-

Japan's TOPIX jumps 1.5 percent despite stronger yen

-

Yen edges higher notwithstanding growing political risk

-

Global stocks gain on upbeat US employment data and stagnant wages

-

Dollar falls on lowered rates hike expectations

-

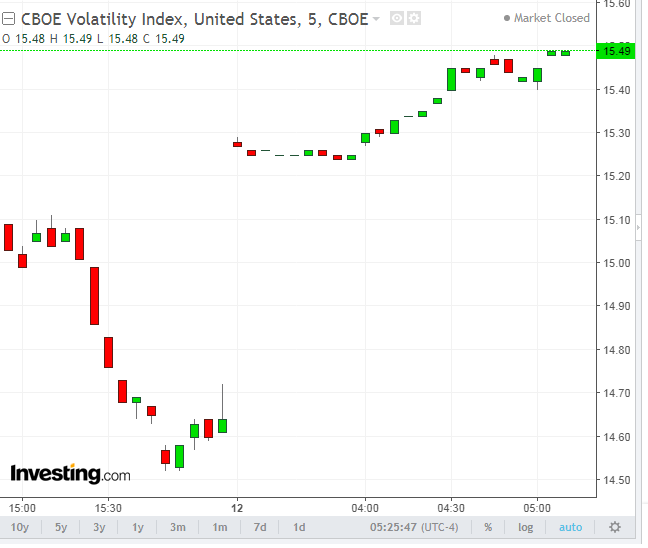

Rising VIX warrants caution

-

Oil loses ground on higher production even as rig count falls

-

Bitcoin's rebound slips within a return-move to a double top

-

Gold drops on renewed risk appetite

-

China data on industrial production, retail sales and fixed-asset investment, all out on Wednesday, are likely to point to slower growth, according to Bloomberg Economics forecasts.

-

Key indicators for the Fed dominate the economic agenda in the coming week. Headline inflation may have edged up to 2.2 percent in February from 2.1 percent, though consensus before Tuesday’s report is for core inflation to remain at 1.8 percent.

-

The U.S. Treasury will sell $21 billion of 10-year notes and $13 billion 30-year bonds at March 12-13 auctions, plus $28 billion of three-year notes, the most since 2014. Last month’s auction of those maturities drew lackluster demand.

-

Also this week, Germany’s Angela Merkel officially starts her fourth term; EU27 government officials discuss the European Union’s Brexit position, and U.K. Chancellor of the Exchequer Philip Hammond issues his spring statement.

-

The STOXX Europe 600 Index rose 0.5 percent with its sixth consecutive advance.

-

S&P 500 Futures Index climbed 0.4 percent to the highest level in more than five weeks.

-

The MSCI AC Asia Pacific Index gained 1.6 percent, in its biggest move in 16 months.

-

The U.K.’s FTSE 100 Index rose 0.2 percent, reaching the highest level in almost two weeks on its sixth consecutive advance.

-

The MSCI Emerging Market Index gained 1.2 percent to the highest level in more than five weeks.

-

The Dollar Index dipped 0.1 percent.

-

The euro rose 0.2 percent to $1.2333.

-

The British pound climbed 0.2 percent to $1.3873.

-

The Japanese yen strengthened 0.3 percent to 106.54 per dollar, the largest advance in more than a week.

-

South Africa’s rand gained 0.2 percent to 11.7938 per dollar.

-

The MSCI Emerging Markets Currency Index rose 0.2 percent.

-

The yield on 10-year Treasurys increased one basis point to 2.90 percent, the highest in more than two weeks.

-

Germany’s 10-year yield was unchanged at 0.65 percent.

-

Britain’s 10-year yield decreased less than one basis point to 1.489 percent.

-

WTI crude dipped 0.4 percent to $61.82 a barrel.

-

Gold fell 0.1 percent to $1,322.36 an ounce.

Key Events

Global stocks resumed Friday's energetic rebound this morning, benefiting from the upbeat wave spurred by Nonfarm Payroll results stateside. Fresh US employment figures revealed the strongest January reading since mid-2016, with 313,000 jobs created for the first month of the year smashing expectations of 200,000.

A high job reading reflects an expanding economy. Still, wage growth undershot forecasts, falling to 2.8 percent. This means that economic growth is not coupled with higher inflation. An increase of the latter metric would have forced the Fed to increase interest rates at a faster pace, to manage the growth.

In short, the data means that companies won't need to incur higher borrowing costs for expansion. Similarly, investors can continue to bid up stock prices.

Global Financial Affairs

This morning, the STOXX Europe 600 Index mirrored gains across Asian markets, advancing for a sixth day. The European index is enjoying its longest winning streak since October 2017, mostly helped by gains this morning in Utilities stocks.

Bullishness was so overt that Tokyo's TOPIX managed to climb higher even against the headwind of a rising yen. It emerged on Monday that Japanese Finance Minister, Taro Aso, is refusing to step down after it was revealed that his name and that of Prime Minister Shinzo Abe were removed from documents connected with a land-sale scandal. While domestic political headwinds would normally weaken a country's currency, the yen's safe haven status could, ironically, cause it to grow stronger.

But even ignoring political risk, a strengthening currency would make a country's exports more expensive for foreign importers, hurting its sales. This would in turn dent corporate earnings and push investors to sell stocks, as they price in lower projected shares value.

On top of that, yen-denominated stocks would become more expensive for foreign investors, who would have to buy the currency first. That's how events would unfold under normal circumstances. Instead, Monday was the strongest day of trading since September 19, demonstrating how hungry investors are at present.

This rare economic environment, characterized by strong job growth and dwindling wage growth, has created what has been dubbed the Goldilocks Economy. In this scenario, economic growth is more sustainable since it's moderate—neither too hot, nor too cold.

In addition, it doesn't require irksome Fed intervention via rate hikes. This fortunate combination is currently overshadowing concerns about US President Donald Trump's trade war threats, buoying global equity markets, which are continuing to run their ongoing, nine-year old, bull marathon.

Still, the current stock rally isn't as complacent as previous rallies. The VIX jumped on opening Friday and extended its advance to 15.50, where it continues to trade, a sign that there are no speculators willing to short the fear index. Rather, traders seem to agree that there's more volatility is on the cards. Normally, elevated volatility is followed by declines.

Since inflation fears eased, so did dollar trader expectations for higher rates. As a result, disappointed investors sold the greenback.

Meanwhile, the price of oil has been slipping, as money managers liquidated 15,417 long positions last week and opened 4,386 short positions, according to Dutch bank ING. While a falling rig count and a jump in employment numbers—a clear sign of economic growth, which increases demand for oil—may help support prices, oil production remains very high.This puts US crude oil exports ahead of those form Saudi Arabia, and second only to Russian output.

Bitcoin is set for its first move higher in five week days, though it has found resistance by the neckline of its completed double top, suggesting this increase is nothing more than a return-move, before a downward reversal.

The price of gold fell by 0.2 percent, even as the dollar dropped by 0.15 percent. While this is a rare occurrence for the pair, which usually shows a negative correlation, their relation is now probably dominated by trends in equities, as investors rotate out of safe havens and into growth assets.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities