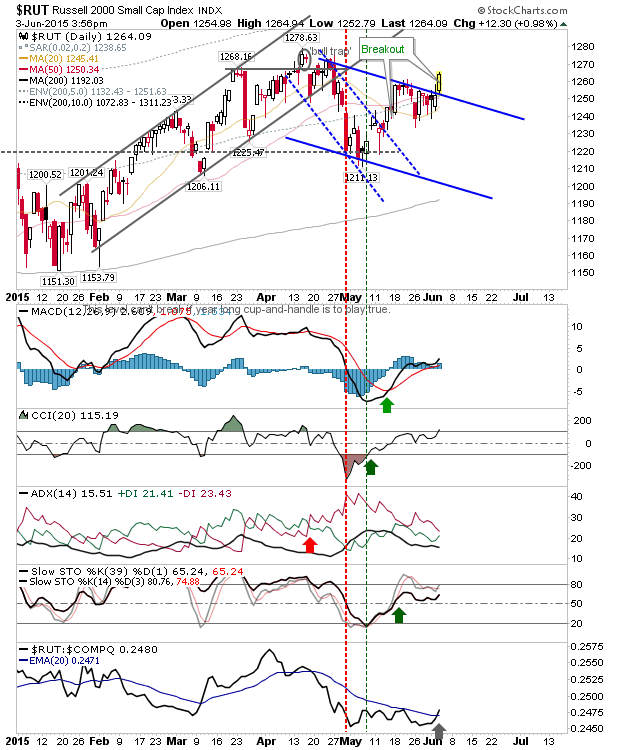

In a low key move, the Russell 2000 broke from its channel in a relative swing, in favour of Small Caps and away from Tech and Large Caps. This is an important development for bulls looking for a larger push outside of 2015 consolidations for the range-bound S&P 500, Dow, NASDAQ and NASDAQ 100.

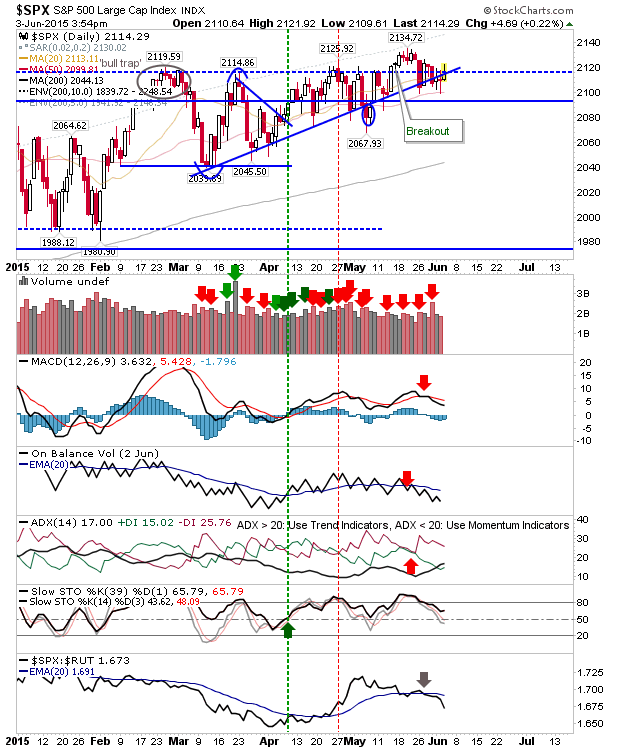

The S&P remains caught sub-2,120. Yesterday's attempt to break this level was again rebuffed, but action in the Russell 2000 offers another opportunity for bulls to drive a breakout today.

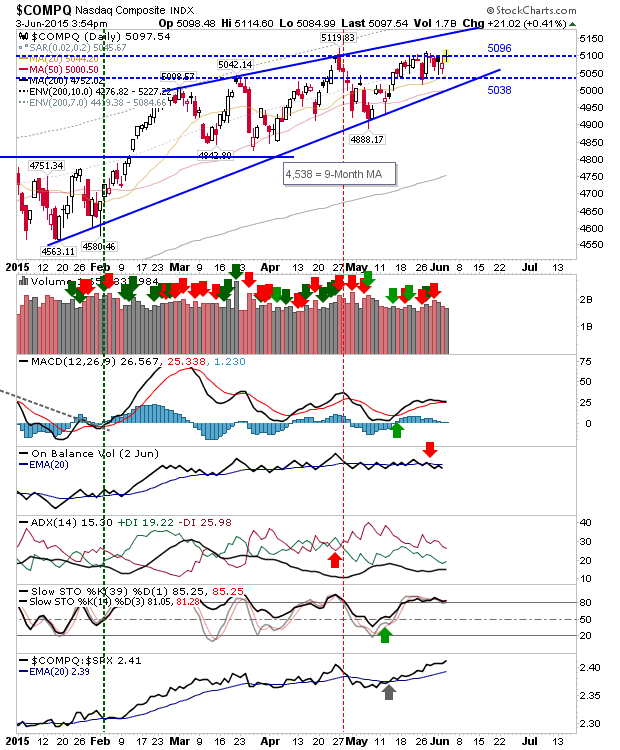

The NASDAQ finished pegged at 5,098 with a neutral doji. Volume was lighter, and the MACD is about to switch to a 'sell' trigger.

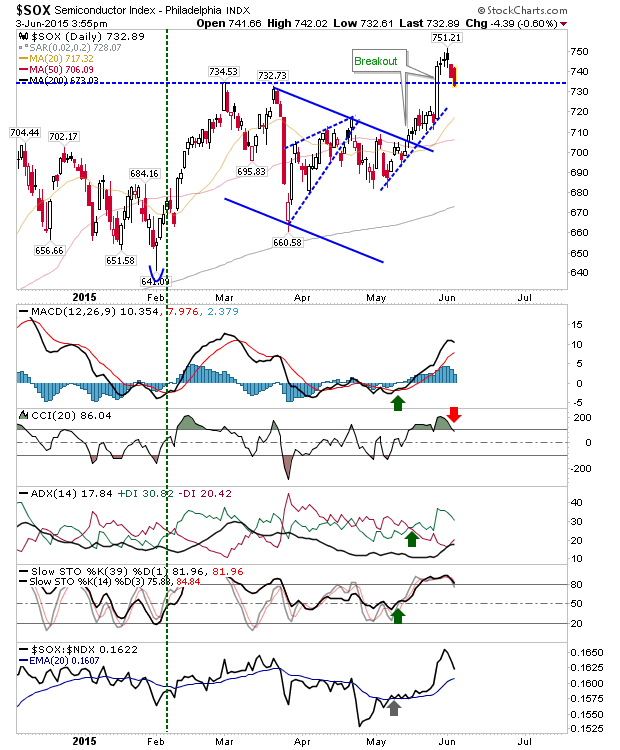

The Semiconductor Index is back at breakout support at 730s. It's an important opportunity to consolidate to the breakout, otherwise the risk is a new test of the 50-day MA. Technicals are well placed for bulls, and there is an opportunity for the NASDAQ to benefit from semiconductor strength.

Today is yet another opportunity for bulls to launch an attack on Tech and Large Cap indices, as they did with Small Caps yesterday.