Monday January 16: Five things the markets are talking about

This is a busy holiday shortened week for capital markets. Today, U.S. banks will be closed in observance of Martin Luther King Day.

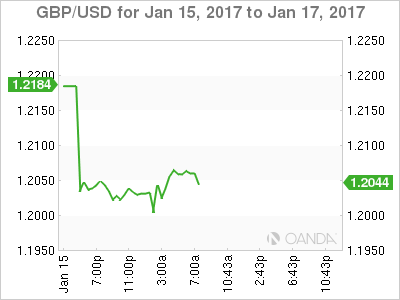

On Tuesday, U.K.’s PM May is expected to call on the country’s populous to reject the hostility of the Brexit referendum in a speech that being billed as setting the stage for a “hard” exit from the E.U. The pound’s plummet overnight to last Octobers ‘flash’ crash levels (-1.6% to £1.1987) seems to have got ahead of her.

The world’s eyes will be on Trump’s inauguration on Friday for any clarity on his economic plans. He disappointed the market during his first official press conference last week; there is no telling what he could say during this historic moment to appease the ‘concerned.’

In the U.S., inflation, industrial production and housing data will dominate, while the Fed’s Chair Yellen will have an opportunity to lay out her thinking with speeches on monetary policy on both Wednesday and Thursday this week.

Elsewhere, central banks begin to hold their 2017 policy meetings with both the Bank of Canada (BoC) and the European Central Bank (ECB) meeting midweek – no change in policy from either is expected. The U.K. will post inflation and labor market data. Expect dealers to scour the data for any Brexit signs of induced inflation and weakening in the labor market.

In Australasia, China reports Q4 growth data along with December output and retail sales.

On Friday we round off the week with the swearing in of the 45th U.S President.

1. Equities see ‘Red’

The Nikkei Stock Average closed at its two week lows while Chinese stocks saw a last-hour slump which some considered similar to panic selling as global investors continue to display caution ahead of U.S. President-elect inauguration this Friday and over fears of a ‘hard’ Brexit.

The Nikkei Stock Average closed down -1% as export stocks lagged amid the yen’s strength (¥114.04). Elsewhere in the region, Korea’s KOSPI ended off -0.6% while Taiwan and Hong Kong’s Hang Seng Index each fell -0.9%.

However, resisting the regional trend, the Aussies ASX 200 closed +0.5% higher, supported by strong gains in utilities stocks and higher commodity prices.

In China, the Shenzhen Composite Index fell -3.6% to the lowest point in seven months. Traders pointed to concern that regulators will accelerate the pace of initial public offerings, already at a 19-year high, diverting liquidity from existing shares. The Shanghai Composite fell -0.3% after paring a loss of as much as -2.2% in intraday trading percent.

In Europe, equity indices are trading lower as U.K PM May’s scheduled speech on Tuesday is expected to signal a clean and ‘Hard Brexit.’ Financials are underperforming on most of the major indices, while homebuilder stocks are trading notably lower on the FTSE 100. Commodity and mining stocks are trading generally higher on the index.

U.S. Futures are trading in the red (-0.2%).

Indices: Stoxx50 -0.5% at 3,304, FTSE 100 flat at 7,338, DAX -0.6% at 11,566, CAC 40 -0.5% at 4,896, IBEX 35 -0.9% at 9,425, FTSE MIB -1.1% at 19,303, SMI -0.7% at 8,390, S&P 500 Futures -0.2%

2. Oil prices slip on doubts over output cuts

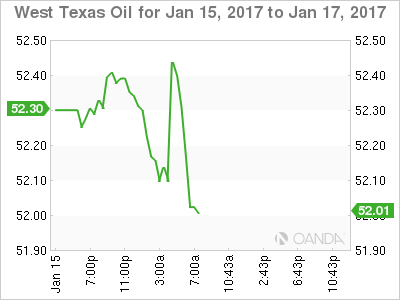

Oil prices remain pressured by doubts that OPEC and non-OPEC members will reduce production as promised and on expectations that U.S. production would increase again this year.

Brent crude oil futures are down -10c a barrel at +$55.35, while U.S light crude (WTI) fell -10c to +$52.27.

Note: OPEC has agreed to cut production by -1.2m bpd to +32.5m from January 1 in an attempt to clear global oversupply that has depressed prices for more than two-years.

Global oil production remains high and with inventories near record levels in many areas.

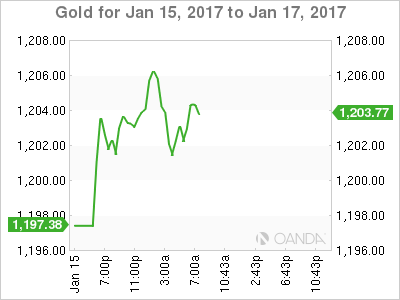

Gold prices have edged up overnight (+0.6% to trade at +$1,204.8 an ounce), supported by safe-haven demand due to uncertainty over U.S. policy ahead of President-elect Donald Trump’s inauguration and amid concerns over Britain’s exit from the E.U.

Note: Bullion last Thursday touched a high of +$1,206.98, its best since Nov. 23.

Data released on Friday indicates that Hedge funds and money managers (in the week to Jan. 10) have raised their net long position in COMEX gold contracts for the first time in nine-weeks.

3. Sovereign yields fall on “Hard” Brexit talk

Sovereign bond markets continue to retrace from their yield highs set in the middle of last month.

German Bund prices trade up in quiet trading as U.S cash markets are closed in observance of MLK Holiday. 10-year bunds currently yield +0.32%, down -1bps.

After ‘Hard’ Brexit talks over the weekend by PM May ahead of her speech on Tuesday has given U.K gilt prices a lift this morning. Yields on U.K.’s 10-year government bonds fell -5 bps to +1.32% after climbing +7bps last Friday.

Elsewhere, the yield on Aussie 10-year government debt fell -2 bps to +2.66%.

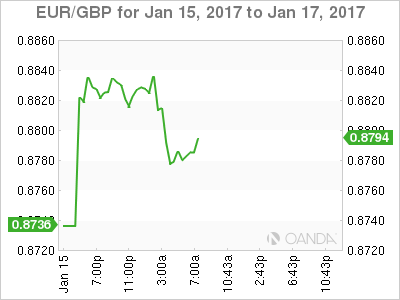

4. Pound plunges on expectations of “Hard Brexit”

GBP/USD at £1.2037 is down -1.2%, but off an earlier overnight low of £1.1987.

The pound has come under renewed pressure on weekend reports that U.K.’s PM May will point to a ‘hard’ Brexit in a speech tomorrow, where the U.K. may lose E.U. single market access to have immigration controls.

There is little new in these speculations or reports, therefore it may not be enough to keep the pound trading sub-£1.20 for the short-term. The market is certainly ‘short’ sterling, another factor that should provide the currency with some temporary support. A significant move lower for the pound would require harder evidence of economic weakness, hence why the bears will look to U.K. inflation and labor data this week for support.

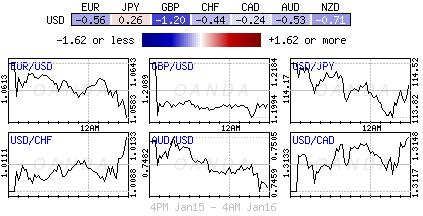

Elsewhere, JPY (¥114.24) has benefited from risk aversion stemming from the ‘Hard Brexit’ concerns, while the EUR/USD trades softer by -0.5% and back below the psychological €1.06 level (€1.0585).

5. Euro exports jump in November

The eurozone’s trade surplus widened in November, driven by a jump in exports that is consistent with other indications of a pickup in economic growth during Q4.

E.U. exports exceeded imports by +€25.9B in November, up from +€22.9B y/y. Seasonally adjusted figures show that exports rose +3.3% m/m, while imports were up +1.8% m/m, leading to a widening of the surplus to +€22.7B vs. +€19.9B in October.

This would suggest that the U.K.’s pound has not yet had a material negative impact, while the ‘mighty’ dollar’s strength should point to a further pickup in Euro exports in the coming months.