by Pinchas Cohen

Key Events

- PepsiCo completed a Double-Top reversal yesterday

- Asia shares rise on low volume, as China extends declines on sluggish consumer prices

- Oil below key $45 level

- Kiwi sold off on missed spending data

- Yen extends 3rd day decline on intervention and risk sentiment

Global equities have opened on cautious optimism ahead of the US earnings season, as shares in Asia crawl higher on low volume.

Global Affairs

Japanese and South Korean shares advanced—0.75 percent and 0.4 percent respectively—with volume nearly a third below average. Australian shares fluctuated but remain flat, and Hong Kong shares climbed, their most in four months, gaining 1.45 percent on a rising gap.

Mainland Chinese equities have suffered a second day of losses, even after the release of a positive PPI report, after having failed to lead consumer prices—an ever widening consumer-led global growth issue. Examples of struggling growth can be seen in the US's stagnant wages, Canadian concerns over consumer stamina and UK consumer spending falling to lowest level in nearly four years—even as the economic powerhouse Germany reported its consumer sentiment rose to its highest level in almost 16 years.

After opening higher, European shares erased earlier gains as oil failed to rally, dragging energy producers down with it.

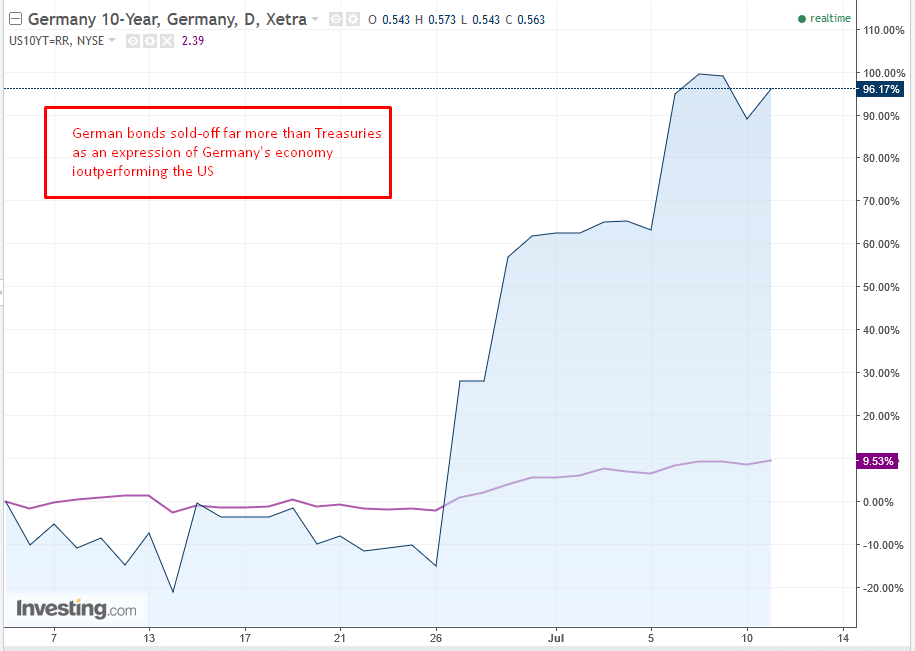

Safe havens are still down on reflationary expectations.

The kiwi declined after spending data missed forecasts, allowing the dollar to climb back above its uptrend line since September.

The yen extended its third consecutive decline, upon a breakout of a H&S reversal on central bank rhetoric of further intervention. As the go-to safe haven asset, its fall affects reflationary risk-on sentiment, following increasingly hawkish rhetoric by central banks.

Gold continued to decline, remaining suppressed below the neckline of a Double-Top reversal for a third day, an event we forecast here, at the end of June.

Bonds slipped further, sending yields higher, to retest the 2.4 percent resistance level.

Oil managed to climb to $44.92, but was forced back down to $44.62, as of 3:39 EDT.

While rhetoric returned global equities to nearly all-time highs, investors want to see profits through corporate earnings. PepsiCo (NYSE:PEP), JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) all report this week. These reports may reveal the catalyst to another rally that will beat previous all-time highs, or offer a correction to a relatively stable market. Goldman Sachs Chief Asia-Pacific strategist Tim Moe said on Bloomberg TV that he anticipates a slightly-above-expectation nine percent US earnings.

Pepsi beat profit expectations for the past 20 quarters by raising prices to offset declining volume. How long can they hope to create profits that are not based on growth? And having said that, are we actually still talking about Pepsi or about the stock market itself?

Perhaps it’s appropriate that earnings open with Pepsi, as its growth dynamic mirrors the US equity market. The company is expected to report a core EPS of $1.40 based on revenue levels of $15.60 billion according to FactSet, up from $15.40 billion YoY.

Pepsi’s stock has outperformed its peers and the broader market this year on account of its rising price and anticipation of a merger. How would the stock react if the merger potential goes away on lowered demand? Remember Twitter (NYSE:TWTR)? Its stock fell 35-percent from $25 to $16 between October 5 and 14 when hopes of a buyout evaporated. From a technical perspective, Pepsi completed a Double-Top reversal, on high volume and with confirming momentum, in an expression that investors were in agreement when it comes to the price of this stock.

The US is also on unstable footing, as growth in the country has been consistently disappointing this year—especially compared to Europe’s unparalleled growth—but investors are continuing to remain optimistic for now. After Trump’s failed reflation, they have placed their faith in the Fed and its reflation rhetoric, while at the same time disregarding political risk and the flat economy.

The question is how long will they continue to believe things will get better, without seeing results? While the headline calls attention to stocks holding up near all-time highs, their momentum has markedly diminished. One of the key sectors leading the rise in equities, tech, has completed a top—its rally this week is nothing more than a correction, which is expected to extend its declines. The first leg was seen on June 9 and the second leg occurred between June 26 and July 6.

Investors will still tune in to today’s Fedspeak to listen for any potential mixed-signals, as FOMC member Lael Brainard discusses normalizing balance sheets at 12:30 EDT, while Neel Kashkari—who voted against the June interest rate hike—speaks at 13:20.

Market Moves

Stocks

- The Nikkei 225 is up 0.57% to 114.50.

- Japan's TOPIX is up 0.73% to 1627.14.

- Hong Kong's Hang Seng is up 1.65%, climbing its most in the past four months.

- China's Shanghai Composite is down 0.37% to 3203.04.

- The DAX is up 0.20 to 12,471.

- The FTSE 100 is down 0.56% to 7328.75.

- The STOXX 600 is down 0.18% to 381.00.

- S&P 500 futures are flat.

Currencies

- The Dollar Index rebounded 0.5% to 96.10, after a four-straight day decline of 5.4%

- The euro declined 0.25% to 1.1399, as it seems unable to stay above the psychologically round number

- The pound is down 0.91% to 1.2906, being pushed down from yesterday’s above 1.3000 close, as it struggles with its own round number

- The kiwi lost 1.42% to 1.3829, after disappointing spending forecasts

- The yen is down 1.83% to 114.35, as it's squeezed both by intervention concerns and rotation of safe haven to growth

Commodities

- Oil is down 0.66% to $44.20, after providing a hopeful rally toward the $45 key level

- Gold is down 0.24% to $1,210.12

Bonds

- US 10-year Treasury yields are up 0.7% to 2.391 percent, while Germany’s 10-year yields shot up 4.15% to 0.563, which is a good gauge of Germany’s economic outperformance of the US.