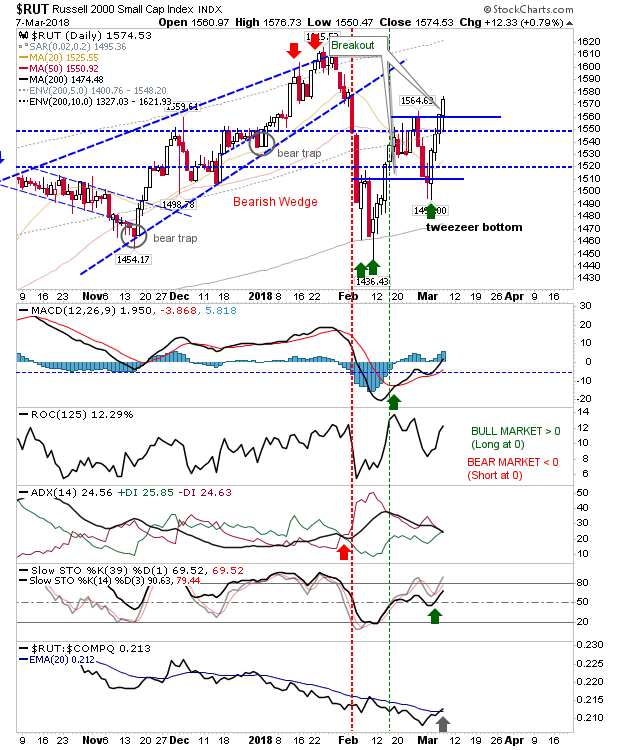

The Russell 2000 may not be the index pushing all-time highs but the last four days have seen steady gains for the index—enough to generate a new relative performance advantage against the strong performing NASDAQ and NASDAQ 100. Leadership from Small Caps is critical for building long-term rallies. This is a good start and an excellent confirmation of the `tweezer`bottom.

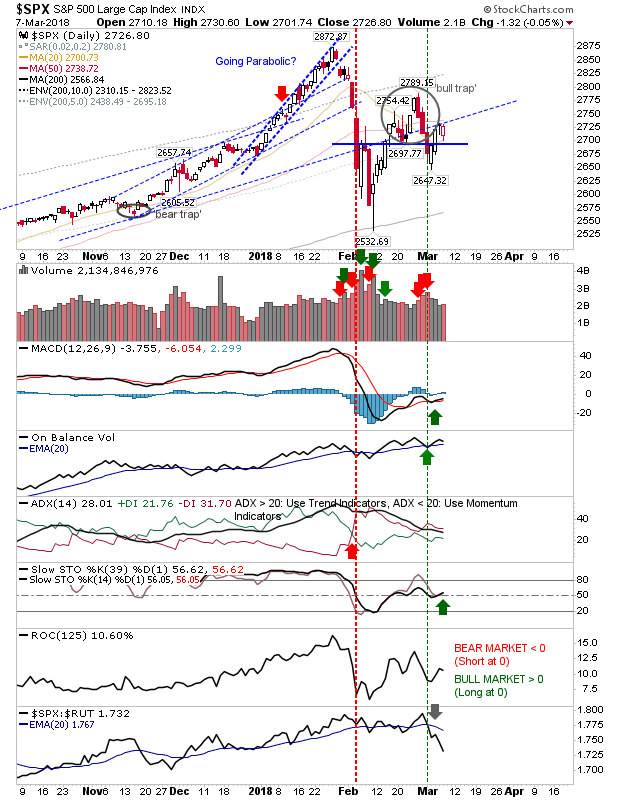

The S&P is struggling a little. Yesterday's action came in as distribution (although not particularly strong selling). With the Russell 2000 having cleared its most recent swing high the expectation will be for Large Caps to do likewise. It may be a slow crawl higher but long positions look favored at this point

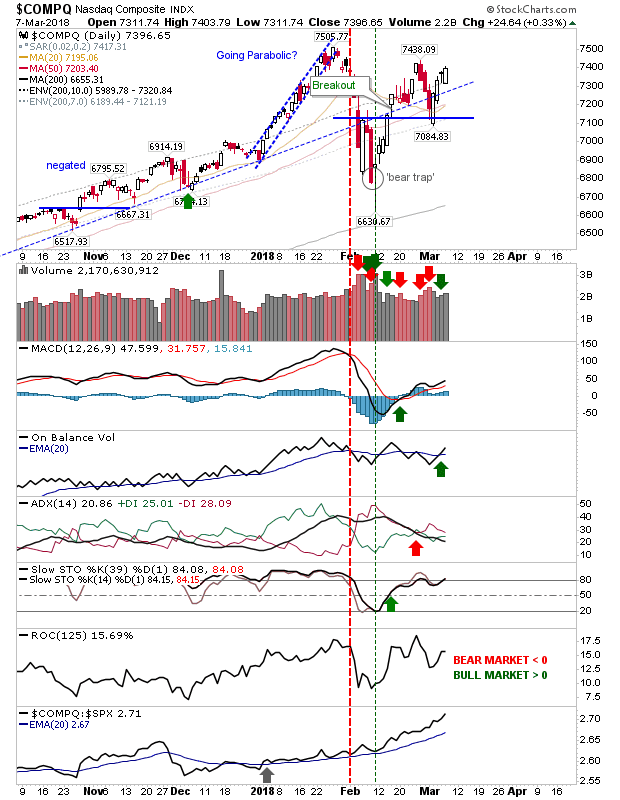

The NASDAQ will likely be the next index to make new highs. Yesterday's candlestick engulfed the potential topping doji which removed the risk of a bearish 'evening star'. The NASDAQ maintains its strong relative performance (but remember the Russell 2000 has outperformed it over the last four days).

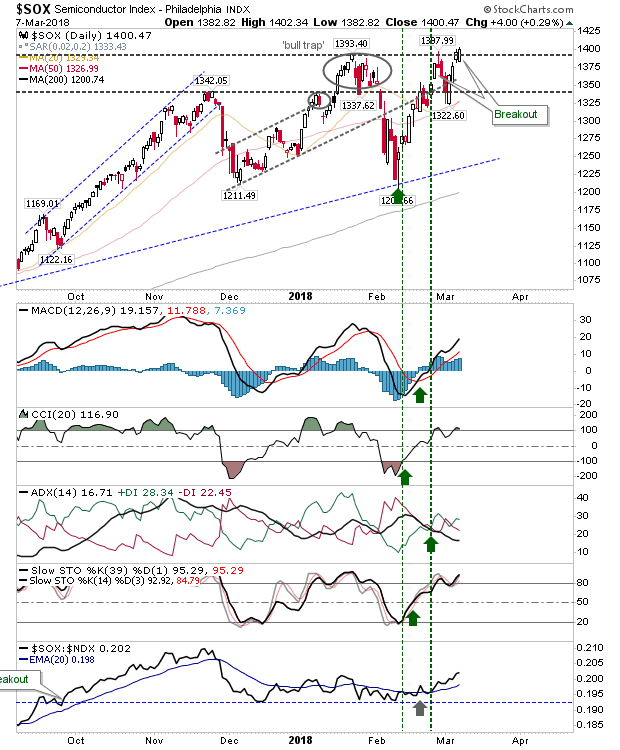

Despite the strong action in the Russell 2000 it was left to the Semiconductor Index to break to new 2018 highs. This is further good news for the NASDAQ 100 and NASDAQ. Long risk is broad with stops going on a loss of 1,322 or the 50-day MA. One for the long haul.

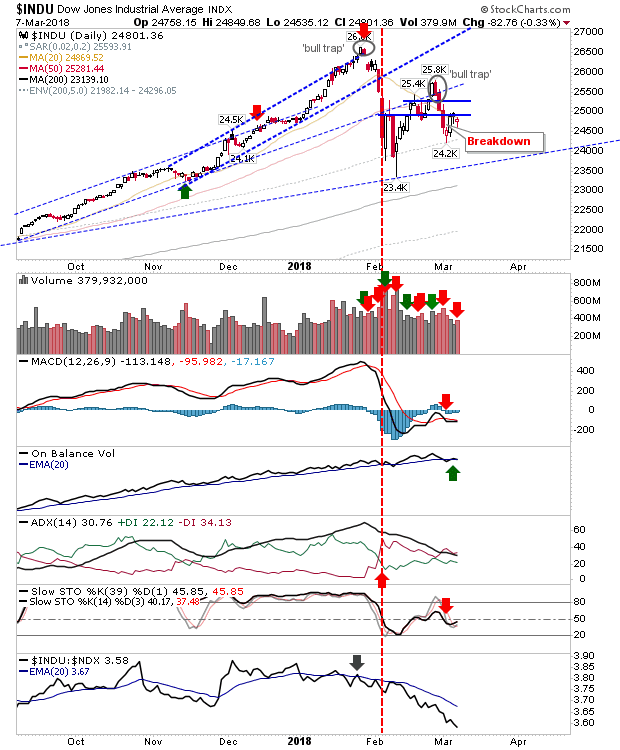

While there isn't much for shorts to work with there is the Dow Jones Industrial Average, which may be offering an opportunity. It was the weakest performer on the day yesterday and it's currently up against resistance. Technicals are not net bearish but with On-Balance-Volume looking like it will only be one more day of selling to trigger there is probably enough weakness to offer shorts a play with stops above Tuesday's high.

If today opens weak then look for accelerated losses in the Dow. If selling really accelerates, then possibly a 'bull trap' in the Semiconductor Index. In a strong open, look for Semiconductors to build on their breakout and the Russell 2000 to make it five days of gains in a row.