by Pinchas Cohen

Key Events

- Dollar traders are wary of trusting the Fed again

- Pound maintains uptrend since October

Global Affairs

Global equities opened with strong start this morning, as tech stocks in Asia were the biggest gainers in the MSCI Asia Pacific Index—as the price of crude oil gained for a third day and stayed above $43—leading the equity rally from South Korea to Hong Kong.

Last week oil completed a 20 percent decline from its January high of $55, signaling the beginning of a bear market, where advances are considered corrections and the presumed trend is a decline. This in turn triggered a sell-off in the energy sector, which brought down averages and scared investors into selling equities.

Perhaps the biggest worry for traders was fear of something that was there all along—a contracting global economy. Oil, which itself has a heavy and wide impact on equities, influences the prices of many products and services in industrial economies. Falling oil prices can have a strong ripple effect, and the potential to drag inflation down.

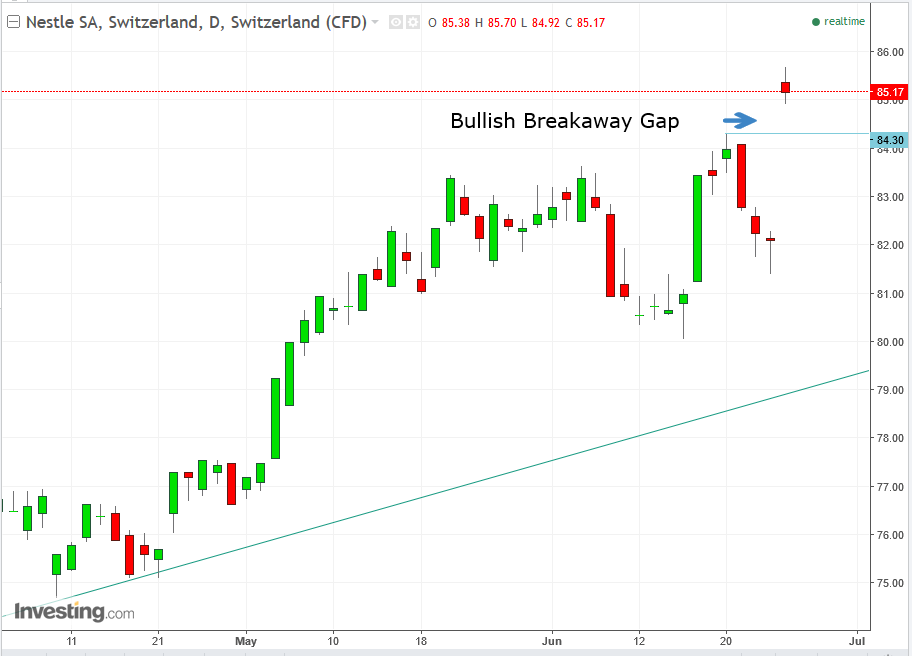

In Europe, Nestle SA (SIX:NESN, OTC:NSRGY) sparked a rally, as the stock of Europe's largest company leaped to its all-time high after being targeted by activist Dan Loeb in his biggest bet ever with a $3.5B position. Through his hedge fund, Third Point LLC, he encouraged Nestle to sell its stake in the cosmetic maker L’Oreal SA (PA:OREP), increasing leverage for share buybacks and adopting a formal profitability target. The stock leaped 4.7 percent in early Zurich trading.

Fool me Once

Dollar traders have been selling while Treasury traders have been buying, after disheartening first quarter growth for the US, followed by a string of disappointing data on economic releases. Investors have lost faith in the Trump reflation trade and are wary of this round of reflation, spurred by the Fed.

After this month's Fed meeting on the 14th, investors were becoming convinced that maybe another reflation was on its way. Fedspeak during the following days aimed to allay their concerns, until it seemed they were thoroughly persuaded. At which point they began buying dollars and selling Treasuries.

The situation reversed though when oil crashed, leading to equity sell-offs, and bearish traders quickly returned to investing in safe-havens. Despite today's equity rally the yen remains flat, suggesting that investors are not quite ready to go all-in after last week’s oil crash.

Fed is Steadfast

The narrative developing was that the Fed itself is questioning itself and its growth outlook. They themselves know they won’t be able to raise rates.

However, today Federal Reserve Bank of San Francisco President John Williams said it is necessary for the US Central Bank to press forward with interest-rate increases, in part to reduce the risk that the economy might overheat. Most importantly, he expects inflation to rise to the Fed’s 2 percent target next year, dispelling the market presumption that the Fed itself—or at least this regional president—has any second thoughts on the matter.

Nevertheless, despite the equity sell-off and surrounding fears, global stocks remain near all-time highs. Treasury yields are set for their first repeated quarterly declines in a year, while the Dollar Index is seeing its first consecutive quarterly decline in in three years .

The pound rebounded for a fourth day upon nearing its uptrend line since the October flash crash in Asian markets. This occurred even as the UK entered Brexit negotiations with a weaker hand after PM Teresa May lost political power in the recent UK elections. May's weakened position, and the ongoing threat to Tory leadership, have already forced her to cave to EU demands to first settle the divorce terms before any trade agreements can even be negotiated.

Markets Movers

Markets may react to public statements this week from the heads of key central banks including ECB President Mario Draghi, Federal Reserve Chair Janet Yellen and Bank of Japan Governor Haruhiko Kuroda.

However, despite the oil crash, analysts don’t expect a deviation of central bank policy paths. Nevertheless, when heads of central banks speak, investors listen. And react. At times causing sharp, short-term market movements that have the potential to become longer-term trends.

Economic data are additional market movers, with key reports on inflation, employment, manufacturing and housing scheduled to be released from China to the US.

Up Ahead

- U.S. spending data this week may reveal consumers are only moderately rebounding and the inflation backslide is continuing—will this vindicate the bears and the market narrative which presumed the Fed would tame its rush toward raising the interest rate?

- Durable goods orders on Monday are expected to show a 0.6 percent decline, as lack of details surrounding tax and trade reform cause reduced order activity.

- China’s PMI might have declined in June after remaining surprisingly flat in May, reflecting government efforts to cut overcapacity and leverage. The official manufacturing measure is estimated to have dropped to 51 from 51.2.

- Also due this week: Japanese inflation, factory output, unemployment, household consumption and housing starts.

Market Moves

Stocks

- The Stoxx Europe 600 gained 0.7 percent as of 8:19 a.m. in London. Nestle surged 3.8 percent, its most in a year. L’Oreal jumped 2.6 percent, and is poised for a record close.

- The MSCI Asia Pacific Index rose 0.3 percent. Hon Hai Precision Industry Co. (TW:2317) jumped 6.7 percent, the most since April, and Samsung (KS:005930) gained 1.4 percent to lead the advance among technology shares.

- Japan’s TOPIX rose less than 0.1 percent. Trading was suspended in Takata (T:7312) after the air-bag maker filed for bankruptcy protection in the biggest corporate failure in postwar Japanese manufacturing.

- South Korea’s KOSPI increased 0.4 percent to an all-time closing high.

- Hong Kong’s Hang Seng Index added 0.7 percent and the Hang Seng China Enterprise Index advanced 1 percent.

- China's Shanghai Composite gained 0.9 percent.

- Taiwan’s TAIEX jumped 1.3 percent to the highest level since 1990.

- S&P 500 futures rose 0.2 percent. The underlying gauge rose 0.2 percent last week as tech shares extended their rebound.

Commodities

- West Texas Intermediate oil climbed 1.3 percent to $43.56 a barrel. Futures are up 2.4 percent over the past three days, after dropping more than 20 percent from a February high.

- Gold declined 0.2 percent to $1,254.65 an ounce, after a three-day advance.

Currencies

- The pound increased 0.3 percent to $1.2751, bringing its four-day gain to 1 percent.

-

- The yen fell 0.2 percent to 111.48 per dollar. While the currency increased over the four preceding days, gains were incremental, with each session marking an advance of less than 0.1 percent.

- The euro was flat at $1.1199.

- The Dollar Index attempted a rally but was little changed after three days of declines.

- The South Korean won climbed 0.2 percent, increasing for a third session.

Bonds

- The yield on 10-year Treasuries rose less than one basis point to 2.15 percent.

- The yield on Australian government bonds with a similar maturity was little changed at 2.37 percent. UK benchmark yields added one basis point to 1.04 percent.