Market Brief

Early this morning, the Reserve Bank of Australia released the minutes of its July 7 meeting where they maintained the cash target rate at a record-low 2%. The central bank said that despite “output growth in the March quarter had been stronger than expected” and noted that growth remained below average, and early indications that were that the strength in the March quarter had not carried through to the June quarter. However, the RBA acknowledged that “non-mining business profits had increased over the past year and that business conditions had generally improved over recent months to be a bit above average”. Members indicated that despite the Aussie depreciated considerably against the US dollar, the depreciation had been more modest against a basket of currencies and “the exchange rate had thus far offered less assistance than would normally be expected”. Therefore, we can reasonably expect that the RBA will cut rate before the end of the year as it clearly held an easing bias. However, it’s more likely that Governor Stevens will wait for further economic data before doing so; we therefore do not expect a rate cut at the August 4 meeting given the current economic conditions. The Aussie reacted negatively to the headline and is moving lower since then as AUD/USD is heading towards the 0.7328 support (previous low).

In New Zealand, net permanent migration (s.a.) fell to 4,800 in June versus 5,080 previous month while credit card spending grew by 6.5%y/y in June versus previous month upward revision of 7.2%y/y. NZD/USD is right in the middle of its declining channel and is taking a breather after last week’s sharp sell-off. Traders are currently positioning themselves ahead of tomorrow’s RBNZ rate decision and, as most market participants, we expect the central bank to cut its official cash rate by 25bps to 3%.

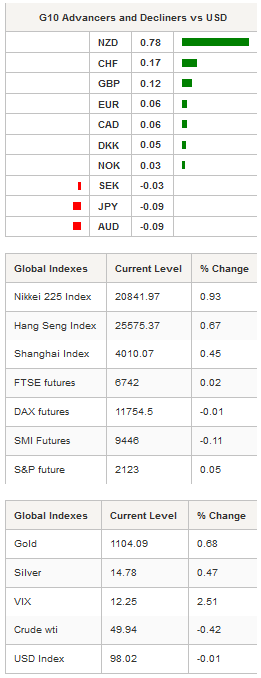

In Asia, equity returns are broadly positive with Shanghai Composite adding 0.45% and Shenzhen Composite 1.27%. In Japan, the Nikkei reopened higher after a public holiday on Monday. Tokyo’s leading index added 0.93% while the broader TOPIX index gained 0.66%. In Hong Kong, the Hang Seng is up 0.70%, in South Korea, the KOSPI edges up 0.50% while in India the Sensex loses 0.12%.

In Europe, equity futures are edging higher amid Greece’s creditors plan to disburse the first tranche of the bailout by August 17. In the meantime, Greece has made its bonds payment to the ECB and cleared its arrears to the IMF, using the bridge loan obtained on Friday. However, the bailout package still needs to be approved by national parliaments. EUR/USD has proven unable to break the strong support lying at 1.0819 (low from May 27) and is currently trading slightly higher. German DAX edges down -0.01%, CAC 40 is up 0.40% while the Footsie gains 0.02%.

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.0827

S 1: 1.0819

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5577

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 124.39

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9719

CURRENT: 0.9633

S 1: 0.9151

S 2: 0.9072