Monday September 12: Five things the markets are talking about

September trade has finally ushered in some volatility.

This month, the market has and will be focusing on Tier 1 central banks for direction (to come BoE, SNB, BoJ and Fed). To date, despite the “lower for longer” mantra across the board, it’s been the rhetoric that’s managed to jolt the various asset classes from their slumber.

Late last week it was the ECB’s turn. Despite holding pat on rates and stimulus measures, Draghi was decidedly more ‘hawkish’ than many had expected in his commentary – the ECB did not discuss extending its QE timeframe. Net result, global sovereign bonds sold off aggressively, yields rallied, pushing benchmark rates in Europe and the U.S up to levels not seen since the Brexit vote.

On Friday, the pressure was amplified by a more ‘hawkish’ tone from a slate of Fed speakers (Rosengren and from the surprise ‘dove’ Tarullo) that alarmed markets about the possibility the Fed could actually make its next rate move as early as next week. Stock markets have come under pressure and the ‘big’ dollar has caught a global bid on higher rates.

While the odds still favour the Fed will hold rates steady at next week’s policy meeting, the aforementioned Fed speakers have cast some doubts. Tomorrow marks the onset of a five business day quiet period ahead of the FOMC Sept. 20-21 meeting.

Expect later today “dove” Fed Lael Brainard remarks to be closely watched (01:15pm EDT). If she happens to change her tune or deviates ever so slightly from her ‘dovish’ stance, we can probably expect a repeat of Friday’s moves – further pressure on bonds and equities.

1. Stocks hangover continue as CB’s threaten to turn off tap

It’s not a surprise to see Asian stocks plummeted overnight, following the U.S’s S&P 500’s -2.5% decline on Friday, as investors worry that ‘easy’ monetary policies have become a thing of the past (see above). Even China is getting in on the act, with the People’s Bank of China (PBoC) saying today that China “should curb excessive financing into the real estate sector”, fueling worries that the PBoC will not want loose monetary conditions either.

The Hang Seng Index tumbled -3%, while the Hang Seng Index slumped -3.7%. The Nikkei 225 was down -1.7%. The KOSPI Index tumbled -1.7%, and Australia’s S&P/ASX 200 was down -2.2%.

In Europe, major stock indexes are trading on the back foot and have fallen as much as -2% in early trade, putting them on course for their biggest losses since June. Wall Street futures pointed to a fall of -0.7%.

Indices: Stoxx50 -2.2% at 2,986, FTSE -1.7% at 6,661, DAX -2.1% at 10,350, CAC 40 -2.2% at 4,392, IBEX 35 -2.4% at 8,809, FTSE MIB -2.6% at 16,707, SMI -1.4% at 8,155, S&P 500 Futures -0.6%

2. Crude oil sees red

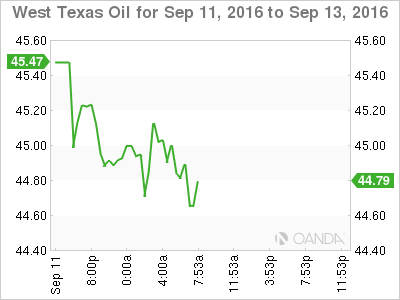

In early trade, oil prices have extended Friday’s -4% losses as speculators pare their bullish bets by the most in three-months last week (CFTC data second consecutive week) and U.S. crude drillers added more rigs for a tenth week running.

Brent crude oil futures (Nov) are trading -53c lower on the day to £47.48 a barrel, while U.S. WTI futures (Oct) fell -66c to $45.22 a barrel.

Adding to crude price pressure is the “big” dollars rise against EM currencies, as the markets prices in a potential Fed rate hike next week.

Investors can expected the energy market to be consumed by the OPEC meeting (Sept 26-28) over the next two-week. Will member states be able to curtail global production to stabilize world prices? Looking at the past records, the answer is probably ‘no’ to any consensus.

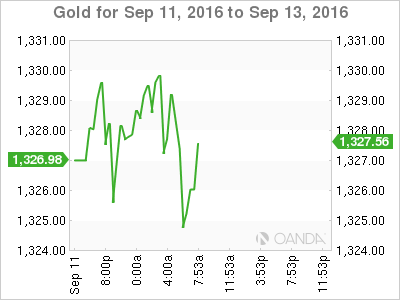

Gold ($1,329.60) prices are experiencing “push/pull dynamics and the reason why prices are little changed ahead of NY open. The global sell off in stocks is increasing the “safe-haven” appeal of the precious metal, while preventing gold from rallying too much is the markets expectations of a Fed rate hike next week.

3. Rate expectations steepen sovereign curves

Global bond prices are plummeting again on concerns that central banks’ commitment to the super-low or NIRP and asset purchase programs may be disappearing.

German 10-year bund yields rose further above zero to +0.04%, its highest since the Brexit vote. Australian 10s have surged +9bps to +2.05%, after gaining +10bps on Friday, while New Zealand debt jumped +11bps points to +2.47%. The yields on U.S 10s have rallied two basis points to +1.69%.

Fed fund futures now see a +38% probability of a rate raise next week and +50% odds of a December hike.

With the Fed’s Brainard, a leading opponent of rate increases is speaking today, and if she happens to change her tune, investors can expect yield curves to shift again.

4. “Big” dollar move today depends on Fed speakers

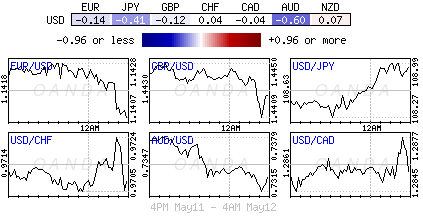

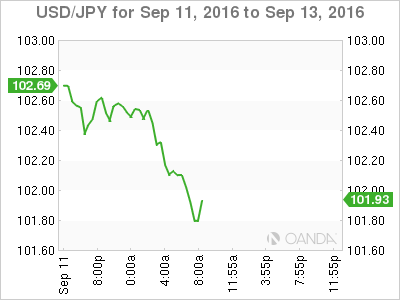

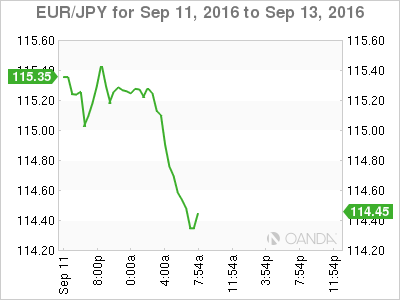

In FX, heightened risk aversion is benefiting the perceived historical safe haven currencies such as the yen while hitting “carry” trades in higher yielding currencies including the AUD, ZAR, TRY.

The dollar has fallen against the yen (¥102.08), is relatively flat against the EUR (€1.1223) and the pound (£1.3265), and higher against commodity sensitive EM currency pairs.

The dollars next move will most likely depend on what Fed Brainard (dove) has to say before the one-week blackout ahead of next weeks FOMC meet.

Elsewhere, Atlanta Fed President Lockhart will give a speech on monetary policy in Atlanta at 8 am EDT, while Minneapolis Fed President Kashkari’s speaks at 1 pm EDT.

5. Geopolitical risks compound monetary worries

Geopolitical risks are also creeping into market sentiment, adding policy uncertainty to the monetary worries.

Stateside, Hillary Clinton health is being questioned, despite her doctor stating she was suffering from pneumonia. On the Korean peninsula, South Korea officials warned that the North has already completed preparations for another nuclear test.

Finally, the U.S and Russia had reached a ceasefire agreement on Syria that they hope will result in a peace process, however, already one of the main rebel groups have stated that they will not be bound by the truce.