by Pinchas Cohen

Asia-Pacific markets followed in lock-step with yesterday’s US panic sell-off, the worst day for markets in eight months. However, US futures, and the dollar bounced this morning while all safe-havens pruned gains.

Market Overview

Japanese and Australian markets led this morning's declines, after the S&P 500 plunged the most since September, falling on a 0.72% gap and closing on a 1.8% loss, after making a record close on Monday and registering a new all-time high on Tuesday. These new records broke out of the congestion since March 1 and revived hopes of another leg in the Trump Trade.

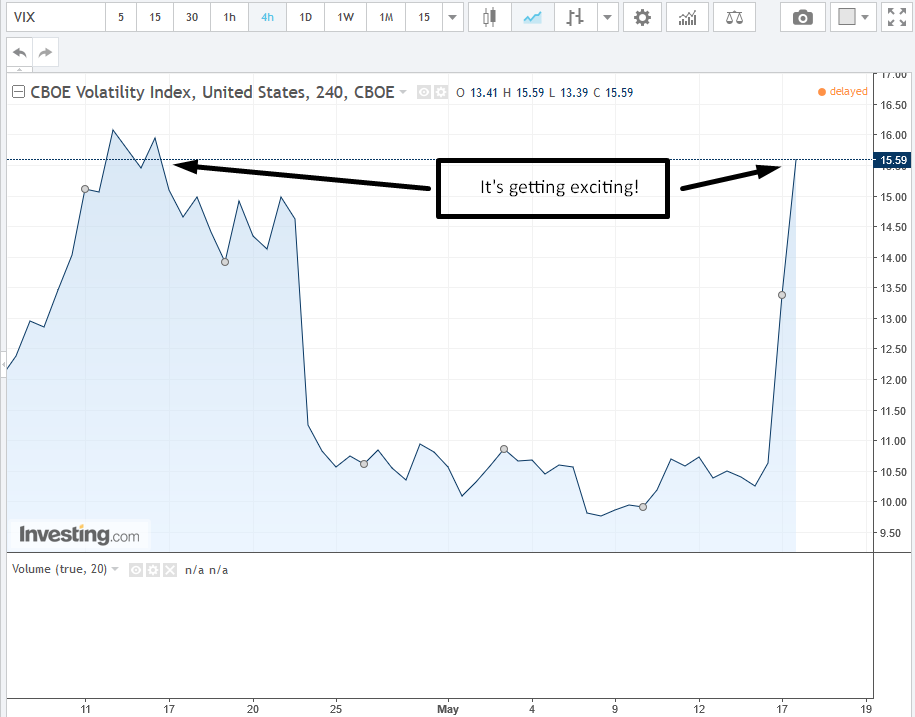

However, yesterday’s revelations of additional political scandals for the Trump administration and increasing talk of a possible impeachment dispelled those hopes and appear to have triggered the declines across all US indices. The CBOE's SPX Volatility Index, the VIX, jumped yesterday, signalling the most volatility for the index since the results of the British Brexit referendum were reported on June 25 last year.

It was largest gain for the VIX since that event. At its highest point yesterday the VIX hit 15.59. Today, it opened lower, at 14.06, but climbed back to 14.77, where it’s steady, but remaining in place, without giving back an inch.

While rising volatility scares investors, it was Christmas for short-term traders, who can profit in short periods of time.

The dollar had unexpected help in this morning's up-move, courtesy of another political scandal in Brazil, after reports from a leading local newspaper said that President Michel Temer is allegedly complicit in a coverup to buy the silence of disgraced former speaker of Brazil's lower house of congress, Eduardo Cunha. The alleged Brazilian obstruction of justice weighed heavily on emerging market currencies, thus supporting the falling US dollar which, ironically, is struggling with its own government's alleged obstruction of justice scandal.

The dollar index is up 0.11% at 97.666, after falling for five straight days to an accumulated 2.10% loss, down from 99.67 at the close on May 10; a mere 11 pips away from the psychological 100.00 level it reached at the high on May 12. Disappointing inflation figures, prior to the current Trump scandal, started the selloff.

The dollar’s rise was also boosted by the yen’s weakness after yesterday’s 2.04% gain. The Swissy, the former safe-haven currency king, rose a mere 0.71%, a little more than a third of the rise seen by the yen. The greenback’s jump naturally made the price of dollar-based gold more expensive. The commodity which is down 0.38% today, after yesterday’s 1.93% decline (0.11% less than the yen).

Yesterday the dollar's plunge boosted oil. Today's dollar advance pushed it right back down.

Today's Market Drivers

- Federal Reserve Bank of Cleveland President Loretta Mester will discuss monetary policy for current economic conditions.

- Federal Reserve Bank of Cleveland President Loretta Mester speaks on the economy and monetary policy, as odds of a June rate hike plunged from 80% to 60%. The next hike might be expected for September, though many now believe it will only take place in November. Coupled with the recent, disappointing inflation data, the Fed, which is charged with stabilizing markets, is less likely to make changes when the political climate is also unstable.

- U.S. Treasury Secretary Steven Mnuchin offers his first congressional testimony since taking office, appearing before the Senate Banking Committee on issues ranging from the rollback of Dodd-Frank financial regulations to his decision not to name China a currency manipulator.

Stocks

- The Stoxx Europe 600 Index declined 0.2 percent as of 8:10 a.m. in London, after tumbling 1.2 percent on Wednesday, its biggest drop since September. The MSCI Asia Pacific Index slid 0.9 percent, the most its fallen since April 6. Japan’s TOPIX slumped 1.3 percent while a volatility measure on the Nikkei 225 jumped 7.7 percent, the highest this month. Australia’s S&P/ASX 200 Index lost 0.8 percent.

- Hong Kong’s Hang Seng Index fell 0.7 percent while the Hang Seng China Enterprise Index retreated 1.2 percent.

- S&P 500 Futures rose 0.3 percent after the benchmark gauge fell 1.8 percent on Wednesday, its worst day since September 9. The Dow Jones Industrial Average lost 372.82 points, while the Nasdaq Compositeplunged 2.6 percent for its steepest drop since June 24.

- A Japan-traded ETF tracking Brazil’s IBovespa Index tumbled 7.5 percent, the most since November, as political crisis returned to the country after last year’s impeachment process.

Currencies

- The dollar index opened lower at 97.491 but climbed to a high of 97.762, and settled at 97.608, 0.03% up from yesterday’s close, as of 4:38 AM EDT. However small, should it close at this price, it will be the first gain for the currency index after a consecutive five-day loss of over 2 percent.

- The yen fell 0.4 percent to 111.30 vs the dollar. The Japanese currency surged 2.1 percent on Wednesday, its biggest upmove since November.

- The Mexican peso led emerging market currency declines, slumping 1 percent. The South Korean won and South African rand each dropped 0.6 percent.

- The Australian dollar rose 0.3 percent, climbing for a seventh straight day, the longest streak for the Aussie since October 2015. Data showed employment rose 37,400 in April, beating consensus forecasts which were calling for a gain of only 5,000. The unemployment rate was at 5.7 percent, compared with a 5.9 percent estimate.

- The euro fell 0.2 percent to $1.1134, after four straight days of gains. The British pound declined 0.2 percent to $1.2949.

Bonds

- The yield on US 10-year Treasuries rose two basis point, after dropping 10 basis points on Wednesday to 2.23 percent, the lowest since April 19.

- Australian benchmark yields fell three basis points to 2.50 percent.

- Benchmark yields in France and Germany were little changed after dropping six basis points in the previous session.

Commodities

- Gold slipped 0.5 percent to $1,254.56 an ounce, following a 2-percent surge in the previous session, the biggest one-day rally for the yellow metal since the aftermath of the Brexit vote.

- Crude dropped 0.4 percent to $48.89 a barrel, after jumping 0.8 percent in the previous session. Oil reached the highest close since April 28 as U.S. supplies fell for a sixth week -- a sign that OPEC-led production curbs are starting to be felt in the world’s biggest oil-consuming nation.