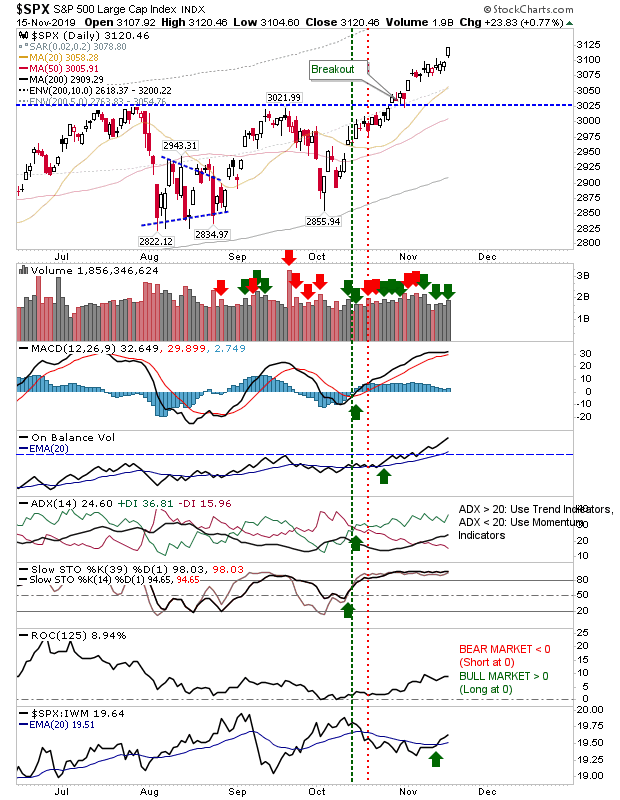

After a relatively narrow trading range, Friday saw indices kick on with higher volume accumulation. At that point the S&P delivered a new swing high with a bullish cross in relative performance against the Russell 2000. On-Balance-Volume finished with a new multi-year high.

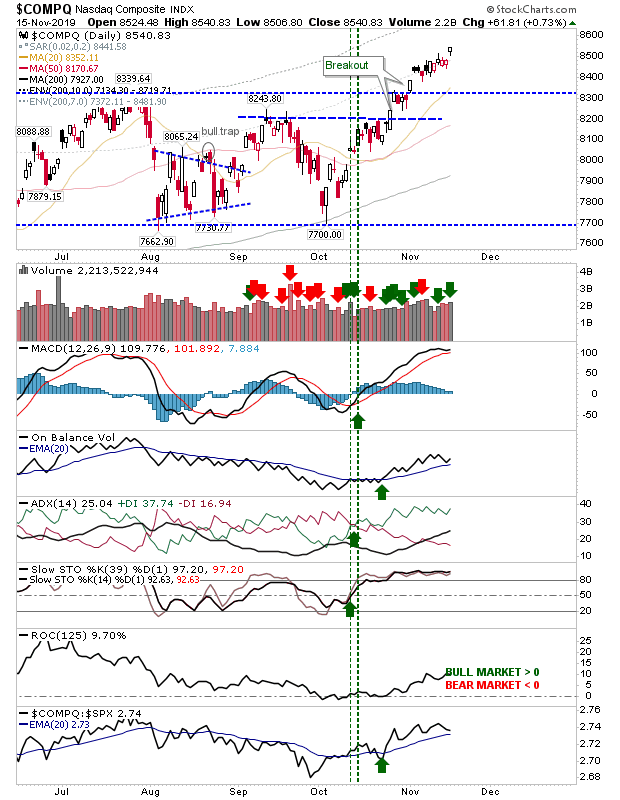

Likewise, the NASDAQ enjoyed a small gap higher as it posted a new closing high for the rally (and all-time high). Relative performance did lose a little ground but it was not too substantial.

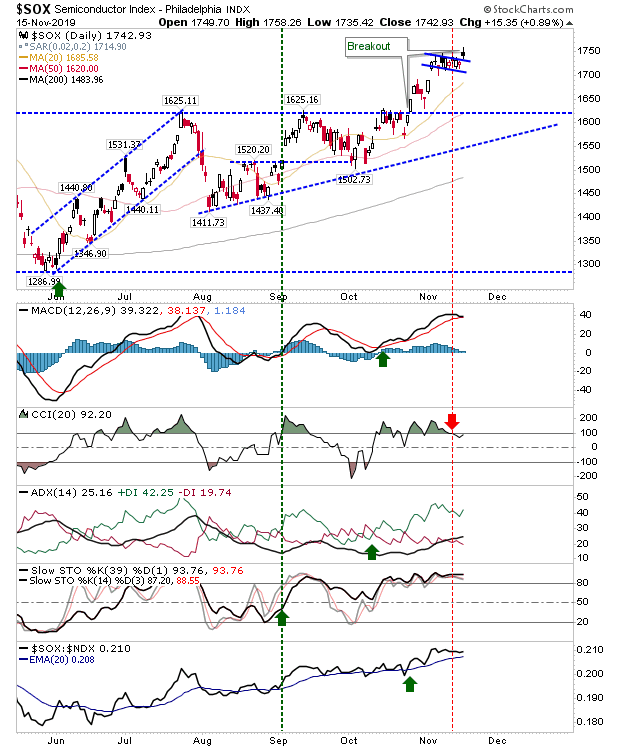

The Semiconductor Index broke from its mini-flag, although the 'spinning top' candlestick is a neutral candlestick and not one to suggest there will be further upside on Monday. There is a 'sell' trigger in CCI and a pending signal in the MACD further adds to the possibility of a 'fake out' on the breakout.

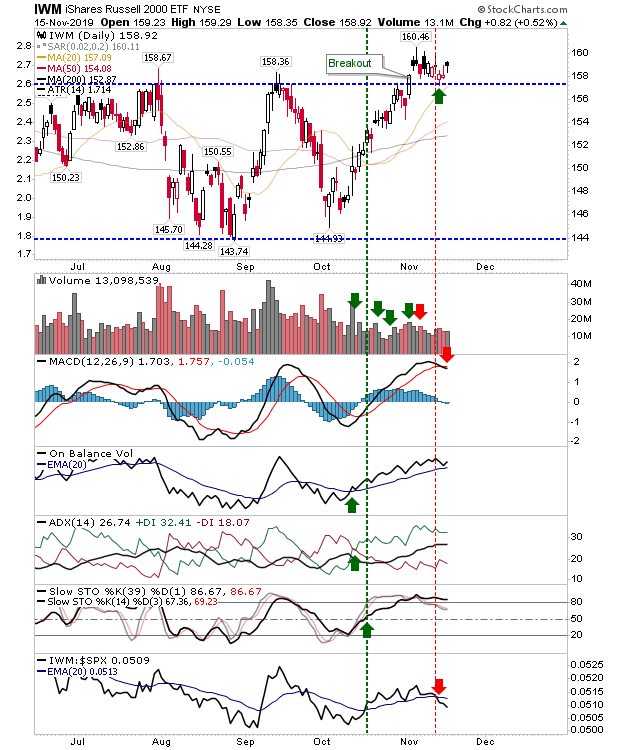

The Russell 2000 (via iShares Russell 2000 (NYSE:IWM)) continued its bounce from the breakout retest. It still has the MACD trigger 'sell' to reverse (along with the relative underperformance switch) but the index was able to close near Friday's high which gives it impetus to continue higher.

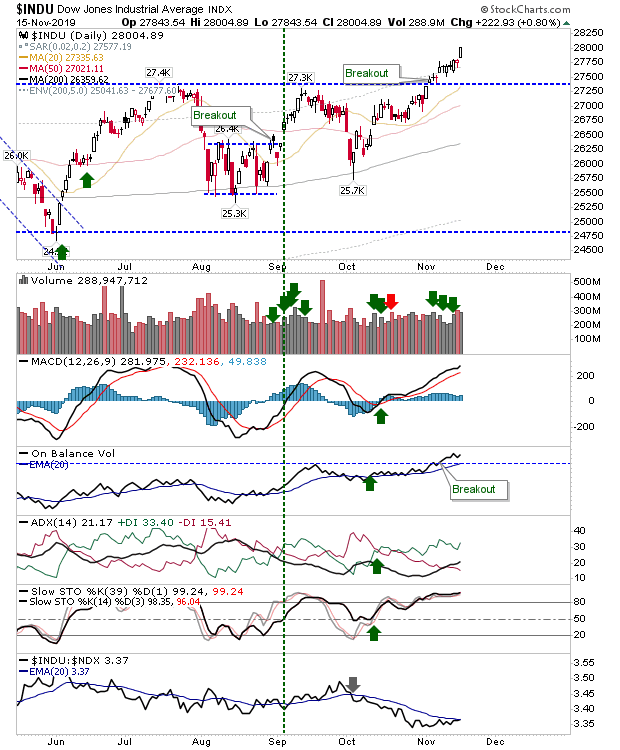

The Dow Industrials marked its run higher with one of the strongest finishes of the indices. While it didn't register as an accumulation day, it did manage to put the rally further from breakout support and leave the index just shy of a new relative 'buy' trigger against the NASDAQ 100.

While defensive Large Caps look well positioned to continue to benefit, long term rallies are built off the back of strength in Small Caps. The Russell 2000 didn't have a spectacular Friday but is still nicely set for further buying. Indices have well established breakouts, which will help attract money sitting on the sidelines. Add to this bullish seasonal factors and we could see a nice end-of-year flourish.