by Eli Wright

As markets in the US return from the long holiday weekend, the dollar continues to drop lower, global equity markets are mixed, and attention will focus on the aftermath of British PM Theresa May’s speech today; developments from the World Economic Forum in Davos, Switzerland where China's Xi Jinping, the first Chinese president ever to attend the annual conclave, will deliver the keynote address; and Donald Trump’s upcoming presidential inauguration on Friday.

Overnight in Japan, amid outsized gains for the safe haven yen, the Nikkei dropped 1.48% to close at 18,813.53, its lowest level this year. However, markets in China and Hong Kong rose: the Shanghai Composite gained 0.17%, to close at 3,108.77, while the Hang Seng climbed 0.54%, to 22,840.97.

In Europe, markets started the day lower. The FTSE is down 0.35% at 7,300.55; the German DAX is 0.9% lower, at 11,450.50; and the Stoxx 50 dropped 0.73%, to 3,273.50.

This past Friday the Dow edged 0.03% lower, to 19,885.73, but other major indices finished the week up. The NASDAQ rose 0.48% to 5,574.12, while the S&P gained 0.18%, to 2,274.64. The Russell 2000 rose 0.93%, to 1,372.94.

In pre-market trading today all the major indices are higher: the Dow is up 0.03%; the NASDAQ is up 0.45%; and the S&P is up 0.26%.

The Volatility Index headed higher by 11.4% today, up to 12.51, a sign that bigger moves could be on the horizon. According to Mike Paulenoff, the bullish pennant indicator on the S&P, could portend a move to 2,300 by the end of the month, but there are also many who question whether the Trump Rally can hold much longer.

US Treasury yields are lower today. The 2-year yield is 1.165%; the 10-year yield is 2.334%; and the 30-year yield is 2.933%.

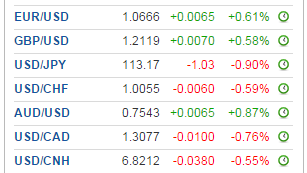

Forex

The US dollar has weakened, falling nearly one percent against the majors possibly on Trump’s remarks to the Wall St. Journal, published yesterday.

The greenback continued to weaken this morning, declining against safe-haven currencies, such as the yen and Swiss franc, comm-dollars, such as the Aussie, and loonie, and even against the euro and pound, both of which face uncertainty because of impending Brexit fears. The dollar is weaker against the yuan as well.

On the docket today are speeches by FOMC members Dudley and Brainard, as well as Treasury Secretary Jack Lew. Throughout the week, markets will also be keeping a close eye on the Senate confirmation hearings for Trump’s cabinet picks—including for Secretary of State Rex Tillerson, Secretary of Treasury Steve Mnuchin, Secretary of Housing Dr. Ben Carson, and Secretary of Energy Rick Perry.

Perhaps the real story today is, however, the British pound, as Theresa May sets out her Brexit plan ahead of triggering Article 50, which is planned for late March. Though sterling is experienced an uptick so far today on this morning's release showing that UK CPI rose to 1.6% yoy, its highest level since August, 2014, it faces strong headwinds moving forward.

After May’s speech, markets will turn to Davos where in the face of Brexit and Trump’s often-repeated positions on US protectionism, alongside the global rise in right-wing populism, China's President Xi will address the benefits of globalization. Headlines out of Davos and Trump’s corresponding tweets could become additional market drivers.

Commodities

Among major asset classes, commodities led the way higher last week. The iPath Bloomberg Commodity ETF (NYSE:DJP), a broad measure of the asset class, jumped 2%.

Gold is up 1.44% this morning to $1,212.45, as risk-off sentiment once again takes hold and the weaker dollar makes the precious metal more affordable; $1,260 may now be within reach.

Silver is up 1.56% to $17.023, a one-month high.

Oil has barely moved over the past four sessions. Crude is currently up 0.36%, at $52.55, while Brent is flat at $55.86.

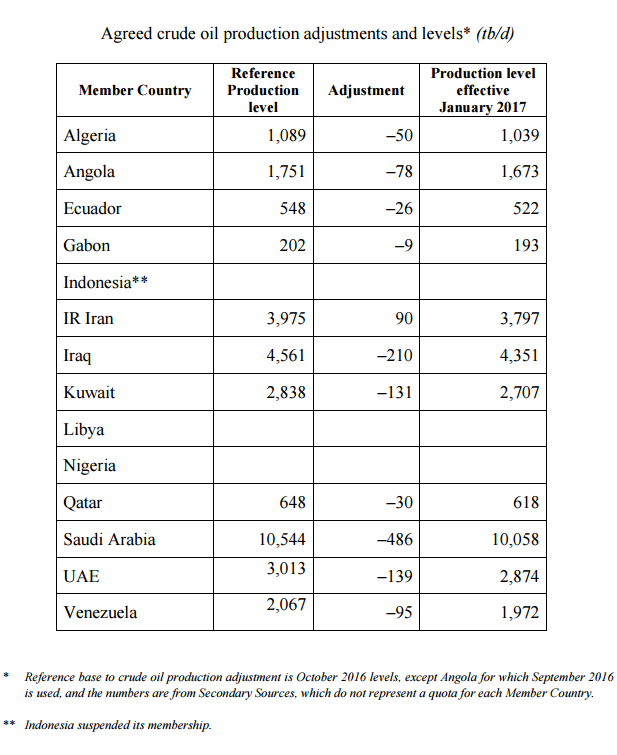

Market participants are waiting for monthly OPEC data due out tomorrow, looking for information about compliance—or lack thereof—of the cartel’s agreement with 11 non-OPEC nations to slash production by almost two million barrels per day (1.2M of which will come from OPEC members).

Source: OPEC.org

The OPEC Monitoring Committee will meet in Vienna on January 21-22. Markets don't really expect 100% compliance, but Reuters quoted an OPEC source last Friday that said 50 to 60 percent compliance would still be good enough to raise prices. Another OPEC delegate pegged sufficient compliance at 80%.

Because of the Monday holiday, US EIA weekly crude inventories will be out on Thursday.

Stocks

Ebullience about a Trump presidency and a seemingly hawkish Fed will carry markets only so far. The S&P 500’s overall price-to-expected-earnings ratio is now 17.55, higher than the four most recent historical averages: 5-year (15.0), 10-year (14.4), 15-year (15.3), and 20-year (17.2). Markets will need good reasons to continue to justify these lofty valuations and move higher. They may find some rationale if earnings surprise to the upside.

Major banks began reporting Q4 results last week, and Bank of America (NYSE:BAC), JPMorgan (NYSE:JPM), and Wells Fargo (NYSE:WFC) all reported better-than-expected earnings.

Morgan Stanley (NYSE:MS) reports today, with expected EPS of $0.65 on $8.28B in revenue. A number of regional banks will be reporting as well, including Mercantile (NASDAQ:MBWM), Century Bancorp (NASDAQ:CNBKA), and Bank of the Ozarks (NASDAQ:OZRK).

Companies from a variety of other sectors, will be reporting today as well:

- Brocade Communications (NASDAQ:BRCD), a tech company specializing in data and storage networking, expects EPS of $0.26.

- United Continental Airlines (NYSE:UAL) expects EPS of $1.73.

- UnitedHealth Group (NYSE:UNH), a supplier of health care benefit plans, expects EPS of $2.07.

- Brokerage Charles Schwab Corporation (NYSE:SCHW) expects EPS of $0.36.