EU and US equities gained yesterday, with the Dow Jones and the S&P 500 hitting fresh record highs as Democrats win control of the US Senate. The only exception was NASDAQ, which slide on increased risk of antitrust scrutiny of Big Tech. Yesterday, we also got the minutes from the latest FOMC gathering, but they barely affected the markets.

Equities And Risk-Linked Assets Gain On Democrats Senate Victory

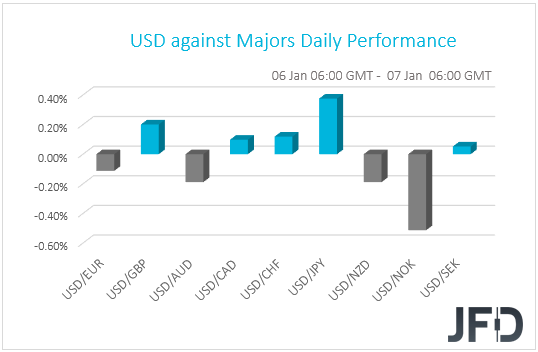

The US dollar traded mixed against the other G10 currencies on Wednesday and during the Asian session Thursday. It gained against JPY, GBP, CHF, CAD, and SEK in that order, while it underperformed versus NOK, NZD, AUD, and EUR.

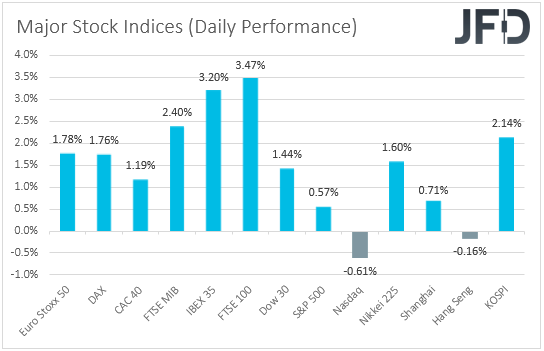

The weakening of the safe havens yen and franc, combined with the strengthening of the risk-linked Kiwi and Aussie, suggests that markets traded in a risk-on fashion yesterday. Indeed, major EU and US indices closed in positive waters, with the Dow Jones and the S&P 500 hitting fresh records. The exception was NASDAQ, which slid 0.61%, as increased risk of antitrust scrutiny of Big Tech pressured shares of companies like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) and Facebook (NASDAQ:FB).

The optimism rolled over into the Asian session as well, with Japan’s Nikkei 225, China’s Shanghai Composite and South Korea’s KOSPI gaining 1.60%, 0.71%, and 2.14%. The exception here was Hong Kong’s Hang Seng, which slid 0.16%.

The drivers behind the improved market sentiment may have been the approval of Moderna's (NASDAQ:MRNA) vaccine by the European Medicines Authority (EMA) and the European Commission, as well as the victories in the Georgia runoff elections by Democrats, which handed them a narrow control of the Senate.

As we already expected, a Democratic sweep may have raised speculation that President-elect Biden’s fiscal agenda will pass much more easily, which could mean more fiscal stimulus and infrastructure spending. A Democratic controlled Congress could also mean higher taxes and more regulation, which is negative for stocks, but we still believe that due to the coronavirus vaccinations, the fiscal support in the US, the monetary policy easing around the globe, and the Brexit trade accord, the path of least resistance for equities and other risk-linked assets may be to the upside.

Yesterday, we also got the minutes from the latest FOMC gathering, at which officials kept policy unchanged, but changed their forward guidance saying that they will continue to buy bonds “until substantial further progress has been made towards the Committee’s maximum employment and price stability goals.” The minutes revealed that some participants noted that they could consider future adjustments to their purchases, such as increasing the pace of purchased securities, or weighting them towards longer maturities.

That said, other said that once progress towards their goals had been attained, a gradual tapering could begin. In our view, whether the chances of more stimulus will increase, or not, will depend on the US employment report, due to be released tomorrow. Yesterday, the ADP report revealed a 123k job loss, which shifts the risks of the NFP forecast (71k) to the downside.

DJIA Technical Outlook

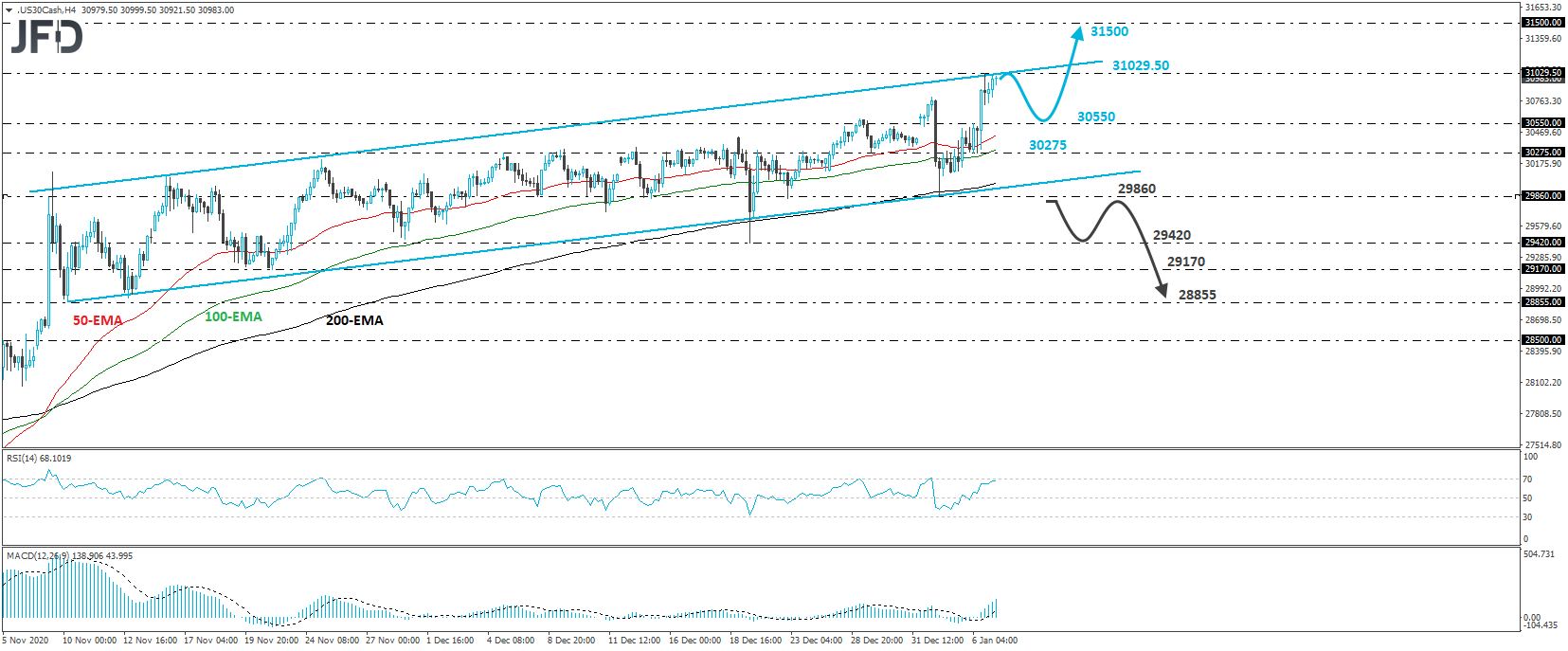

The Dow Jones Industrial Average cash index edged north yesterday, hitting a fresh record high at 31029.50. Overall, the index continues to trade within an upside channel that’s been in place since Nov. 9, and thus, we would consider the near-term outlook to still be positive.

That said, given that the index is currently trading near the upper end of that channel, we would see decent chances for a corrective setback before the next leg north, perhaps for the price to test the 30550 zone, marked near the inside swing high of Jan. 5. Investors may jump back into the action from near that zone and perhaps aim for another test near the upper end of the channel. A break higher would paint an even brighter picture and perhaps see scope for advances towards the 31500 territory.

We will abandon the bullish case only if we see a decisive dip below 29860, the low of Jan. 4. This will confirm a forthcoming lower low and may pave the way towards the low of Dec. 21, at 29420. If that level doesn’t hold, then we may see a test near the 29170 zone, marked by the lows of Nov. 20 and 23. Another break, below 29170 could set the stage for the low of Nov. 10, at 28855.

EUR/USD Technical Outlook

EUR/USD traded higher yesterday, but hit resistance at 1.2350 and today, during the Asian session, it pulled somewhat back. Overall, the pair continues to print higher highs and higher lows above the upside support line drawn from the low of Nov. 4, and thus, we would see a positive near-term picture.

A clear and decisive break above 1.2350 may allow the bulls to target the 1.2415 zone, which is defined as a resistance by the high of April 17, 2018. If that territory is not able to halt the advance, then its break may open the path towards the 1.2477 area, marked by the high of Mar. 27, 2018.

On the downside, we would like to see a dip below 1.2225 in order to start examining whether the bears have gained control, at least in the short run. Such a move would confirm a forthcoming lower low on the daily chart and may initially pave the way towards the 1.2150 level, marked by the low of Dec. 23, or the 1.2128 barrier, marked by the low of Dec. 21. If neither area is strong enough to stop the fall, then a dip lower may pave the way towards the low of Dec. 9, at 1.2058.

As For Today's Events

During the European morning, we get Eurozone’s preliminary CPIs for December. The headline rate is expected to have ticked up, but to have stayed within the negative territory. Specifically, it is expected to have risen to -0.2% yoy from -0.3%. The HICP excluding energy and food is expected to have slowed to +0.3% yoy from +0.4%.

At the last meeting for 2020, the ECB decided to expand its Pandemic Emergency Purchase Programme (PEPP) by EUR 500bn and extended the scheme by nine months to March 2022. That said, the euro gained on the decision, as, due to the currency’s prior appreciation, many may have expected the Bank to deliver more.

Currently the EUR/USD exchange rate is trading at a higher level than back then, which is a negative for consumer prices. After all, President Lagarde said at the press conference following the last decision that the appreciation of the euro exercises downward pressure on prices and that they will monitor it very carefully.

Thus, another round of negative headline and very low core inflation prints may raise speculation that the ECB may decide to act again in the first months of the new year.

The bloc’s retail sales for November and the UK’s construction PMI for December are also coming out. Euro area’s retails sales are anticipated to have fallen 3.6% mom after rising 1.5%, while the UK construction PMI is forecast to have inched up to 55.0 from 54.7.

Later in the day, from the US we have the ISM non-manufacturing PMI for December, the trade balance for November, and the initial jobless claims for last week. The ISM print is expected to have declined to 54.6 from 55.9, while the trade deficit is forecast to have widened to USD 64.50bn from USD 63.10bn. Initial jobless claims are forecast to have risen to 800k from 787k the week before.

We get trade data for November from Canada as well, with the nation’s deficit expected to have narrowed somewhat, to CAD 3.30bn from CAD 3.76bn.

We also have three speakers on today’s agenda: Philadelphia Fed President Patrick Harker, St. Louis Fed President James Bullard, and Chicago Fed President Charles Evans.