by Eli Wright

Right now, the US dollar appears to be recovering from yesterday's Trumponomic pot-shots via comments from the President's new head of the National Trade Council, Peter Navarro, who characterized the euro as 'grossly undervalued' versus the dollar. His comments reflect Trump's conviction that Germany, China and Japan are profiting from their already devalued currencies at the expense of the United States' currency. The greenback slid lower after the comments, down 0.8% yesterday and the Dollar Index fell below 100.

The Dollar Index remains below 100 this morning, but could get some help from tonight's FOMC Statement. Though a rate change isn't expected, the quality and tone of forward guidance could provide some fuel for the flagging USD. However, the greenback could lose value if the Fed voices concerns about US economic growth, a possibility after Friday's US GDP disappointment.

On today's Economic Calendar ISM manufacturing PMI and ADP nonfarm employment changes are both scheduled.

Much like the dollar, global equities are trying to recover after struggling yesterday.

Overnight in Asia, the Nikkei rose 0.5% to 19,136. However, the Hang Seng, reopening after the lunar New Year, fell 0.17%, to 23,321. Markets in China remain closed until February 3.

In Europe this morning, the FTSE is up 0.67%, to 7,146.50; the DAX is 0.79% higher, at 11,627; and the Stoxx 50 has gained 0.49% to 3,257.50.

On Wall Street yesterday, the S&P 500 extended losses for a fourth consecutive day, dipping by 0.09%, to 2,278.87; the Dow fell for a third straight day, down 0.54%, to 19,864.09. The NASDAQ ticked higher 0.02%, to 5,614.79.

In pre-market trading, the S&P and Dow are both up nearly 0.2%, while the NASDAQ is up 0.45%.

US Treasury yields are up across the board this morning: the 2-year yield is 1.217%; the 10-year yield is 2.474%; and the 30-year yield is 3.076%.

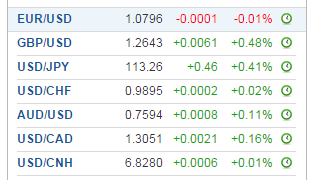

Forex

The Dollar Index finished yesterday below 100 for the first time in eleven weeks, capping a 2.6% drop last month, the worst January performance for the index in 30 years, As of this writing, it's at at 99.59.

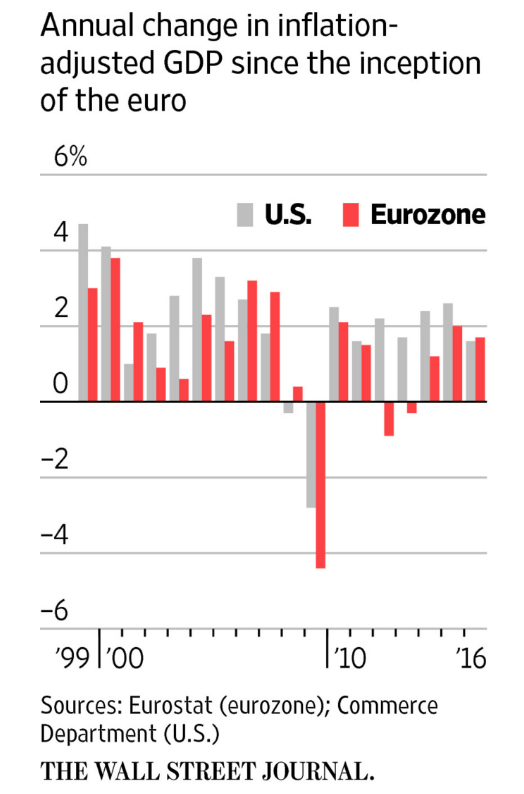

The euro has ticked 0.01% lower, to 1.0796, but the single currency’s prospects are looking brighter. The euro zone economy appears to be keeping pace with the US and unemployment is now at a seven-year low.

The pound is 0.48% higher, at 1.2643 after today's UK Manufacturing PMI release indicated a strong start to 2017. The Bank of England’s inflation report and its interest rate decision are expected tomorrow, after which BoE Governor Carney will speak. No change is anticipated.

The yen has found support at 112.70. USD/JPY is up 0.41% this morning, at 113.26, after the disappointing manufacturing PMI yesterday evening weakened the Japanese currency.

The loonie is down 0.16% to 1.3051 on lower oil prices. That said, yesterday’s MoM GDP report was positive though the Bank of Canada Governor Stephen Poloz said the rising USD is carrying the Canadian dollar along with it, hampering exports. The CAD could rise to 1.28.

The Mexican peso is up 0.42% to 0.0482 despite annual GDP coming in worse than expected.

Commodities

Oil prices are up approximately 0.28% as EIA data on US crude stockpiles is awaited. Crude is currently trading at $52.96, while Brent is at $55.73.

Yesterday’s API report said that US oil inventories increased by 5.8M barrels in the previous week.

Safe haven metals are benefitting from the hesitant equity markets and weaker dollar. Gold is currently near a one-week high, up 0.2% to $1,213, while silver is up 0.22%, at $17.582.

Stocks

Apple (NASDAQ:AAPL) reported Q1 2017 earnings after the market closed yesterday. EPS was $3.36 on $78.35B in revenue, thanks to higher iPhone sales in the holiday quarter and 18.4% growth in Apple’s services business. Shares of the world’s most valuable listed company are up 2.95% in pre-market trading.

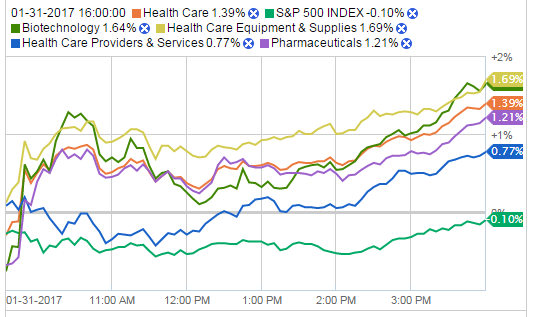

Source: Fidelity.com

Thought the S&P fell 0.09% yesterday, the index’s healthcare sector rose 1.39% after Trump met with heads of Big Pharma companies, including the CEOs of Novartis (NYSE:NVS), Merck (NYSE:MRK), Johnson & Johnson (NYSE:JNJ), Eli Lilly (NYSE:LLY), Celgene (NASDAQ:CELG), and Amgen (NASDAQ:AMGN). Despite the President indicating he wanted pharmaceutical manufacturing jobs moved to the United States plus lower drug prices, he also said he would work to reduce regulations; and added that he wanted to see other countries pay their fair share of medication costs.

Shares of all the companies whose CEOs attended the meeting rose in the aftermath.

Among the large caps reporting earnings today: