NYSE Cumulative Breadth Improves

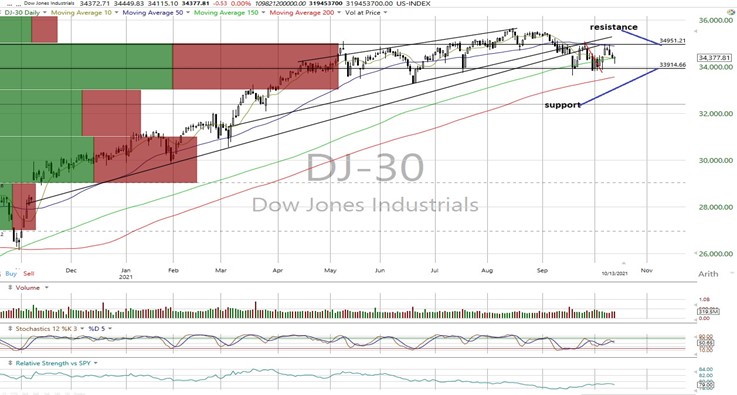

The major equity indexes closed mostly higher Wednesday except for the DJT posting a loss. All closed at or near their intraday highs as late session selling failed to appear for a change. Internals were positive on the NYSE and NASDAQ as NYSE volumes rose and NASDAQ volumes declined from the prior session. However, despite the day’s strength, there were no violations of trend or resistance or trend, leaving the index charts in a mix of negative neutral and positive near-term projections.

One positive from the session was improvement in the NYSE cumulative advance/decline line to positive from neutral. However, the data remains mixed with the McClellan OB/OS Oscillators neutral while the insider buy/sell ratio still finds insiders as active sellers lately. So, while the day was positive and the futures suggest a fairly strong open, the data and charts currently suggest our near-term “neutral/negative” macro-outlook for equities should be maintained.

On the charts, the indexes closed mostly higher yesterday with positive internals across the board.

- The only exception was the DJT posting a loss. They held on to their gains into the close for a change as all closed at or near their intraday highs.

- However, no technical events of import were generated other than the VALUA closed back above its 50-DMA.

- The DJT chart remains positive with the COMPQ and NDX still in near-term downtrends with the rest neutral.

- NYSE cumulative breadth turned positive form neutral but the All Exchange A/D remains neutral and the NASDAQ’s negative.

- No stochastic signals were generated.

The data finds the McClellan 1-Day OB/OS Oscillators remaining neutral (All Exchange: +23.98 NYSE: +35.53 NASDAQ: +14.74).

- The detrended Rydex Ratio (contrarian indicator) measuring the action of the leveraged ETF traders was unchanged and remains a neutral 0.24 as their bullish expectations have waned from their excesses at the market’s highs.

- Of note, the Open Insider Buy/Sell Ratio remains in bearish territory and unchanged at 20.0% as insiders continue to increase their selling activity.

- This week’s contrarian AAII Bear/Bull Ratio (38.9/27.83) remains mildly bullish as the “crowd” has become cautious. The Investors Intelligence Bear/Bull Ratio (22.5/40.4) (contrary indicator) saw a drop in bulls but remains neutral.

- Valuation finds the forward 12-month consensus earnings estimate from Bloomberg dipping slightly to $213.09 for the SPX. As such, the SPX forward multiple is 20.5 with the “rule of 20” finding fair value at approximately 18.5.

- The SPX forward earnings yield is 4.88%.

- The 10-year Treasury yield dipped to 1.55%. after a recent run to 1.61%. We see resistance at 1.62% with support at 1.47%.

In conclusion, yesterday’s market left the charts and data intact that continue to suggest our near-term “neutral/negative” macro-outlook for equities be maintained until enough evidence appears to suggest otherwise.

SPX: 4,300/4,427 DJI: 33,914/34,951 COMPQX: 14,292/14,670 NDX: 14,509/14,920

DJT: 14,256/14,731 MID: 2,624/2,723 RTY: 2,200/2,280 VALUA: 9,361/9,590

All charts courtesy of Worden

S&P 500

Dow Jones Industrials

NASDAQ Composite

NASDAQ 100

Dow Jones Transports

S&P Midcap 400

Russell 2000 Futures