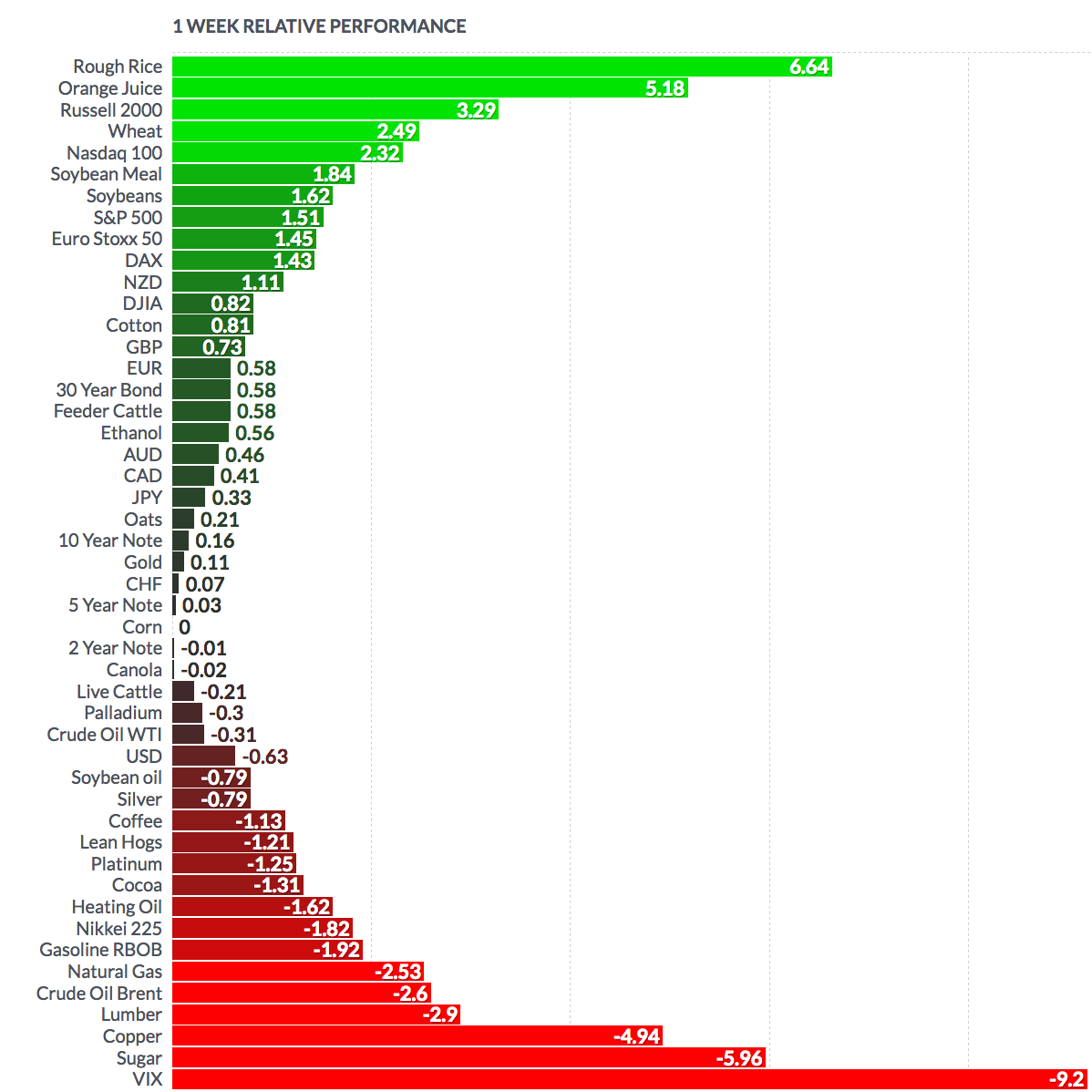

Volatility: The VIX fell 2.9% this week, ending the week at $13.37.

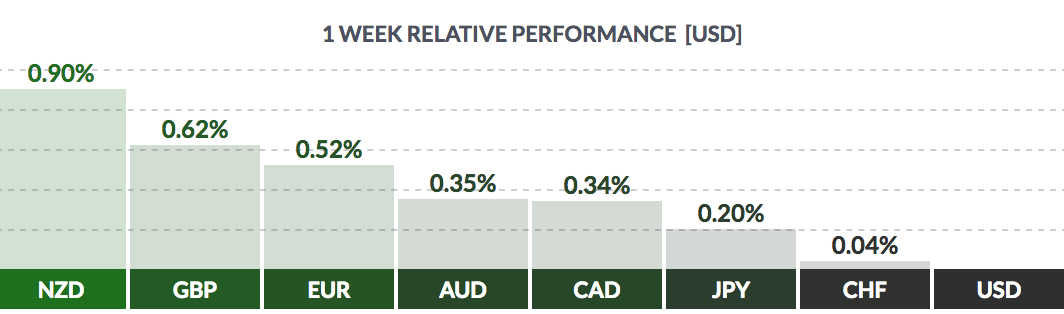

Currency: The US dollar retreated this week, stung by trade war tariffs- it fell vs. other major currencies.

Market Breadth: 21 of the Dow 30 stocks rose this week, vs. 12 last week. 79% of the S&P 500 rose this week, vs. 30% last week.

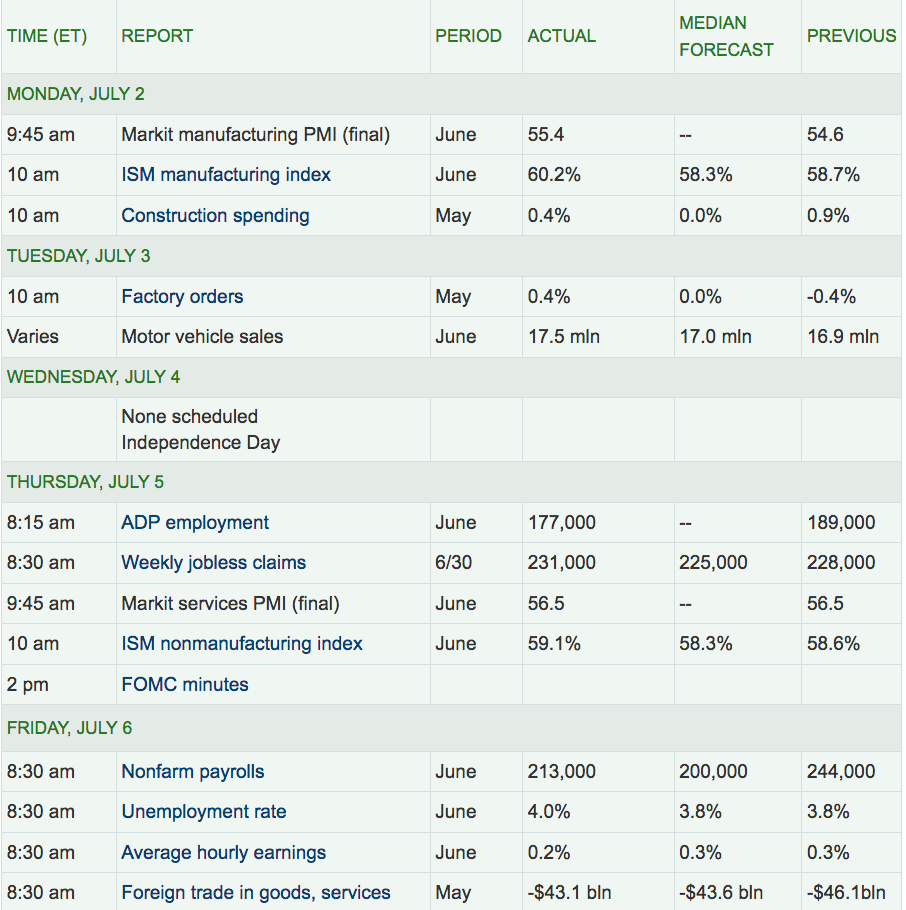

Economic News:

'Nonfarm payrolls increased by rose by 213,000 jobs last month,' the Labor Department said on Friday. 'Data for April and May was revised to show 37,000 more jobs created than previously reported. The economy needs to create roughly 120,000 jobs per month to keep up with growth in the working-age population. The unemployment rate rose to 4.0 percent from an 18-year low of 3.8 percent in June as more people entered the labor force in the sign of confidence in the jobs market.

The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one, rose to 62.9 percent last month from 62.7 percent in May. It had declined for three straight months. Average hourly earnings rose five cents, or 0.2 percent in June after increasing 0.3 percent in May. That kept the annual increase in average hourly earnings at 2.7 percent. The moderate wage growth should allay fears of a strong build-up in inflation pressures. The Fed’s preferred inflation measure hit the central bank’s 2 percent target in May for the first time in six years.' (Reuters)

'U.S. services sector activity picked up in June amid strong growth in new orders, but trade tariffs and a shortage of workers were starting to strain the supply chain, which could slow momentum in the coming months. While other data on Thursday showed private payrolls rising less than expected last month and a surprise increase in new applications for unemployment benefits last week, overall labor market conditions continue to tighten. The labor market is considered to be near or at full employment, with the jobless rate at an 18-year low of 3.8 percent. The unemployment rate has dropped by three-tenths of a percentage point this year and is near the Federal Reserve’s forecast of 3.6 percent by the end of this year.' (Reuters)

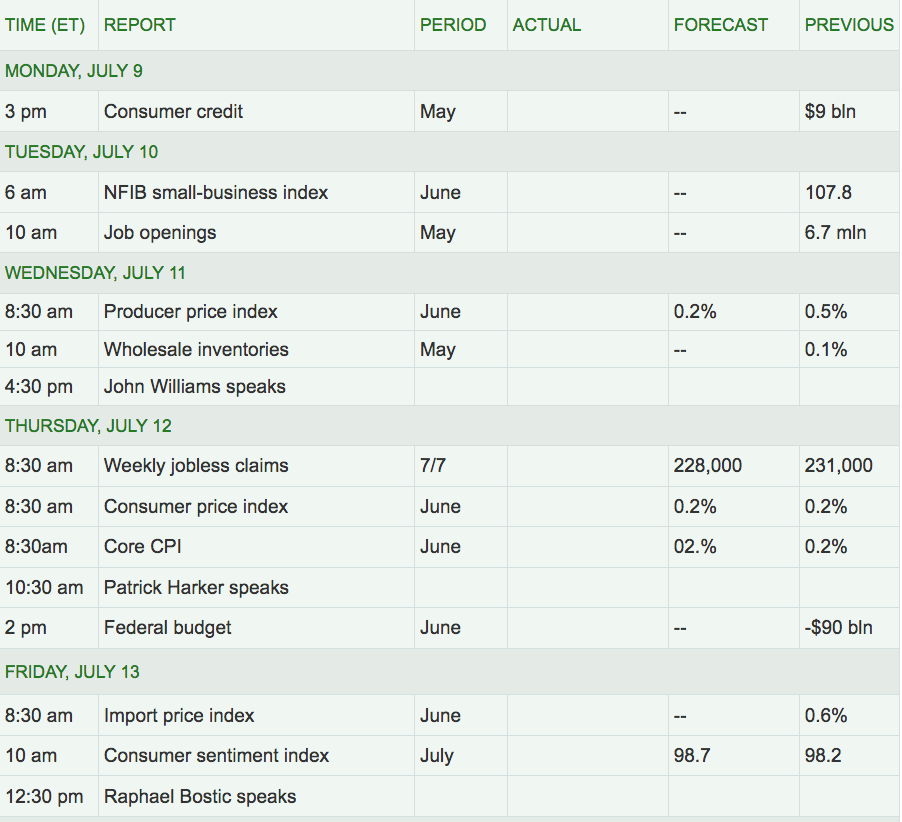

Week Ahead Highlights: The market will tiptoe into the Q2 earnings season next week via big banks, with 1 DOW stock – JPMorgan Chase reporting, and 13 S&P 500 stocks reporting, including Citi, PNC, Wells Fargo, in addition to Delta Airlines.

Next Week’s US Economic Reports:

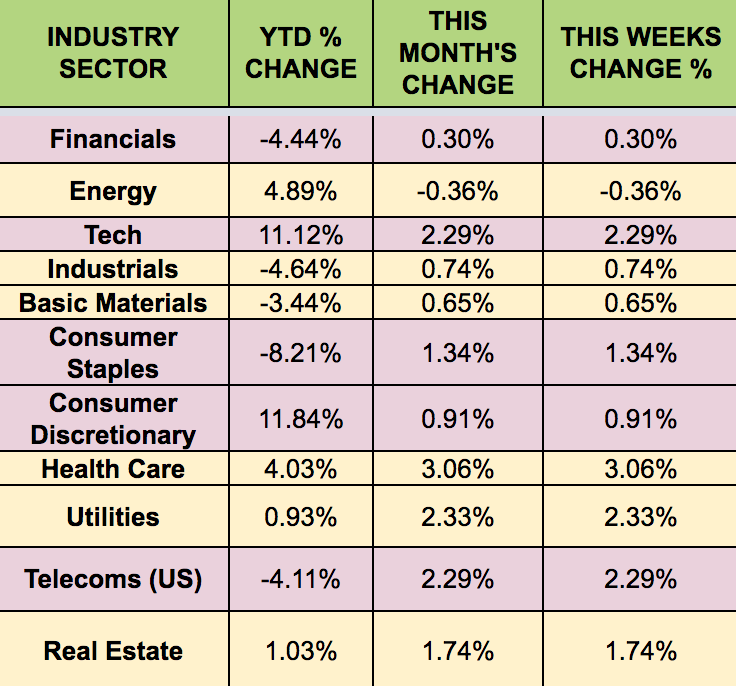

Sectors: The Health Care and Tech sectors led again this week, while Energy trailed.

Futures:

The U.S. imported a record volume of crude from its northern neighbor last week, even as the Canadian oil industry struggles to deal with widespread transportation bottlenecks. In Canada, increasing supplies have strained southbound pipeline capacity, pressuring oil prices lower. Some of that volume has spilled into rail networks, but the market is crying out for more pipes as a more economical mode of transport for their supply.

Despite the bottleneck, American refiners took 3.73 million barrels a day of Canadian oil for the week ending June 29, the largest volume since June 2010. (Bloomberg)

WTI Crude oil futures were down -0.31% this week, while Natural Gas fell -2.53%: