by Pinchas Cohen

Key Events

- Dollar, Treasuries show signs of buying into Fed’s optimisitc outlook

- Yen confirms reversal from year’s risk-off trend

- Pound falls on Carney’s Brexit concerns, confirming a medium-term top

Global Affairs

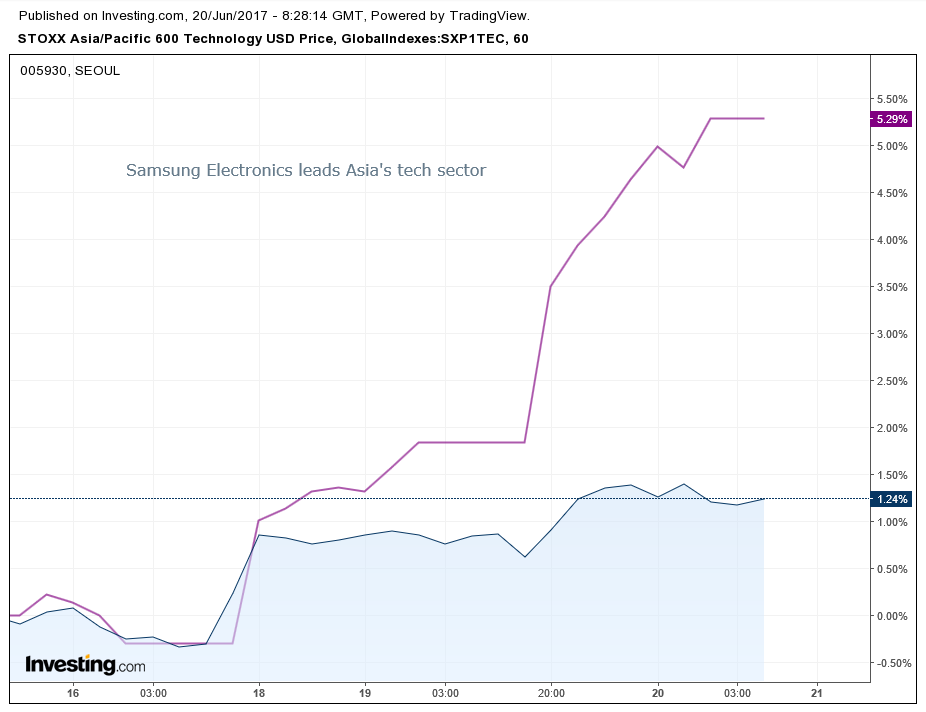

Global equities markets continued their rally, post the tech sector sell-off scare that began on Friday, June 9th and resumed, for a time, into last week. Tech shares in the MSCI All-Country World Equity Index resumed yesterday's rebound, following the Nasdaq 100 Index's biggest rally since November, before President Donald Trump’s election victory. This morning, Asian markets rallied, led by the continued upturn in the technology sector.

Confidence rose after Fedspeak calmed nervous traders on the outlook of the US economy, and the dollar held on to its daily gains.

The yen fell while tech stocks rose, helping boost Japanese equities to their highest levels since August 2015, as Samsung Electronics (KS:005930) led the technology sector’s second-day rebound.

In China, equity traders sold assets and cashed out on gains in Hong Kong's Hang Seng on anticipation of Chinese shares being included for the first time, after three rejections, into MSCI’s benchmark indexes.

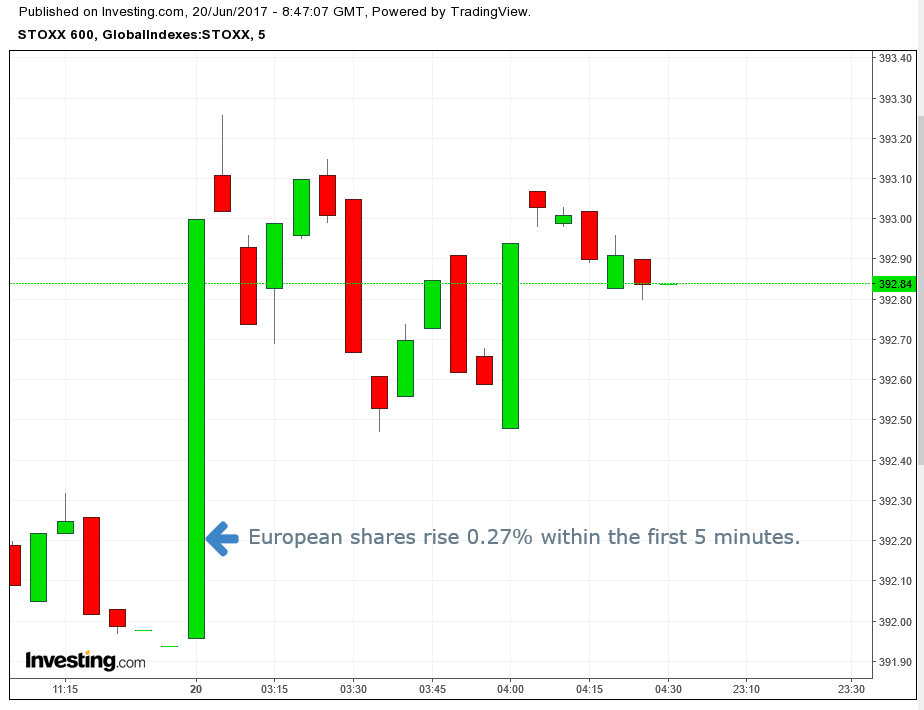

In Europe, shares opened with a sharp uptick, rising more than a quarter percent within the first five minutes of trade.

The jump was led by the tech sector, which registered a 0.39% surge shortly after markets opened.

10-Year Treasury Yields

Treasuries fell Monday after Federal Bank of New York President William Dudley confirmed the Fed’s cycle direction, saying stopping it would endanger economic growth. The second rate hike this year, after last Wednesday's FOMC meeting, returned the Fed to conviction on its cycle, which some thought may have been wavering before the market sell-off on May's disappointing CPI, which fell 0.1 rather than climbing, and the 0.3 percent fall in retail sales, the steepest dip since January 2016.

The repeated rallies after Yellen’s announcement last Wednesday, and Dudley’s yesterday, created a short-term uptrend line, a sign that perhaps bond traders are joining equity traders’ optimistic outlook.

GBPUSD Confirms Mid-Term Top

The pound dropped after the BoE’s Governor Mark Carney – in his first major show in six weeks – focused on his concerns regarding the impact of Brexit and how it would effect the British economy, while domestic inflation and wage growth remain weak. Carney emphasized that additional rate hikes are not in the cards for the near future.

Upcoming Events

- Ongoing rounds of Fedspeak continue with Vice-Chair Stanley Fischer today, while Eric Rosengren, Robert Kaplan, Jerome Powell, James Bullard and Loretta Mester are scheduled to speak later in the week.

- American Global benchmark provider MSCI will decide whether it will finally include Chinese shares after three prior rejections. China’s $6.8 trillion onshore market is the world’s second largest after the US and makes up 9 percent of global equity value. The prior rejections were based on problems with Chinese capital control and long trading halts. Analysts expect MSCI to announce that it will finally include Chinese shares, since this time they are contemplating a much more modest and therefore more realistic inclusion. The decision will be announced after US markets close.

Market Moves

Stocks

- Japan’s TOPIX rose as much as 1.2 percent to 1625.05 and settled on a 0.7 percent gain at 1617.25—completing a bullish flag pattern. It gained for a third day to close at its highest point since August 2015.

- Australia’s S&P/ASX 200 Index slipped 0.4 percent, after Moody’s downgraded the country’s largest banks on home loan risks. These are the same type of risks which started the US's 2008 financial crisis.

- South Korea’s KOSPI changed little, but Asia’s tech rally leader Samsung rose 2.8 percent, heading toward its biggest two-day increase since October.

- Hong Kong’s Hang Seng fell 0.1 percent, reversing an earlier gain of 0.5 percent.

- China's Shanghai Composite edged up less than 0.1 percent.

- The Stoxx Europe 600 rose 0.9 percent.

- Futures on the S&P 500 Index increased, fluctuating between a 1 and 1.25 percent gain to 2,448.75. The underlying gauge rose 0.8 percent Monday, as tech and healthcare shares climbed.

- Nasdaq futures rose 0.23 percent to 5,779.38

- Dow 30 futures rose 0.58 percent to 21,528.99

Currencies

- The yen slid 0.1 percent to 111.68 per dollar.

- The South Korean won dropped 0.4 percent.

- The Australian dollar lost less than 0.1 percent of its value yesterday.

- The Dollar Index was flat after advancing 0.45 percent on Monday. The measure has been climbing after touching its lowest level since October last week.

Bonds

- The yield on 10-year Treasuries was little changed at 2.19 percent, after rising four basis points Monday.

- Australian 10-year yields increased two basis points to 2.42 percent.

Commodities

- Oil was little changed at $44.22 a barrel, after settling on Monday at its lowest level since November. Crude has fallen for four weeks straight as U.S. drillers continue to add rigs, blunting OPEC-led efforts to rebalance an oversupplied market.

- Gold rose 0.1 percent to $1,245.19 an ounce, after closing Monday at its lowest in more than a month.