Market Brief

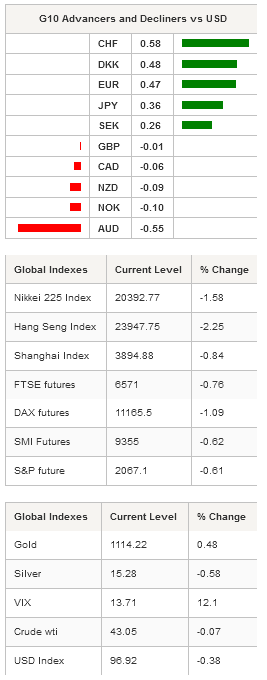

In the wake of the yuan devaluation by the PBoC, Asian FX and equity markets continue to feel the heat as investors try to price in the implications of a weaker Chinese currency. Asian regional equity markets tumbles with most shares indexes down more than 1%. The Japanese Nikkei 225 lost 1.58% while the broader TOPIX index retreated -1.29%. In Hong Kong, the Hang Seng fell -2.25% while Chinese mainland shares are also trading lower with the Shanghai Composite losing 0.84% and the SZSE Composite falling -1.27%. In the FX market, the Renminbi is down 1.8% to 6.4425 versus the dollar. The USD/INR is down 0.95%, USD/KRW -0.97%, TWD -1.34% and IDR -1.50%. The reduction of purchasing power of Chinese importers also have a negative effect on commodity prices as WTI fell as much as 1.50% to $43.05 a barrel in overnight trading while futures on copper and aluminium were also heavily sold-off.

Bond markets have not been held behind as US treasury yields fell as well. US 10-Year is down 7bps while the 5-year dropped 6bps. The combination of lower commodity prices and the prospect of a stronger dollar is weighting on US yields as investors revaluate the probability of a September rate hike.

In Australia, Westpac consumer confidence index (SA) rebounded in August by 7.8%m/m versus -3.2% a month earlier. Meanwhile, Q2 wage price index remained stable at 2.3 %y/y, matching median forecast. Elsewhere, in Japan July’s PPI missed slightly median forecast and printed at -3%y/y versus -2.9% expected. July’s industrial production final reading came in above consensus, printing at a solid 2.3%y/y versus 2%. USD/JPY is down 0.49% to 124.65 from its morning high of 125.27.

In Europe yesterday, Greece and its creditors reached an agreement to unlock €86bn of bailout fund ahead of August 20 €3.2bn payment to the ECB. However, the agreement still has to be ratified by Eurozone members. As a result, German 10-Year yields fell 3bps since yesterday and 16bps from its peak of August 5. Nevertheless, PBoC’s yuan move is weighing heavily on European equity markets with the German DAX down -1.09%, French CAC 40 down -0.90%, Euro Stoxx 50 down -1.05%, the FTSE 100 down -0.76% and the SMI down -0.62%. EUR/USD finally break the strong 1.1049 resistance (Fib 38.2% on June-July debasement) to the upside and is heading towards the next one standing at 1.1123 (Fib 50% and previous highs). However, the euro has to break the 1.12 level (Fib 61.8% and previous highs) to validate and exit of its 1.5 months range.

Today traders will be watching trade balance from Italy; jobless claims and ILO unemployment rate from the UK; ZEW survey from Switzerland; Eurozone’s industrial production; industrial production from India; retail sales from Brazil; monthly budget statement from the US.

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.1096

S 1: 1.0819

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5588

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 124.65

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9863

CURRENT: 0.9834

S 1: 0.9526

S 2: 0.9072