Wednesday November 14: Five things the markets are talking about

European stocks have started today’s session deep in the ‘red,’ beating losses in Asia overnight and U.S futures, as the market considers the ongoing rout in oil market and a mixed bag of data on China’s economy and the latest trade developments.

Crude oil prices have extended their steep slide on market worries about weakening world demand and oversupply, while global stocks slumped as energy sector worries increased concern about a slow down in the global economy.

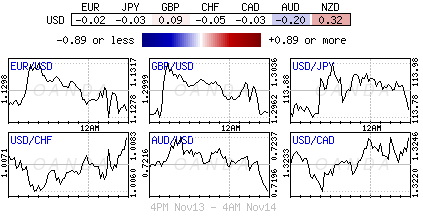

The U.S dollar trades within striking distance of its 18-month highs, while safe haven demand has Treasury and G7 sovereign yields under pressure. Italian yields also eased away from this morning’s high print despite Italy’s populist government standing firm on budget yesterday.

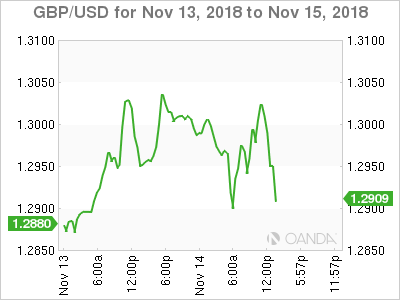

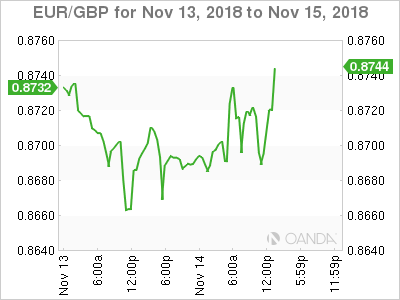

Sterling remains currency traders’ main focus as traders wait to see if PM Theresa May can persuade cabinet colleagues to back her Brexit plans today. The PM is due to meet her cabinet at 09:00 am EDT. The meeting is expected to last several hours.

If the Cabinet rejects the deal today, this would likely see the pound plummet (£1.2916), as it would not only mean prolonged uncertainty regarding the terms of the U.K’s exit from the E.U, but also increase the probability of a new general election.

On tap: U.S CPI is expected to have rebounded last month after easing in September (08:30 am EDT). Later this evening, Fed Chair Powell discusses national and global economic issues with Dallas Fed President Kaplan (06:00 pm EDT).

1. Stocks see mostly red

Most Asian stocks finished lower overnight as global growth worries persisted and Italy’s populist government escalated a row with the E.C over the country’s spending plans.

The outlier was in Japan, shares ended another volatile session a tad higher as tech companies and electronic component makers surged on short covering. The Nikkei average inched up +0.2%, rebounding from its two-week low print on Monday. The broader Topix index also closed +0.2% higher.

Down-under, financials and commodity stocks led declines in Aussie shares, pressured by concerns of slowing growth. Australia’s S&P/ASX 200 index slipped for a second consecutive session, closing -1.7% down. The benchmark closed -1.8% lower on Tuesday.

In S. Korea, the KOSPI index weakened overnight due to a further fall in oil prices. Domestic investors were also cautious ahead of the financial regulator’s decision on alleged accounting rule violation by drug maker Samsung BioLogics (KS:005930). The index closed down -0.15%.

In China and Hong Kong, shares fell after the release of mixed economic data. The benchmark Shanghai Composite index dropped -0.9%, while Hong Kong’s Hang Seng index ended down -0.5%.

Note: Industrial production in China rose an annual +5.9% in October, exceeding market expectations for +5.8%. Retail sales climbed +8.6% y/y, missing forecasts for a gain of +9.2%, while fixed asset investment advanced an annual +5.7%, beating forecasts for +5.5%.

In Europe, regional bourses trade lower across the board continuing the volatility seen in recent weeks tracking lower Asian markets and weaker U.S futures this morning.

U.S stocks are set to open in the ‘red’ (-0.3%).

Indices: STOXX 600 -0.6% at 362.2, FTSE -0.5% at 7018, DAX -0.6% at 11402, CAC 40 -0.7% at 5066, IBEX 35 -0.6% at 9095, FTSE MIB -1.2% at 19000, SMI -0.6% at 8960, S&P 500 Futures -0.3%

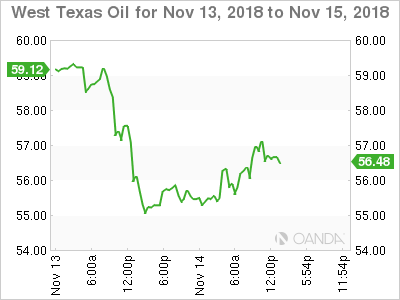

2. Crude oil extends steep dive, gold prices steady

Oil prices have extended their steep slide overnight on the back of worries about weakening world demand and oversupply.

Brent crude is down -0.35% at +$65.24 per barrel after sinking -6.8% yesterday, while setting an eight-month low of +$64.61.

Note: Brent soared to a four-year high of +$86.74 in early October as the market waited for U.S sanctions on Iran, but prices have plummeted -25%in four weeks.

U.S West Texas Intermediate (WTI) crude futures trade at +$55.30 per barrel, for a loss of -0.7%, following a descent to a 12-month low of +$54.75 overnight.

OPEC warned yesterday that a supply glut could emerge in 2019 as the world economy slows and rivals increase production more quickly than expected.

Led by top exporter Saudi Arabia, OPEC has been making more public statements of late that they would start withholding crude in 2019 to tighten supply and prop up prices.

In its monthly report, IEA left its forecast for global demand growth for 2018 and 2019 unchanged from last month at +1.3M (NYSE:MMM) and +1.4M bpd, respectively, but cut its forecast for non-OECD demand growth. For H1 2019, based on its outlook for non-OPEC production and global demand, and assuming flat OPEC production, the IEA said the “implied stock build is +2M bpd.”

Note: Both OPEC and Russia are under pressure to reduce current production levels; this decision could be taken at the next OPEC meeting on Dec. 6. There are rumors that there is a proposal to cut oil output by up to -1.4M bpd for 2019.

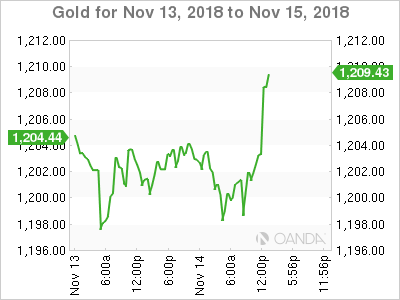

Ahead of the U.S open, gold prices are holding steady as the ‘big’ dollar eases away from its 18-month high print earlier in the week, easing amid a jump in the EUR (€1.1270) and the pound (£1.2969) on a draft Brexit agreement. Spot gold is little changed at +$1,202.08 per ounce, while U.S gold futures are up +0.1% at +$1,203.9 per ounce.

3. BTP yields rise as Italy sticks to deficit target

Italian government bond yields have backed up sharply this morning after Italy resent its 2019 budget to the E.C with “unchanged growth and budget deficit assumptions, but falling debt targets.”

Note: Italy’s first draft budget for 2019 was rejected last month for breaking E.U rules.

Italian BTP yields are +5 to +7 bps higher across the curve and the BTP/Bund yield gap has widened to +311 bps from around +303 bps from late yesterday.

Elsewhere, the yield on the U.S 10-year note has gained less than +1 bps to +3.14%. In Germany, the 10-year note has fallen -2 bps to +0.39%, the lowest in two-weeks, while in the U.K, the 10-year Gilt yield has eased -4 bps to +1.484%.

4. U.K cabinet meeting in focus for sterling

The focus for sterling this morning is the U.K Cabinet meeting (09:00 am EDT), when PM May’s Cabinet may approve the Brexit deal that reportedly has been reached between the U.K and the E.U this week.

Consensus expects the pound to find a ‘bid’ if the Cabinet signs off on the deal, because this would open the possibility for the agreement to be considered at an extraordinary E.U summit in late November, and for the U.K. Parliament to vote on it before the Christmas recess.

However, if the Cabinet rejects the deal at today’s meeting, this would likely send GBP (£1.2916) spiraling aggressively lower, as it would not only mean prolonged uncertainty regarding the terms of the U.K’s exit from the E.U, but also increase the probability of a new general election.

Elsewhere, EUR/USD (€1.2963) is slightly lower after Germany’s Q3 GDP (-0.2% vs. +0.5%) missed expectations and contracted for the first time in over four-years. German officials reiterated that slowdown was “temporary and largely related to the emission situation in the auto sector.”

SEK (€10.2733, +0.5%) is softer after Sweden Oct CPI came in below expectations. Some of the weakness was due to reposition of bets for the first potential Riksbank hike being pushed back to the February time frame.

5. U.K inflation holds steady as fuel costs are offset by food

Data this morning from the ONS showed that annual inflation in the U.K held steady in October, as weak growth in prices for food and drink counterbalanced surging fuel costs.

Consumer prices rose +2.4% on year in October, matching the increase in September.

The figures would suggest that the Bank of England (BoE) remains on track to hike interest rates next year provided the U.K’s exit from the E.U goes smoothly. A bitter ‘divorce’ is expected to cause widespread economic disruption.

Note: Governor Carney signalled this month that they would need to nudge up interest rates two to three times in the next-three years to bring inflation back to its +2% goal.