American stocks advanced further yesterday. Nasdaq recorded a new historical high, as Google (NASDAQ:GOOGL) added 13.5% after trading day closure. Ebay (NASDAQ:EBAY) increased 3.4%, while Netflix (NASDAQ:NFLX) rallied 18%. Citigroup (NYSE:C) reported the maximum 8-year return, with its stocks rising 3.8%. From now on, most investors expect the overall corporate profit to drop 2.9%, as compared to previously estimated 3.1%. US dollar index edged higher when FRS reiterated the decision to raise the rate this year with due regard to economic performance. Today, it has slightly been pulling back ahead of June Consumer Price Index release at 14:30 CET. The tentative outlook is positive; however, it does not encourage a sooner rate hike. Building Permissions in June will be published at the same hour. University of Michigan will announce Consumer Confidence Index at 16:30 CET. The tentative outlook is negative. Today, investors expect the General Electric (NYSE:GE) quarter report, which may considerably affect markets. Despite the sharp growth of quotes, the American stocks turnover was 15% below the monthly average, making 5.6bln shares.

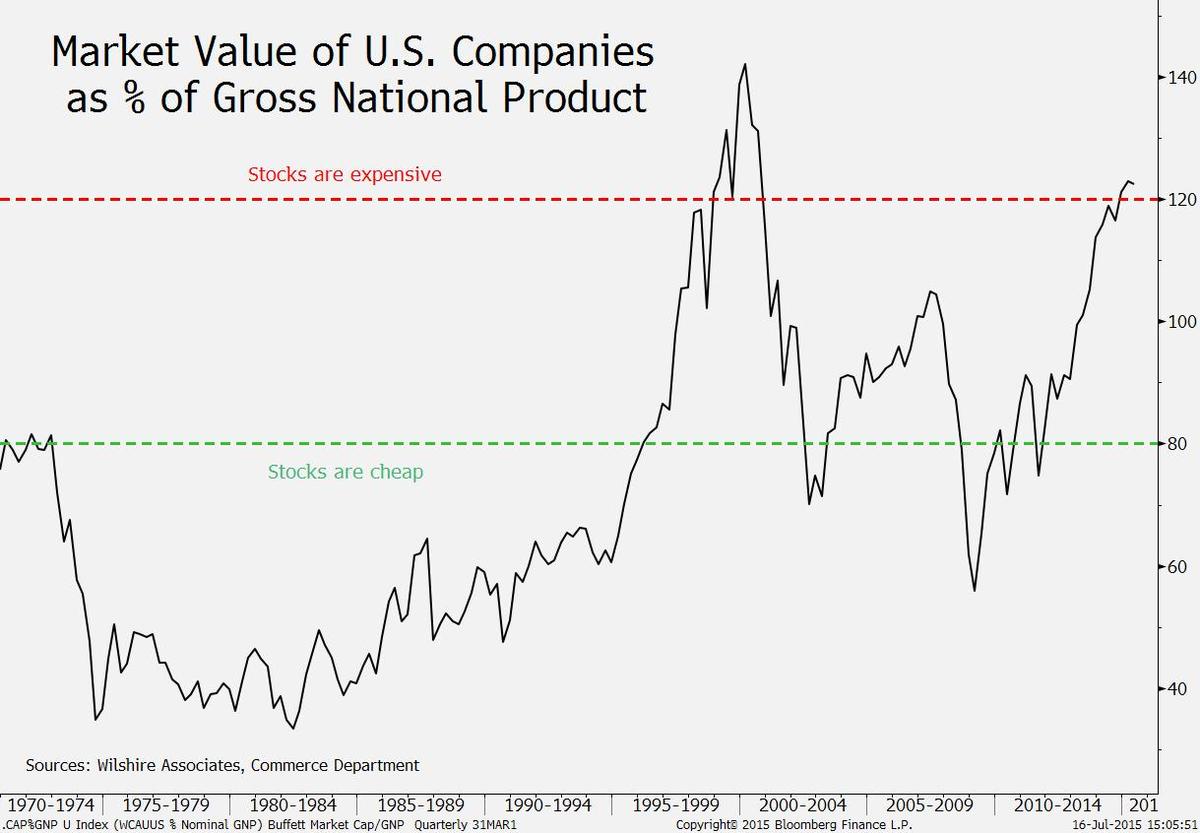

Warren Buffett Indicator reached the overbought zone, which may indicate that the American stock market is overpriced. The indicator is calculated as a relation of share capital to GDP (excluding inflation). We would like to remind that since the beginning of the year, S&P 500 has gained 3.2%, Dow Jones – 1.3%, and Nasdaq scored 8.5%. Federal Reserve System estimates that GDP will grow 1.8-2.0% in 2015. Office of Management and Budget (an institution affiliated to the US government) forecasts 2% GDP expansion this year and 2.9% growth in 2016. The outrunning advance of American stock indices will drive up the Warren Buffet Indicator.

European stocks increased yesterday together with American ones. According to economic data, Ericsson (ST:ERICAs) shares gained 5.6%, as Electrolux (OTC:ELUXY) climbed 2.8%. The market sentiment was improved by the Greek parliament ratifying the austerity measures agreement. It sharply decreases default risks and makes additional financial aid more likely. From now on, Greece will have both to cut pensions and to transfer property worth €50bln to the private sector. Most market participants expect corporate profit to add 5%. We believe it confirms that the European economy is more sustainable, as compared to the US. Since Greek default risks faded, the euro may stabilize. No important macroeconomic data is released today in the eurozone. Stoxx 600 may hit the weekly record since January.

Nikkei advanced today following global indices. It completed the 5-day winning streak, showing the best weekly performance since October – plus 5%. It was underpinned by Chinese stock market recovery as well. According to Japan Exchange Group, last week the amount of Japanese stocks net buying was 527bln shares, the highest since January 2014.

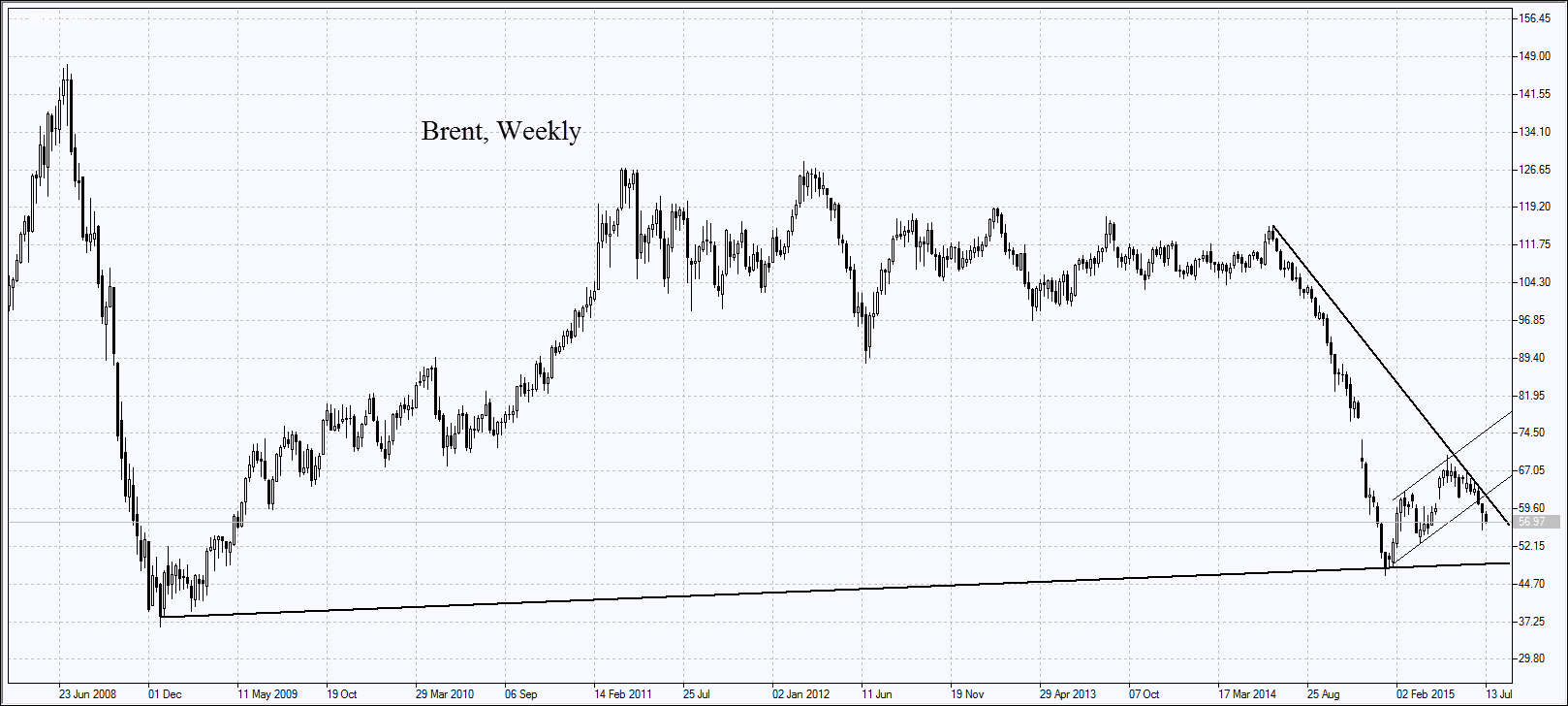

Oil prices dropped, as the first supertanker Starla, carrying 2mln barrels, sailed to Asia from Iran. After the recent sanctions lifting, Iran is going to boost production by 500 thousand barrels daily in 2 months. It may then expand 1mln barrels per day within 6-7 months. It is worth mentioning that since the beginning of the year, the Iranian rial plunged almost 9%. In theory, it may strengthen when the country gets additional oil money.