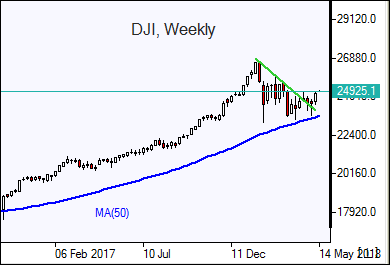

Dow logs sixth straight gain

US stocks ended higher Friday buoyed by healthcare shares. S&P 500 rose 0.2% to 2727.72. SP 500 rallied 2.3% for the week. Dow Jones Industrial Average gained 0.4% to 24831.17. The NASDAQ Composite slipped however less than 0.1% to 7402.88. The dollar slowed weakening as the 0.3% rise in import price index in April was smaller than an 0.5% expected gain: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.2% to 92.51 and is lower currently. Stock indices futures indicate higher openings today.

European stocks log seventh straight weekly gain

European stocks rebounded Friday erasing previous day losses. The British Pound joined euros’climb against the dollar with both currencies gaining currently. The Stoxx Europe 600 Index gained 0.1%, ending 1.4% higher for the week. TheDAX 30 lost 0.2% to 13001.24. France’s CAC 40 slipped 0.1% while UK’s FTSE 100 advanced 0.3% to 7724.55. Markets opened mixed today.

Asian indices rise

Asian stock indices are higher today following US President Donald Trump pledge to help China’s ZTE (HK:0763) corporation to “get back into business, fast” after banning the Chinese technology company from exporting sensitive technology from America three weeks ago. Nikkei ended 0.5% higher at 22865.86 despite yen slide against the dollar. Chinese stocks are higher as the central bank injected more liquidity into the financial system: the Shanghai Composite Index is up 0.3% and Hong Kong’s Hang Seng Index is 1.2% higher. Australia’s ASX All Ordinaries is up 0.3% as Australian dollar extended gains against the greenback.

Brent slips

Brent futures prices are extending losses today as on rising US output. Prices closed lower Friday as Baker Hughes reported the number of active US drilling rigs rose by 10 to 844 last week. Brent for July settlement lost 0.5% to close at $77.12 a barrel Friday.