- US futures slide on renewed trade uncertainty

-

Asian and European shares halt US rally momentum

-

Oil consolidates above $71 after rallying on US calls for barring all Iranian imports

-

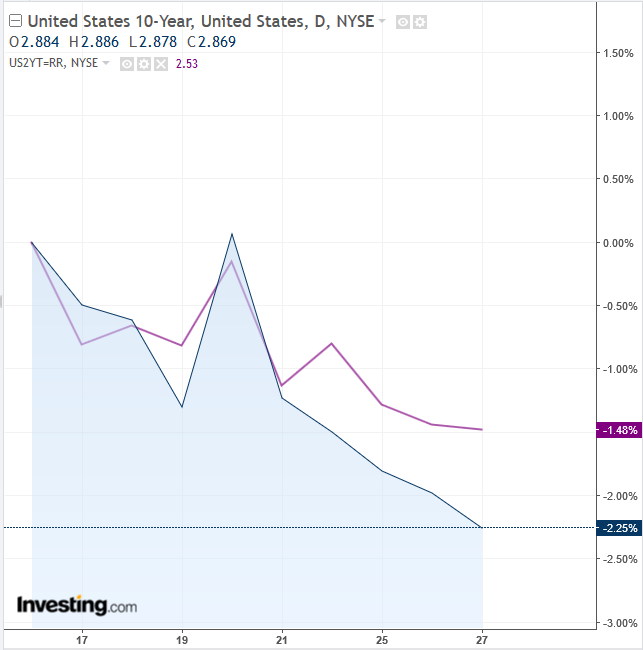

US yield curve narrows the most since 2007

-

Yen strengthens

-

USD continues to climb, pushing gold lower

Key Events

European shares and US futures on the S&P 500, Dow and NASDAQ 100 slipped lower on Wednesday after Asian indices succumbed once again to trade worries, failing to hold on to gains posted by US markets on Tuesday.

The US yield curve narrowed the most since 2007, highlighting growing concerns over the longer-term ramifications of global trade restrictions for the US economic growth trajectory.

The yield on 10-year notes in particular hit its lowest level since May, just as the yen strengthened and gold weakened against a stronger dollar.

The price of oil is consolidating above $71 after soaring during the US session, following reports that the US State Department will require allies to cut all oil imports from Iran by November. Two drivers could keep prices elevated through the summer.

Gains by oil and gas stocks were overshadowed by broader losses across most other sectors in European trade, dragging the STOXX 600 about 0.65 percent lower by mid morning.

Global Financial Affairs

Earlier, during the Asian session, Chinese shares both on the mainland and in Hong Kong led a selloff across regional indices, spurred by the official entrance of the Shanghai Composite into a bear market on Tuesday.

The Chinese benchmark index did manage to trim a 1.55 percent loss down to 1.05 percent, after dipping below Tuesday’s hammer low and closing above it, as bulls and bears fought over the 20 percent decline mark from the January high—the accepted signal of a bear market.

The preceding completed pennant pattern suggest further declines lying ahead. The possible effects of the historic passage in the Shanghai Composite could be comparable to those of a bank run—where failures at one bank spark a wider fund withdrawal across a country's banking system.

The Chinese yuan rebounded, as, according to traders, at least one local bank was selling dollars in the onshore market, to keep the domestic currency above the 6.6 level.

Japan’s TOPIX bounced back from a 0.4 percent decline, finishing flat.

South Korea’s KOSPI closed 0.4 percent lower in a pennant pattern, suggesting a pick up of the current selloff, signaled by a downside breakout. Australia’s S&P/ASX 200 ended in negative territory for the fourth day, albeit by a paltry 0.05 percent.

The broad declines seen across global indices today spoil the defiant performance posted yesterday by US majors, which managed to rebound from the worst selloff since early April, mostly thanks to the jump in oil prices, which allowed traders to shift focus away from worries over global trade glitches, which could hinder the first synchronized global growth since the Great Recession.

The S&P 500 gained 0.22 percent, crossing back above its 50 DMA. Energy stocks led the advance (+1.26 percent), buoyed by WTI prices hitting their highest level in a month—less than 3 percent away from the May, $72.83 peak.

However, the SPX gave up up a higher 0.57 percent climb and its price swings formed a High Wave candle, highlighting a lack of leadership. Nevertheless, this price move is still better than any stronger signals that might point to leadership heading lower.

The Dow Jones Industrial Average ticked 0.15 percent higher, hitting its 200 DMA. The NASDAQ Composite climbed 0.48 percent after being hit the hardest on Monday. The small cap, Russell 2000, with its domestically focused companies that are less exposed to international trade jitters, outperformed once again with a 0.67 percent climb—underscoring that tariff headwinds are still at the forefront of investor concerns.

Mixed trade policy signals by the US continue to paint a murky picture for investors: President Donald Trump signaled he may soften his stance on curbing Chinese investment, while Trade Representative Robert Lighthizer re-ignited tensions by attacking the retaliatory measures advanced by the EU and other trading partners. Meanwhile, the President of Federal Reserve Bank of Atlanta, Raphael Bostic, warned against the implications of wider dirsruptions in global trade.

The yield gap between 2-year and 10-year Treasury notes is now roughly 0.34 percentage points. The curve spread was last at these levels in 2007, when the US economy was heading towards what was arguably the worst recession in almost 80 years. This most likely underscores trader concerns over the longer-term economic implications of a fully-fledged trade war, but also the ongoing theme of accelerated monetary policy tightening by the Fed.

Still, to date, stocks listed on the S&P 500 and the Dow Jones remain in an uptrend since February, having consolidated since the January record, as well as in a very resilient bull market since the 2009 bottom. Moreover, both the NASDAQ Composite and the Russell 2000 hit fresh records last week, which clearly confirms they are also in a bull market.

The stronger dollar, buoyant for the fourth month out of five, provides further evidence of the current bull market. Not only is a rising USD a sign of confidence in the US economy, it underpins equity bullishness, as it shows that demand for US stocks is strong enough to sustain a costlier underlying currency.

Up Ahead

-

New Zealand and Indonesia monetary policy decisions on Thursday.

-

US personal spending probably increased in May for the third month, economists forecast ahead of Friday's data.

-

China manufacturing and non-manufacturing PMI are due on Saturday.

Market Moves

Stocks

-

The STOXX Europe 600 dropped 0.6, to the lowest level in more than 11 weeks.

-

Futures on the S&P 500 slid 0.5 percent to the lowest level in almost four weeks.

-

The UK’s FTSE 100 gained less than 0.05 percent.

-

The MSCI Asia Pacific Index fell 0.5 percent to the lowest level in more than eight months.

-

The MSCI World Index of developed countries lost 0.1 percent.

Currencies

-

The Dollar Index increased less than 0.05 percent.

-

The Japanese yen increased 0.3 percent to 109.78 per dollar.

-

The euro climbed 0.1 percent to $1.1661.

-

The British pound dropped less than 0.05 percent to $1.3223, the weakest level in a week.

Bonds

-

The yield on 10-year Treasuries fell two basis points to 2.86 percent, reaching the lowest in four weeks on its fifth straight decline.

-

Germany’s 10-year yield declined two basis points to 0.32 percent, the lowest in more than four weeks.

-

Britain’s 10-year yield declined three basis points to 1.273 percent, the lowest in almost four weeks on the biggest fall in more than a week.

Commodities

-

Gold slipped 0.1 percent to $1,257.95 an ounce, the weakest level in more than six months.

-

Brent crude climbed 0.5 percent to $76.72 a barrel, the highest level in two weeks.

-

LME copper fell 0.4 percent to $6,683.00 per metric ton, the lowest level in three months.