Yesterday, the main event was the Bank of England (BoE) decision not to proceed with hitting the hike button as market pricing suggested. The decision disappointed those who added bets on such action following hawkish hints at the last gathering, as well as hawkish remarks by several officials, including Governor Bailey himself.

Today, the highlight may be the US employment report for October, where decent numbers could add to the case of a hike next year, despite Chair Powell signaling patience on Wednesday.

BoE Officials Refrain From Pushing the Hike Button Despite Market Pricing

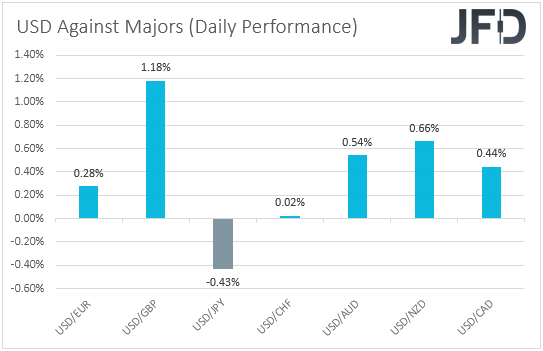

The US dollar traded higher against most of the other major currencies on Thursday and during the Asian session Friday. It gained the most versus GBP, NZD, and AUD, while it underperformed only against JPY. The greenback was found virtually unchanged against CHF.

The strengthening of the US dollar and the other safe havens, yen, and franc, combined with the weakening of the risk-linked Aussie and Kiwi, suggests that markets turned to risk-off trading at some point yesterday or today in Asia.

The pound has been acting as a risk-correlated currency lately, but yesterday's weakness resulted from the BoE outcome rather than the overall market sentiment.

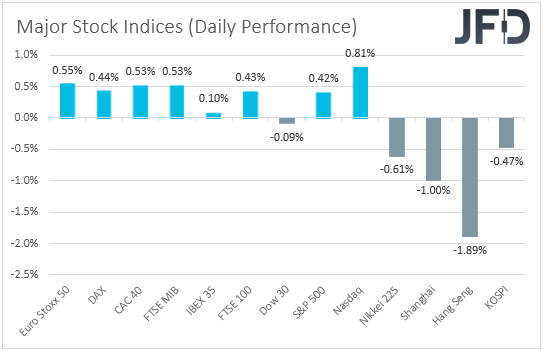

Turning our gaze to the equity world, we see that all but one of the major EU and US indices traded in the green, with the only exception being Wall Street's Dow Jones Industrial Average. The S&P 500 and the NASDAQ hit fresh record highs for another day.

That said, sentiment softened during the Asian trading once again. We stick to our guns with no apparent trigger that this is due to the uncertainty surrounding the Chinese economy and its property sector.

Now, the reason why equities may have continued drifting north this week may be the less-hawkish-than-anticipated central banks. Remember that, on Tuesday, the Reserve Bank of Australia (RBA) signaled that it could start raising interest rates in 2023, sooner than its previous estimate of 2024.

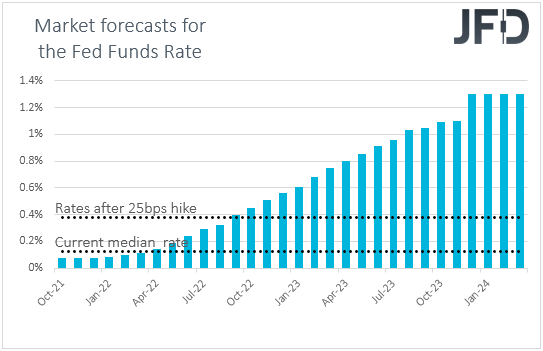

But, the market was already more aggressive, betting that Australia's rates will hit or surpass 1% by the end of 2022. On Wednesday, the Fed began its tapering process as expected. Still, it maintained the "transitory" wording in the accompanying statement, while Fed Chair Powell said they would stay patient on interest rates.

Last but not least, yesterday, the BoE refrained from pushing the hike button, even as prior remarks by its officials let market participants assign an 80% chance to such an action, at least according to the UK OIS forward yield curve.

What's more, British policymakers now noted that it would be necessary over the coming months to increase the bank rate to return inflation sustainably to the 2% target. This means that they may not hike in December either. February is still in the "coming months" spectrum.

That's why we saw the pound falling around 180 pips against its US counterpart. It was not only the decision to keep interest rates unchanged, but the 7-2 vote in favor of doing so, and the "coming months" narrative, which suggests that policymakers may delay a potential rate lift-off beyond the end of this year.

We would expect the pound to stay under selling interest for a while more, especially against the Kiwi, due to the Reserve Bank of New Zealand (RBNZ) being the most hawkish among the major central banks, but also against the US dollar, despite Fed Chair Powell signaling patience on interest rate increases.

Yesterday, we said that, in our view, the committee appeared more concerned about inflation and kept the door for rate hikes starting next year wide open, which could allow the US dollar to strengthen again.

More straightforward remarks or hints that interest rates could indeed start rising after the tapering is over may allow traders to buy more dollars. Speaking about the Fed and the US dollar, today, the main event on the economic agenda maybe the US employment report for October.

Nonfarm payrolls could rebound to 450,000 after falling to 194,000 in September, while the unemployment rate is expected to tick down to 4.7% from 4.8%.

Average hourly earnings are expected to have slowed somewhat on a monthly basis, to +0.4% from +0.6%, but the yearly rate is forecast to rise to +4.9% from 4.6%.

Overall, the numbers point to a decent report and encourage market participants to bring forth their Fed hike expectations. The Fed funds futures anticipated the first 25 bps hike to be delivered in September next year.

All this could encourage more US dollar buying, but the tricky question is: How will the stock market respond? Will it slide due to expectations of faster rate hikes, which could hurt firms' profitability, or will it rise on signs that the US economy is performing better than many may have recently feared due to the latest supply shortages?

In our view, although the former has been the case in the past, we believe that lately, it's been the latter. Thus, we expect decent jobs data to help stocks drift further north.

GBP/USD – Technical Outlook

GBP/USD fell sharply yesterday following the BoE's decision not to hike rates. It broke below the 1.3607 and tumbled to the 1.3470 zone. With the price structure being of lower highs and lower lows since Oct. 26, yesterday's tumble added more negativity to this pair's outlook.

We believe that a break below 1.4470 could extend the fall towards the 1.3412 zone, marked by the low of Sept. 29, the break of which could carry more bearish implications, perhaps paving the way towards the low of Dec. 22, at around 1.3305.

However, before we see the next leg south, the pair has a chance to correct part of yesterday's overstretched slide. Now, to abandon the bearish case in the short run, we would like to see a recovery above the 1.3740 zone, which provided support between Oct. 20 and 25.

A higher-high will be already confirmed, and the bulls may target one of the 1.3815, 1.3835, and 1.3854 zones, defined as resistances by the highs of Oct. 28, Oct. 19, and Sept. 15, respectively.

If neither zone can stop the advance, we may experience extensions towards the peak of Sept. 14, at around 1.3913.

EUR/USD – Technical Outlook

EUR/USD traded lower yesterday to hit once again the critical support zone of 1.1524, which has been holding the rate from falling lower since Oct. 6. Overall though, EUR/USD remains below the downside resistance line taken from the high of May 25, and thus, we would consider the short-term outlook to be cautiously negative.

We would like to see a decisive dip below the 1.1524 territories to get confident on more declines. This would confirm a forthcoming lower low on both the 4-hour and daily charts and may initially target the psychological number of 1.1500, or the 1.1465 zone, marked by the inside swing high of July 20, 2020.

If neither zone can halt the slide, then a lower break could set the stage for declines towards the low of Jul. 16, at 1.1370.

We will start examining a bullish reversal only upon a break above 1.1694, the high of Oct. 28. A surge above the downside line may pave the way towards the 1.1749 zone, marked by the peak of Sept. 23. The break of which could allow extensions towards the high of Sept. 17, at around 1.1790.

As for the Rest of Today's Events

At the same time, with the US nonfarm payrolls, we get the employment report for October from Canada as well. Expectations are for the unemployment rate to slide to 6.8% from 6.9%, but for the net change in employment to show that the economy has added fewer jobs than in September.

With the Bank of Canada (BoC) unexpectedly ending its QE program last week, officials may be now scratching their heads on when the appropriate time for a rate increase may be. The financial world anticipates such a move early next year, and in our view, a slowdown in jobs growth for just a month is unlikely to change that, especially if the unemployment rate indeed slides.

We will also get to hear from four central bank officials including European Central Bank (ECB) Vice President Luis de Guindos, ECB Executive Board member Fabio Panetta, BoE MPC member Dave Ramsden, and BoE MPC member Silvana Tenreyro.