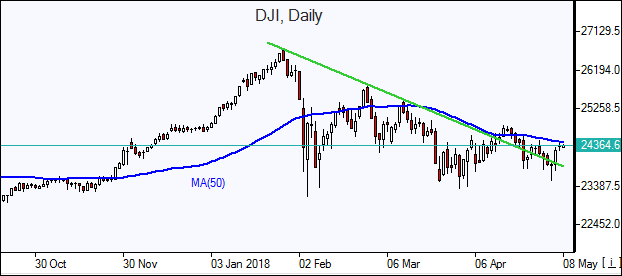

Dow posts third gain in a row

US stocks extended gains Monday. The S&P 500 rose 0.4% to 2672.63 with seven of 11 main sectors finishing higher. The Dow Jones industrial added 0.3% to 24357.32. The NASDAQ Composite index advanced 0.8% to 7265.21. The dollar strengthening continued: live dollar index data show the Intercontinental Exchange Inc (NYSE:ICE), a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 92.74. Stock indices futures point to mixed openings today.

Stocks ended off their session highs as President Trump tweeted he would announce his decision on Iran nuclear deal certification Tuesday at 20:00 CET. If the US abandons the nuclear deal and re-imposes sanctions on Iran, exports of crude oil from the OPEC’s third biggest producers of crude oil will be curbed, limiting global supply. Federal Reserve officials speaking yesterday acknowledged rising inflation but said they do not expect a change in the current interest rate path with two more interest rate increases this year.

DAX leads European indices gains

European stocks added to previous session gains Monday as investors risk appetite was buoyed by positive reports. The euro extended the slide against the dollar while the British pound’s turned higher with both currencies advancing against dollar currently. The Stoxx Europe 600 index rose 0.6%. The DAX 30 gained 1% to 12948.14, France’s CAC 40 rose 0.3%. UK’s markets were closed for a bank holiday. Markets in France are closed today for Victory Day. UK markets are closed for May Day holiday. Markets opened mixed today.

Nestle SA (SIX:NESN) shares 1.6% gain lifted indices after news the Swiss food giant has reached a deal to sell Starbucks (NASDAQ:SBUX) products globally. Indices rose despite weak economic data: German manufacturing orders decline accelerated in March, falling by 0.9% month-on-month after 0.2% decline in February.

Hang Seng leads Asian indices gains

Asian stock indices are higher today ahead of Trump’s decision on Iran nuclear deal. Nikkei rose 0.2% to 22551.35 despite continued yen gain against the dollar. China’s markets are higher as China returns to trade surplus in April: the Shanghai Composite Index is up 0.8% and Hong Kong’s Hang Seng is 1.4% higher. Australia’s ASX All Ordinaries is up 0.1% with Australian dollar little changed against the US dollar.

Brent Oil Futures prices are edging higher today ahead of President Donald Trump's decision whether to withdraw from the Iran nuclear deal. In such a case sanctions will be reimposed on Iran, cutting its crude oil exports and limiting global oil supply. Prices rallied yesterday: July Brent crude settled 1.7% higher at $76.17 a barrel on Monday.