by Pinchas Cohen

Key Events

- Investors are divided as Fed, US equities closed higher on a lower VIX, while yields dropped

- Rotation from tech to financials stuck on lower probability of reflation

- Oil rebounds

- Safe havens fluctuate, reflecting investor confusion

Asian stocks were down while the yen rose as traders switched their investment strategies after the release of Fed minutes clearly showing a diveded Fed.

Global Affairs

After US investors remained sanguine in the face of the Fed division, with the S&P 500 closing 0.15-percent higher and the VIX heading lower (!) even as the complacency signaled by low volatility amid the record-high valuations was the primary concern of the Fed. Investors in Europe and Asia managed to keep their calm today, even though one would think US and global traders would have been concerned about the mixed signals from the the FOMC minutes. Overall, it appears traders remain unfazed from the FOMC's convoluted outlook of the US economy.

The Fed seem at odds with itself on inflation, as well as not unanimous regarding the timeline of scaling down the balance sheet; the FOMC believes inflation will rise again and that its recent slip is only temporary. Members are concerned though that the current policy is too loose and could create another bubble, and have suggested tightening the cycle further to rein in irrational exuberance. This in itself is an inherent contradiction: if the Fed believes inflation will rise, it means business will grow and so would financial assets, i.e. no bubble. If they’re concerned about unjustifiably high valuations which could lead to a bubble, it means they don’t believe inflation will rise anytime soon. So, which is it?

These are highly educated, very smart individuals. How can they seem to make so little sense? Then, again, the investment community has some of the brightest minds, and it seems conflicted too.

Presumably, equities rise driven by investors whose belief in their positive outlook has become dogmatic, while bonds rise because traders are firmly entrenched in their own negative outlook. For every piece of news, whatever it may be, there's a preconceived view that's been rationalized to benefit each trader's own narrative.

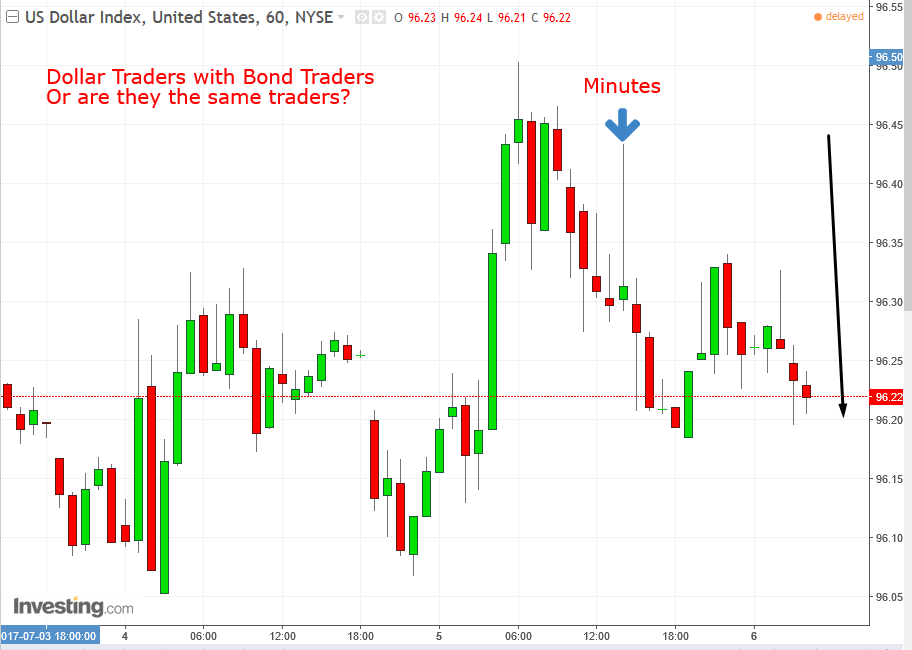

At times, on the same news, both equities and bonds rally together—a blatant contradiction. It suggests that investors have become entrenched in their positions. Dollar traders, by the way, side with bond traders—or maybe they are the same traders? Certainly, foreign Treasury investors must first purchase its base currency.

How can this apparent Fed discrepancy be reconciled? Here’s a conspiracy theory: it’s a cover up. The Fed, including Janet Yellen, is actually worried about inflation.

Last year there was a disagreement among Fed members on the timeline for increasing rates. Some members were concerned about missing the boat, increasing rates while the going was still good. Their fear of waiting too long, so that inflation would start falling, putting them back into square one and unable to raise rates—was exactly what happened in 2014. Yellen is concerned about the messy side effects that don't go away. Had she raised rates back then, she might not have been concerned about a bubble now.

The dissenting FOMC members warned that the Fed will then be between a rock and a hard place, and will be forced to increase rates faster than they would have liked. This in turn will create a liquidity squeeze and a market sell-off. Still, rates didn’t increase as quickly as those dissenting members advocated.

What happened this year? Inflation fell. How did the Yellen respond? She raised rates and said more increases were coming. Is inflation falling? Nonsense she claims, it’s only temporary. What is the Fed’s concern now? That it will be forced to raise rates more quickly than it would have liked in order to prevent a bubble. Sound familiar doesn't it?

This obvious division and perhaps less obvious contradiction is preventing the rotation from the tech sector to financials which began with the prospect of higher inflation. While NASDAQ Financials rose 0.18% yesterday, NASDAQ Tech jumped 1.57%.

Upcoming Events

- The ECB is the next major central bank to release its minutes. Much like with the Fed’s division, ECB lieutenants Peter Praet and Benoit Coeure also argued about interest rates. Praet advocated caution, while Coeure warned that moving too slowly can lead to bigger financial shocks, with Draghi taking Praet’s approach. In his last speech, it seemed he might have gone with Coeure’s outlook, but regretted it and quickly adopted Praet’s viewpoint. This event has the potential to confirm the euro's long-term downtrend since August 2015 or its breakout on the upside, completing a massive triple bottom with a 2.4000 target implications.

- The Group of 20 summit will be hosted by Chancellor Merkel in Hamburg, where US President Donald Trump is expected to hold his first meetings with Russian President Vladimir Putin and Chinese leader Xi Jinping.

- NonFarm Payrolls are expected to reveal that the American workforce has grown by 175,000 jobs in June, with a rise in wages that befits a market favorable to employees. In the past, when growth in employment beat expectations, the dollar fell on a disappointing rise in wages.

Stocks

- S&P 500 Futures declined 0.1 percent after the underlying gauge rose 0.2 percent Wednesday.

- The Stoxx Europe 600 fell 0.1 percent as of 9:44 a.m. in London.

- The NASDAQ 100 jumped 0.9 percent.

Currencies

- The Bloomberg Dollar Spot Index weakened 0.1 percent.

- The euro was flat at $1.134.

- The British pound was little changed at $1.2938.

Bonds

- The yield on 10-year Treasuries rose two basis points to 2.34 percent, after falling three basis points Wednesday.

- UK, French and German 10-year yields all climbed two basis points.

Commodities

- West Texas Intermediate crude futures rose 1.6 percent to $45.84 a barrel. The contract crashed 5.5 percent during Wednesday's trading and closed 3.3 percent lower, its most in four weeks, as Russia supposedly opposed any proposal to deepen OPEC-led production cuts. This is ironic considering that it was Russia that wanted to add an option to extend the deal by three months, which Saudi Arabia opposed in the May deal extension.

- Gold lost 0.2 percent to $1,224.28 an ounce, after two days of gains.