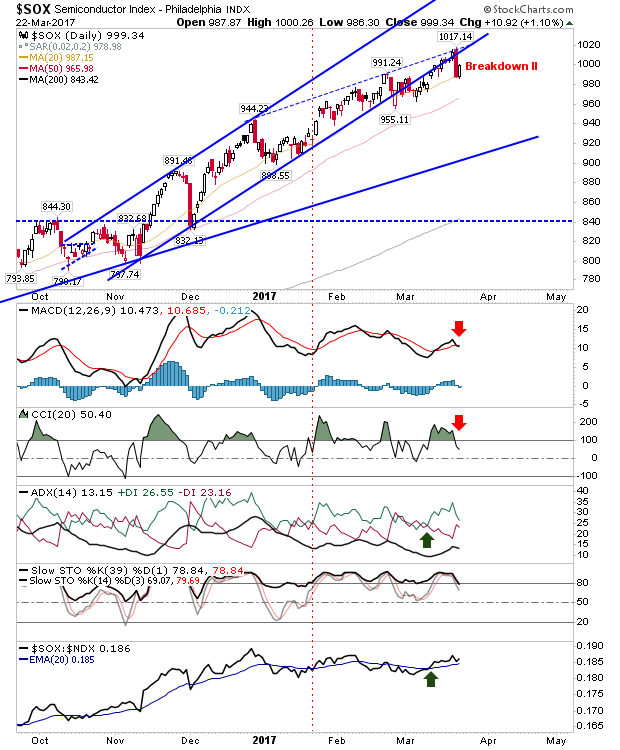

Tuesday's selling didn't follow through with additional losses yesterday. Instead, indices dug in at lows and managed to recover some of Tuesday's selloff. The best recovery came from the Semiconductor Index. It gained over 1% as it bounced off its 20-day MA. However, it wasn't enough to stop a 'sell' trigger in the MACD and CCI.

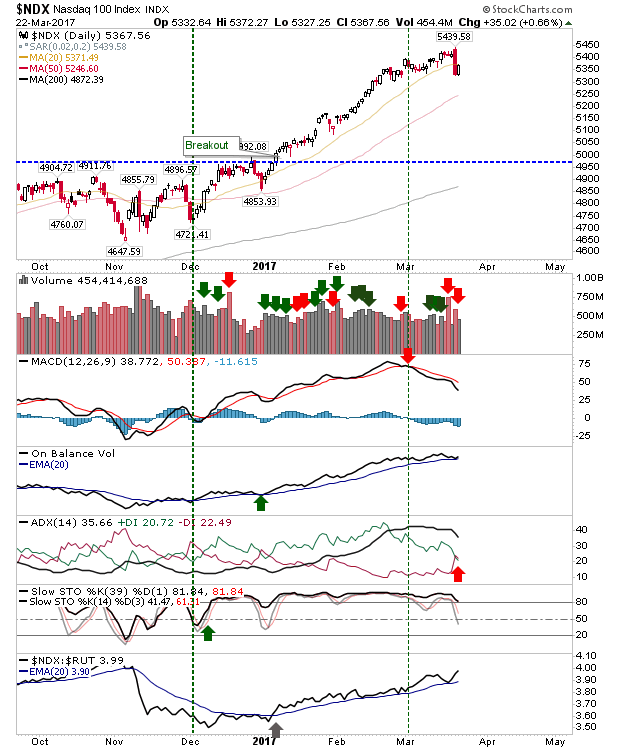

Next is the NASDAQ 100. It staged a recovery, but not from a typical support level. Unfortunately, it has a MACD trigger 'sell' from early March and a new 'sell' trigger between the -DI and +DI, but what was particularly noticeable was the bullish uptick in relative performance against the Russell 2000. If bulls are to lead, this is the index with which to do it.

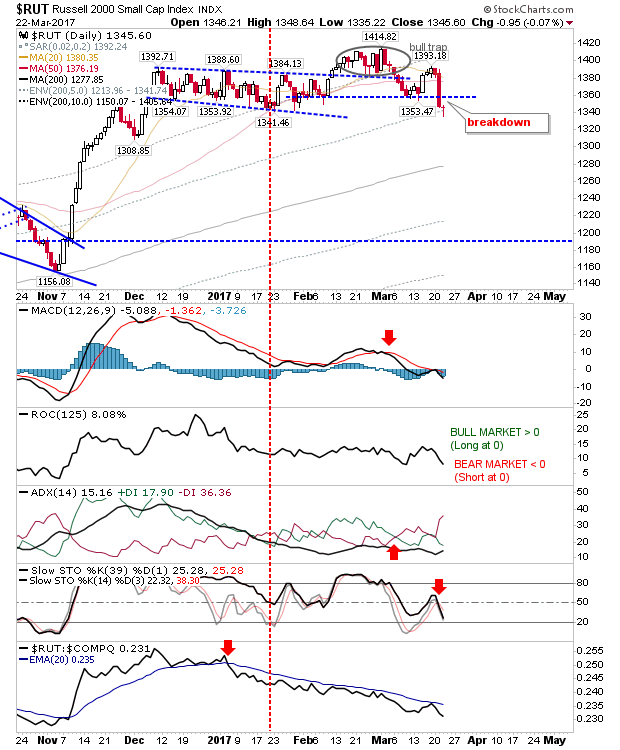

The Russell 2000 had a quiet day. It has struggled since the 'bull trap' in February and yesterday's action was simply a pause in proceedings. Having said that, optimists will look to January's swing low at 1,341 and yesterday's swing low at 1,335 as a successful support test and an opportunity to mount a rally.

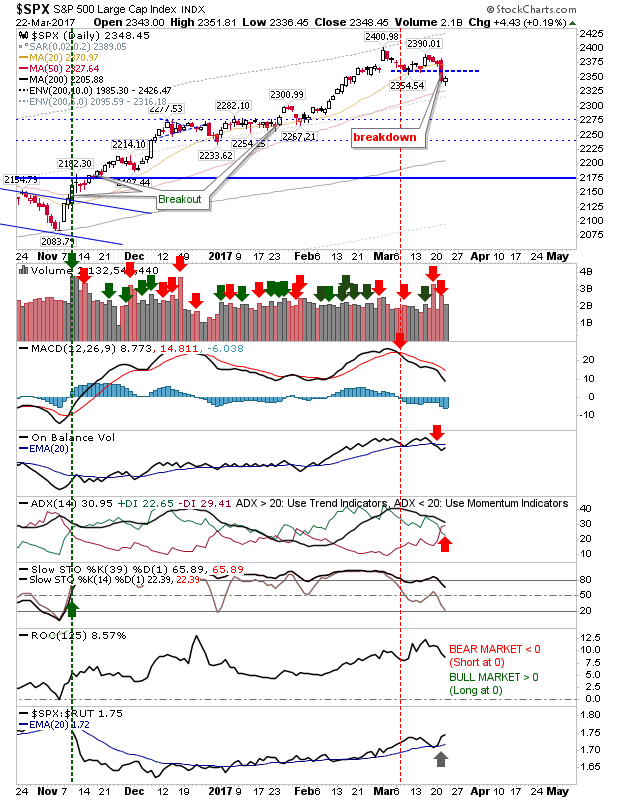

The S&P posted the smallest gain and didn't have a natural support level to work off. Technicals are also net bearish. If buyers post gains in the Russell 2000 and NASDAQ, then the S&P should benefit. But, if there is a sniff of weakness, I would expect the S&P to suffer the most.

For today, bulls will need another day like yesterday; a same or higher open followed by consistent gains, finishing with a higher close. If markets are unable to make advances off the open (e.g. finishing with a doji), then I think Friday could be a rough day for all markets.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI