by Eli Wright

Asian markets moved up this morning, in part as a reaction to last Friday's record high U.S. close. European markets are trading higher right now as well.

Though US President Trump's promise of a 'phenomenal' tax plan goosed markets late last week, it's likely some of this morning's risk-on appetite in Asia was fueled by Trump's comparatively moderate behavior over the past weekend, especially toward Asian allies: his assurance to Chinese President Xi Jinping that the US would adhere to the 'One China' policy which has been the standard for US/China diplomacy for many years, contrary to earlier presidential statements; the fact that he didn't broach the subject of Japanese currency manipulation during his Saturday meeting with Prime Minister Shinzo Abe also calmed markets. His statements to Japan's Prime Minister Shinzo Abe that the "United States...stands behind Japan, its great ally 100%" after North Korea launched a ballistic missile which landed in the Sea of Japan, also eased markets this morning.

Trump's calmer tone could also diminish worries in the US ahead of Fed Chair Janet Yellen’s two-day monetary policy testimony in front of the US Congress , which begins tomorrow. Markets will be waiting for her assessment of the current state of the US economy as well as the strength of the Fed's commitment to ongoing rate hikes.

At least for now, it looks as though the “Trump Trade” is back on. Even extremely low volatility may not be cause for concern.

Overnight in Asia, the Nikkei gained 0.41% to 19,459.15; the Shanghai Composite rose 0.64% to 3,217.22; and the Hang Seng finished 0.52% higher, at 23,697.50.

In Europe, the FTSE has gained 0.4% to 7,258.75; the DAX is up 0.21% to 11,666.97; and the Stoxx 50 is 0.32% higher, at 3,282.

On Wall Street, all three major indices ended last week at record highs. The Dow rose 0.48%, to 20,269.37; the S&P 500 gained 0.36% to 2,316.10; and the NASDAQ closed up 0.33%, at 5,734.13.

The Dow, S&P, and NASDAQ are all approximately 0.1% higher in pre-market trading.

US Treasury yields are up across the board: the 2-year yield is 1.202%; the 10-year yield is 2.422%; and the 30-year yield is 3.015%.

Forex

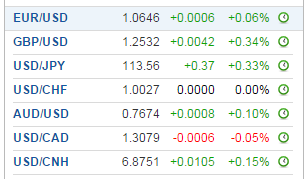

The Dollar Index has slipped 0.06% this morning to 100.74. Since President Trump's plans remain a primary driver for the USD, FX markets (as well as equity markets) await additional clarity on his administration's plans. Though the currency continues to move in a relatively narrow and choppy range, some analysts still see quite a bit of upside ahead.

The euro is trading at 1.0646, clinging to narrow 0.06% gains. Resistance could get tested at 1.075 while to the downside, the single currency could drop to 1.055.

Sterling is up 0.34% at 1.2532. To the upside, the cable could rise to 1.265; to the downside, it could fall to 1.248.

The Canadian dollar is up 0.05% at 1.3079, ahead of Trump’s meeting with Canadian Prime Minister Justin Trudeau later today during which time the two leaders will presumably discuss NAFTA among other subjects.

The Chinese yuan is down 0.15% to 6.8751 ahead of January Chinese PPI and CPI, which are scheduled to be released this evening.

Commodities

Crude oil is down 0.31% to $53.56 while Brent is down 0.31% to $56.39. OPEC is slated to release an assessment of its January production this morning; later in the day, the EIA will publish an update on US shale output. Both reports will likely impact oil’s price trajectory.

Gold is down 0.3%, to $1,232.15 as traders embrace risk-on assets. However, according to some analysts, the gold rally hasn’t yet reached overbought status, and there remains upside potential for the yellow metal to go to $1,280. Silver is up 0.06%, to $17.943.

Of some surprise, the price of coal has jumped. According to Reuters, in an effort to combat extreme levels of pollution, China’s Ministry of Environmental Protection is mulling moves which include redirecting coal shipments away from Tianjin, the port that currently handles 17% of the nation’s imported coal. This alongside pre-existing concerns of a coal shortfall, because of alternative energy sources and myriad global government regulations, have contributed to higher coal prices, which at $60.15, have now increased 60% YoY.

Related, aluminum, and iron ore prices are also on the rise. China is considering forcing aluminum and steel producers to cut output as an additional way to rein in pollution. Aluminum is currently up $10.50 to $1,981.25 while iron ore, used in the production of steel, is up $2.76 to $87.19.

Stocks

Fifty companies reporting earnings today. Among them:

Teva Pharmaceuticals (NYSE:TEVA) is set to report Q4 2016 earnings after the market closes. Expected EPS is $1.35 on revenue of $6.26 billion. The world's largest generic drug maker by sales has been plagued by a string of negative headlines lately: Last week, their CEO of three years, Erez Vigodman, resigned; last month, four patents protecting their flagship multiple sclerosis drug Copaxone were invalidated. Late last year, they agreed to pay a $519M fine due to bribery charges In addition, they remain under investigation for price fixing in collaboration with other Big Pharma companies.

Noble Energy (NYSE:NBL) is expected to report Q4 2016 earnings before the market opens. Expected EPS is -0.10 on $1.02B in revenue. The company has posted negative earnings per share for the last three quarters, but this could change if higher oil prices since the end of November help Noble’s bottom line.

First Data (NYSE:FDC), which provides global payment and e-commerce solutions, is slated to announce Q4 2016 earnings before the market opens. Expected EPS is $0.36 on revenue of $1.86 billion.

A trio of REITs is set to report Q4 2016 earnings before the bell: HCP (NYSE:HCP) is expected to report EPS of $0.26 on revenue of $580.2M. Brixmor Property (NYSE:BRX) is expected to report earnings of $0.19 per share on $320.7M in revenue. And National Retail Properties (NYSE:NNN) is due to report EPS of $0.31 on revenue of $137.5M.

A fourth REIT, Federal Realty Investment (NYSE:FRT), is set to report after the market closes. Expected EPS is $0.78 on $204.1M in revenue.