Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

by Pinchas Cohen

Key Events

Federal Reserve Chair Janet Yellen yesterday reiterated the Central Bank's outlook for a December rate hike, irrespective of the Dudley-Evans argument—whether inflation will move higher. She believes that raising borrowing costs gradually is the appropriate move during uncertain inflation dynamics. It’s as though she is simply priming the market by drumming up investor expectations for a December hike.

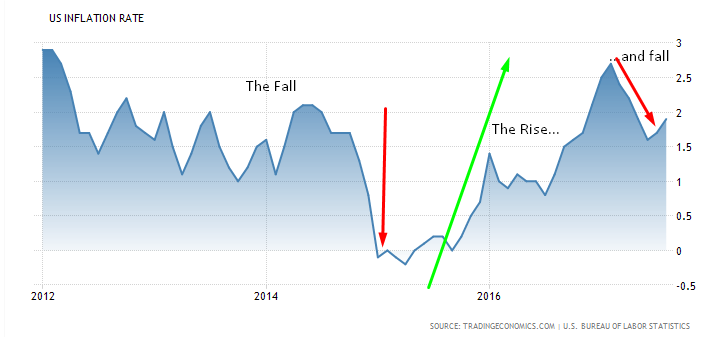

In early July, we pointed out that Yellen is as persistent as she is consistent, even if her views aren't always those espoused by consensus. She refused to raise rates despite growing criticism after inflation began rising in 2015, but startlingly, she turned hawkish this year, once again against the grain, when inflation repeatedly disappointed throughout the year.

We made the argument at that time that she may have missed her chance to normalize rates when the going was good and forecast that she would stick to her interest rate guns come hell or high water, to compensate for her gun-shy attitude last year.

Conspiracy theories aside, chances for a hike by December rose from 60 to 70 percent after the speech.

Global Financial Affairs

Investor conviction driven by the faith in the economy displayed by the Fed boss, however, was short-lived. The S&P 500 rally her speech initially triggered waned and the index closed lower than where it had been before the Fed chief’s bullish comments

Conversely, the dollar managed to hold on to its gains and even extended its longest, biggest rally since February. However, to be fair, the greenback had help: in addition to Yellen’s comments, news was released that US President Donald Trump’s much anticipated tax cut framework will be announced today.

That should have helped stocks even more than the dollar. According to advance information about the framework, listed companies would keep 15-percent more of their profits. The failure of stocks to maintain gains despite both bullish news and events raises a question investors should be asking themselves. One possible explanation is that looking through the prism of higher borrowing costs, stock prices suddenly don’t seem like such a bargain. The remaining question for investors is whether this narrative will take hold and what are its trajectory implications?

Although the dollar's strength weakened the yen, it didn’t boost the export-dependent Japanese stock market. Half of the companies trading on the TOPIX are without the right to receive the next dividend payment, which normally gets distributed after the first half of the fiscal year ends, which is this Saturday. Tokyo equities sank accordingly.

Similar to the dollar, Treasury yields, including the US 10-year, caught the boost, challenging the September 21, 2.282% peak.

Gold, perhaps best characterized as the anti-dollar, was affected by the same dynamics as the USD and yields. The precious metal fell hard, but has now found staunch support at the September 21, $1,291.20 low, around the $1,300 key-level.

Up Ahead

- 8:30 EDT: US – Durable Goods Orders (August): orders predicted to rise 1.5% from a 6.8% drop a month earlier, will provide further clues as to the Fed’s policy path.

- 10:30 EDT: US – EIA Crude Inventories (w/e 22 Sept): the previous week’s crude oil stocks figure showed a rise of 4.591 million barrels.

Market Moves

Stocks

- Japan’s TOPIX slid 0.5 percent at the close in Tokyo.

- Australia’s S&P/ASX 200 Index declined 0.1 percent.

- South Korea’s KOSPI ended less than 0.1 percent lower.

- Hong Kong’s Hang Seng Index climbed 0.4 percent.

- China’s stock benchmarks, including the Shanghai Composite, were little changed.

- The MSCI Asia Pacific Index fell 0.3 percent.

- The U.K.’s FTSE 100 increased 0.4 percent to the highest in almost two weeks.

- Germany’s DAX jumped 0.2 percent to the highest in almost 11 weeks.

- S&P 500 Futures advanced 0.2 percent.

Currencies

- The Dollar Index increased 0.4 percent to the highest since August 23.

- The Japanese yen declined 0.5 percent to 112.79 per dollar, the weakest in almost 11 weeks.

- The euro decreased 0.4 percent to $1.1746, the weakest in almost six weeks.

- The British pound slid 0.6 percent to $1.3373.

- The Swiss franc fell 0.5 percent to $0.974, the weakest in seven weeks.

Commodities

- West Texas Intermediate crude gained 0.6 percent to $52.18 a barrel.

- Gold decreased 0.2 percent to $1,291.76 an ounce.

- Copper gained 0.5 percent to $2.94 a pound, the largest gain for the red metal in more than a week.

Bonds