by Pinchas Cohen

Key Events

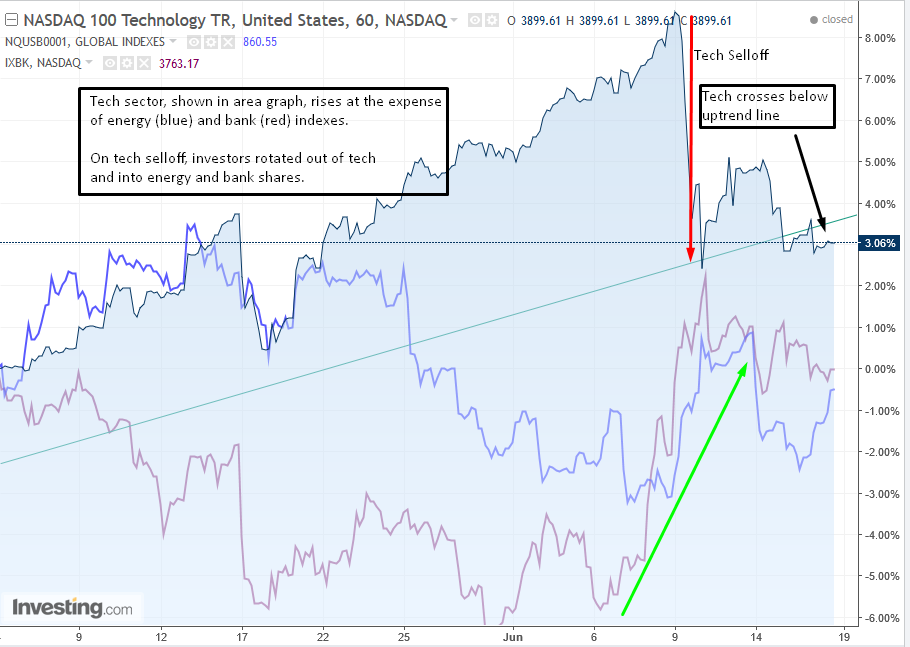

Last week global equities experienced their sharpest sell-off following a Goldman Sachs report focused on concerns surrounding low trading volume among large tech companies. Such a sudden drop has not been seen since the election of President Donald Trump in November, when investors were concerned over Trump's troubled past relationship with the tech sector.

At the end of last week’s tech sell-off, which resulted in investors rotating out of tech and into value stocks—particularly energy and banking—US indices diverged. The blue-chip Dow climbed 0.4 percent on a record close, the S&P 500 scraped up a mere 0.1 percent gain, while the tech-heavy NASDAQ fell 0.9 percent and the small cap Russell 2000 slid one percent.

Today’s global market open started on the rise, as stocks in Asia advanced on a cheaper yen, with tech stocks at bargain prices after falling three percent during last week’s sell-off. Samsung Electronics (KS:005930) is the leader of the tech-rally in the MSCI Asia Pacific Index.

There are talks of China being included into the MSCI Global Index, which led shares both on the mainland and Hong Kong to soar.

The Global equity rally spread, moving from Asia to Europe, as the Stoxx Europe 600 rose to its highest level since April.

Global Affairs

Since the release of the Goldman report which sparked last week's sell-off, increased trading volume has led to the VIX's highest level since mid-March. The rise was attributed to disappointing housing data and consumer sentiment, resuming the trend since the first quarter’s disappointing growth.

Even after last Wednesday’s show of confidence by the Fed and its plans for monetary tightening, investors are still cautious as these readings point to slower than expected growth, fueling demand for bonds and raising pressure on yields.

Positive Chinese economic readings were recently released—boosting investor confidence after previous lackluster releases and discrepancies revealing contrasts between government and private gauges—even as home prices increased in fewer cities last month due to cooling measures imposed by local authorities.

Gold fell, along with what has become the primary gauge of safe havens since last year, the yen. This is gold’s third consecutive week of losses.

Oil is flat, below the $45 key level.

The US political risk factor has been somewhat abated, after Trump's personal attorney Jay Sekulow attempted to make it clear via Sunday TV news shows that the President is not and has never been under investigation by special counsel Robert Mueller.

UK political uncertainty may become clearer, as Brexit talks finally open on Monday, five days before the one-year mark since the referendum that started it all. As of now, uncertainty looms over whether PM Theresa May or Labor's Jeremy Corbyn will have more sway over the version of the Brexit the UK wishes to execute. Investors may be happy with any development as the pound gained 0.20 percent versus the euro, as of 4:30 EDT.

Upcoming Events

- The round of Fed speeches this week kicks off with Chicago Fed President Charles Evans and Fed Bank of New York President William Dudley.

- MSCI will decide on Tuesday whether it will include Chinese shares in its global benchmarks. China has the world’s second-largest onshore market with $6.8 trillion, nine percent of global stock value. China’s shares have been rejected three times by MSCI on capital controls and long trading halts. Even so, Chinese shares soared today on the potential of being included, which will increase its efficiency and liquidity.

Market Moves

Stocks

Asia - Pacific

- The MSCI Asia Pacific Index increased 0.5 percent as of 3:05 p.m. in Tokyo. Samsung rose 1.8 percent, while Foxconn Technology (TW:2354) soared 6 percent, the most since September. Tencent Holdings (HK:0700), which lost 1.7 percent last week, climbed 1.4 percent.

- Japan’s TOPIX index jumped 0.6 percent.

- South Korea’s KOSPI gained 0.3 percent.

- Australia’s S&P/ASX 200 Index rose 0.4 percent. Woolworths (AX:WOW) fell 3.7 percent, the most since May 2016, as it joined a slump in global grocery companies after Amazon.com's (NASDAQ:AMZN) decision to buy the US's Whole Foods Market (NASDAQ:WFM).

- Hong Kong’s Hang Seng Index climbed 1 percent, after its first weekly decline in six weeks.

- The Hang Seng China Enterprises Index jumped 1.3 percent, the most since May 25.

- China's Shanghai Composite advanced 0.5 percent.

Europe

- The Stoxx Europe 600 jumped 0.8 percent as of 8:11 a.m. in London, led by banking shares, after falling 0.5 percent last week.

US

- S&P 500 Futures rose 0.2 percent after the underlying gauge posted a 0.1 percent advance last week.

Currencies

- The yen declined 0.1 percent to 110.94 per dollar.

-

- The dollar is flat, on a failed recovery after Friday’s 0.28 percent decline. It climbed on the European market open 0.12 percent, but retreated to yesterday’s close.

- The Aussie retreated less than 0.1 percent from its highest level since the end of March.

- The kiwi strengthened 0.3 percent.

- The Korean won climbed 0.2 percent, after dropping 0.9 percent on Friday.

- The pound is up 0.16 percent after it fell 0.1 percent to $1.2770. Formal negotiations on the U.K.’s exit from the European Union are due to start.

- The euro was little changed against the dollar, but fell 0.2 percent against the pound, as French President Emmanuel Macron’s party was poised to win the biggest majority in 15 years. The voter turnout was only about 44 percent.

Bonds

- The yield on 10-year Treasuries rose less than one basis point to 2.16 percent.

- Australian benchmark yields increased a similar amount to 2.41 percent.

Commodities

- Gold slipped less than 0.1 percent to $1,252.59 an ounce, heading for an eighth decline in nine sessions.

-