- Coronavirus restrictions announced across Europe

- Pelosi and Mnuchin said to “narrow their differences”

Key Events

Contracts on the Dow, S&P, NASDAQ and Russell 2000 rebounded on Tuesday on lingering hopes of a breakthrough on a US fiscal aid packaged. However, European markets, including the Stoxx 600, were under pressure as a continued increase in coronavirus cases offset positive corporate earnings releases.

The dollar remains under pressure and oil is down on concerns that demand will fall as restrictions are increased across Europe

Global Financial Affairs

S&P futures—which fell overnight on Monday—jumped after a spokesman for US House Speaker, Nancy Pelosi said the divide between the Democrats and Republicans was narrowing.

That positive outlook failed to reach Europe which is besieged by a second wave of the novel virus. Belgium health minister, Frank Vandenbroucke warned of what he characterized as a “tsunami” of new infections. Bars and restaurants there are now closed for four weeks and a curfew has been introduced in an attempt to curtail virus transmission.

Italy added a slew of social restrictions after registering a new record number of cases, and nine major French cities have mandated 9 pm curfews. The Republic of Ireland will begin severe social restrictions for six weeks on Wednesday and the Czech Republic—with the most cases on the continent—is contemplating a countrywide lockdown.

As a result, positive earnings news—normally a boon for stocks, even in the face of broad selloffs and economic contractions—failed to do more than pare some of the losses. Shares in UBS Group AG (SIX:UBSG) added just 4.3% after it announced a 99% surge in quarterly profits, thanks to extreme trading volatility.

Swedish Swedbank (ST:SWEDa) advanced 0.9% on quarterly net profits that beat estimates due to volatile markets and an increase in the bank’s net commission income. However, Logitech (SIX:LOGN) bucked the trend, after its shares leaped a whopping 20.5% to a new all-time high after the computer peripheral maker raised its yearly guidance.

Asia was mixed with Australia's ASX 200 (-0.7%) underperforming on fears of European lockdowns. South Korea’s KOSPI (+0.5%) led the rallies on foreign buying, which pushed the won to an 18-month high.

The supply-demand picture increases the odds for further strengthening of the Korean currency, which can be seen in the following chart.

The dollar’s decline versus the won extended its downside breakout, followed by a fall below the 200-weekly MA for the first time since early last year.

On Monday, the S&P 500 dropped 1.6% to its lowest level in almost two weeks.

The index found support above the neckline of a short-term H&S bottom, suggesting dip buyers will carry the benchmark on another leg up.

Yields on the 10-year Treasury note climbed for the fifth straight session as bond traders continue to believe that a stimulus deal is in the cards.

Having tested the all-time low on Mar. 8, yields started taking on the 0.8% high, aiming to extend the rebound from the 0.5% level.

The Treasury sell-off weighed on the dollar for the third straight day. Any economic stimulus would increase the number of dollars in the economy, reducing the value of each unit.

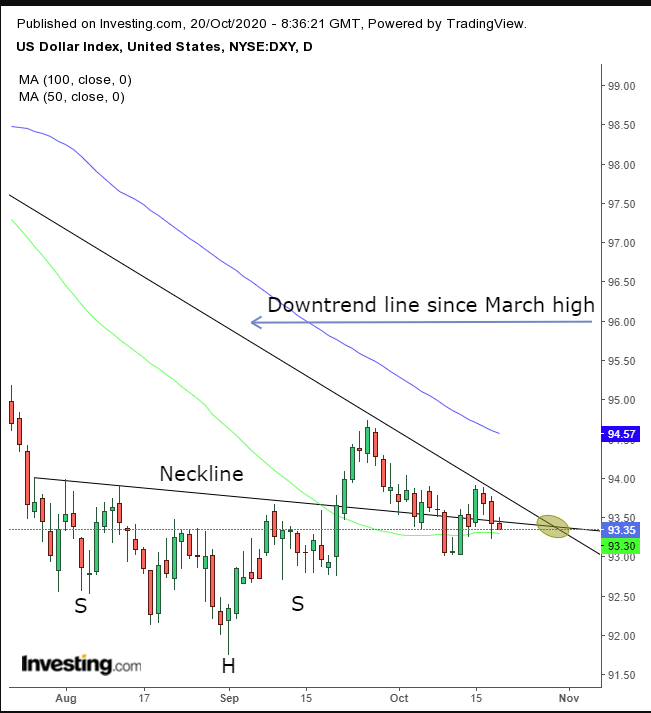

Technically, the greenback struggles between the short and medium terms marked by the converging trendlines and manifested by the support of the 50 DMA versus the resistance of the 100 DMA.

Gold fluctuated and is flat as of the time of writing, despite the weaker dollar but amid a rise in US futures.

The yellow metal continues to struggle between conflicting themes and trends, awaiting a decisive breakthrough to either follow-through with a bearish symmetrical triangle followed by a bearish flag, or to break upwards, completing a bullish wedge.

On-chain data is showing that long-term Bitcoin holders were selling out, leading some analysts to make bearish calls.

However, we are reiterating our bullish call on the cryptocurrency.

Oil declined for the fourth day even after OPEC+ members failed to give definitive guidance on the status of oil production quotas. The second wave of coronavirus is also hampering the demand outlook.

Up Ahead

- Brexit talks are likely to continue at least into next week as the UK and EU struggle to reach an agreement on any future trading relationship.

- The final presidential debate before the Nov. 3 election between President Donald Trump and former Vice President Joe Biden, will be live from Nashville, Tennessee on Thursday.

- September building permits, a key indicator of housing demand are due to be reported today.

Market Moves

Stocks

- S&P 500 futures rose 0.4%.

- Topix index fell 0.8%.

- South Korea’s KOSPI index was flat.

- Hong Kong’s Hang Seng Index fluctuated.

- Shanghai Composite Index was little changed.

Currencies

- The yen was at 105.51 per dollar, down 0.1%.

- The Dollar Index was flat.

- The euro traded at $1.1778, up 0.1%.

- The yuan was at 6.6778 per dollar.

- The Aussie fell 0.5% to 70.41 U.S. cents.

Bonds

- The yield on US 10-year Treasuries held below 0.77%.

- Australia’s 10-year bond yield was at 0.76%.

Commodities

- West Texas Intermediate crude fell 0.6% to $40.57 a barrel.

- Gold slid 0.1% to $1,902.03 an ounce.