Tuesday December 11: Five things the markets are talking about

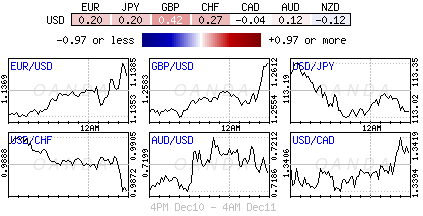

The U.S. dollar remains better bid on pull backs, as investors pile into the currency amid worries over global trade, Brexit and big swings in U.S stocks.

Data from the CFTC shows that the net bullish bets on the dollar in futures markets grew for the third consecutive week in the period to yesterday. Bullish bets totaled +$32.6B, compared to +$30.9B in the previous week.

Equities are mixed overnight, with European shares rallying while U.S futures ease with Asian shares as investors weighed the prospects for success in the Sino-U.S trade talks.

News that Chinese VP Liu He discussed a timetable for trade talks with U.S Treasury Secretary Mnuchin has helped boost market sentiment.

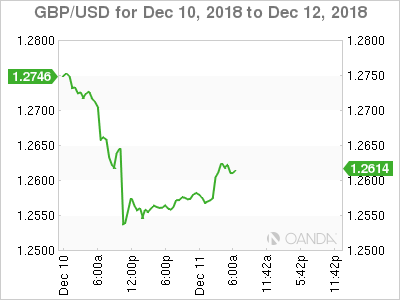

Sterling has edged a tad higher after yesterday’s 20-month low slump and gilt yields have backed up as PM Theresa May delays a critical vote on Brexit. Her plan is to reportedly gain a guarantee from the EU that there will be an end-date to the backstop on the Irish border.

On tap: The ECB is set to cap asset purchases at its final policy meeting of the year on Thursday, while China's industrial production and retail sales data for November are due Friday.

1. Stocks mixed results

In Japan, the Nikkei closed atop of its nine-month lows overnight as worries about global growth pressured financial and cyclical stocks, while uncertainty over a U.S-Japan trade deal hit automakers. The Nikkei share average ended -0.3% lower, while the broader Topix fell -0.9%, the lowest closing level since May 2017.

Down-under, Aussie shares edged higher overnight as China confirmed it was moving ahead on trade talks with the U.S. The S&P/ASX 200 index rose +0.4%, after Beijing said a road map was discussed with U.S officials for the next stage of trade talks. The benchmark fell -2.3% on Monday. In S. Korea, the Kospi Index ended nearly flat as sharp gains in Samsung (KS:005930) offset losses caused by external uncertainties.

In China, stocks ended higher overnight in thin trading as Beijing confirmed that it is still in trade talks with the U.S, and as investors looked to market support from government policies aimed at countering slowing growth. At the close, the Shanghai Composite Index was +0.4% higher, while the blue-chip CSI300 index rose +0.5%.

In Hong Kong, stocks clawed back early losses to end higher on Sino-U.S trade talk confirmation, but anxiety over trade, Brexit and the arrest of a senior Huawei (SZ:002502) executive capped gains. The Hang Seng index ended +0.1% higher, while the China Enterprises Index lost -0.3%.

In Europe, regional bourses push higher following strength in U.S futures and mixed session in Asia overnight. U.S Treasury Sec Mnuchin has started fresh round of talks with China’s Vice Premier Liu.

U.S stocks are set to open in the ‘black’ (+0.2%).

Indices: Stoxx600 +1.31% at 343.42, FTSE +0.87% at 6,780.09, DAX +1.36% at 10,766.61, CAC-40 +1.40% at 4,808.70, IBEX-35 +0.99% at 8,746.00, FTSE MIB +0.80% at 18,556.50, SMI +1.36% at 8,668.20, S&P 500 Futures +0.27%

2. Oil prices under pressure amid global market unease, gold higher

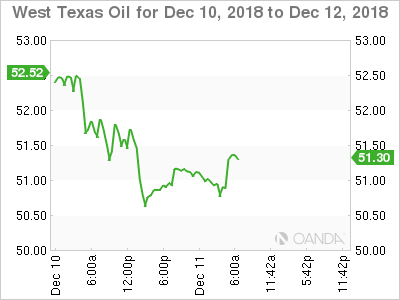

Oil prices are under pressure overnight amid worries over global equity markets and doubts that planned OPEC and output cuts will be enough to combat oversupply.

Crude prices have received some support after Libya’s National Oil Company (NOC) declared force majeure on exports from the El Sharara oilfield, the country’s biggest, which was seized last weekend by a militia group.

Note: NOC said the shutdown would result in a production loss of -315K barrels bpd, and an additional loss of -73K bpd at the El Feel oilfield.

Brent crude oil futures are at +$60 per barrel, up +3c from Monday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$50.98 per barrel, down -2c.

The OPEC-led group of oil producers last Friday announced a supply cut of -1.2M bpd in crude oil supply from January, measured against October 2018 output levels.

There are market doubts that all producers will follow through with their announced cuts.

Earlier today, Russia announced plans to cut its oil output by -50K to -60K bpd in January, much less than its target under a global production deal reached last week.

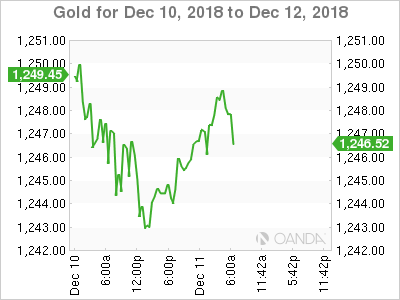

Ahead of the U.S open, gold prices edged higher, supported by hopes that the Fed could pause its rate hike cycle sooner than expected and as the dollar slipped after the previous session’s rally. Spot gold is up +0.3% at +$1,247.92 per ounce. It touched it’s highest in nearly five months at +$1,250.55 in Monday’s session. U.S gold futures are +0.3% higher at +$1,252.6 per ounce.

3. French borrowing costs surge on Macron wage rises, tax cuts

France’s 10-year borrowing costs climbed to their highest level compared with Germany in 18-months earlier this morning, as French President Macron announced spending measures in a bid to restore calm after weeks of violent protests.

Macron announced wage rises for the poorest workers and tax cuts for pensioners late on Monday, measures that are expected to increase public spending by +€8B to +€10B.

France’s 10-year bond yield has backed up +5 bps. The spread over equivalent German bonds has hit +47.5 bps, its widest level since May 2017.

Elsewhere, the yield on 10-year Treasuries has increased +1 bps to +2.86%. In Germany, the 10-year bond yield has gained +1 bps to +0.26%, while in the U.K, the 10-year Gilt yield has fallen -7 bps to +1.199%, the lowest in almost five-months.

4. Pound under pressure

The USD is a tad softer against G7 currency pairs as some risk appetite tried to find some standing room. There is continued dialogue between U.S and China on the trade front despite the recent arrest of a Chinese tech executive cited as a factor.

Sterling (£1.2635) fell to a 20-month low yesterday (£1.2513) after PM Theresa May delayed a parliamentary vote on her government’s Brexit bill, throwing plans for the U.K’s exit from the E.U into disarray. PM May won’t set a date for a new Parliament vote, saying only it would occur before Jan 21, the latest possible date.

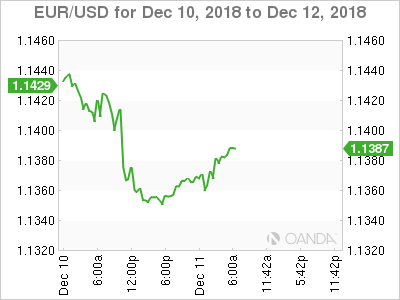

EUR/USD (€1.1379) remains within its recent ranges, but higher in today’s session. Market focus remains on Thursday ECB meeting where a formal end of QE bond buying is expected to be announced.

India’s rupee tumbled after Reserve Bank of India (RBI) chief quit yesterday. Gov. Urjit Patel said late Monday he would leave his post, citing personal reasons. The INR fell as much as -1.6% Tuesday to $72.46 outright, before retracing some ground to stand -0.7% lower. INR is now about -11% lower on the year.

5. German economic expectations rose in December

According to the ZEW economic research institute, German economic expectations rose in December, but they remained below the long-term average historical average of 22.5 points.

The measure of economic expectations rose to -17.5 points from minus-24.1 points in November – the +6.6-point increase from the previous month beat economists’ forecast for a minus -24.0 point reading.

The assessment of the economic situation has worsened dramatically for both Germany and the Eurozone and this is indicative of relatively weak economic growth in Q4.

Note: The ZEW’s measure of the current economic situation in Germany fell -12.9 points to +45.3 points in December.