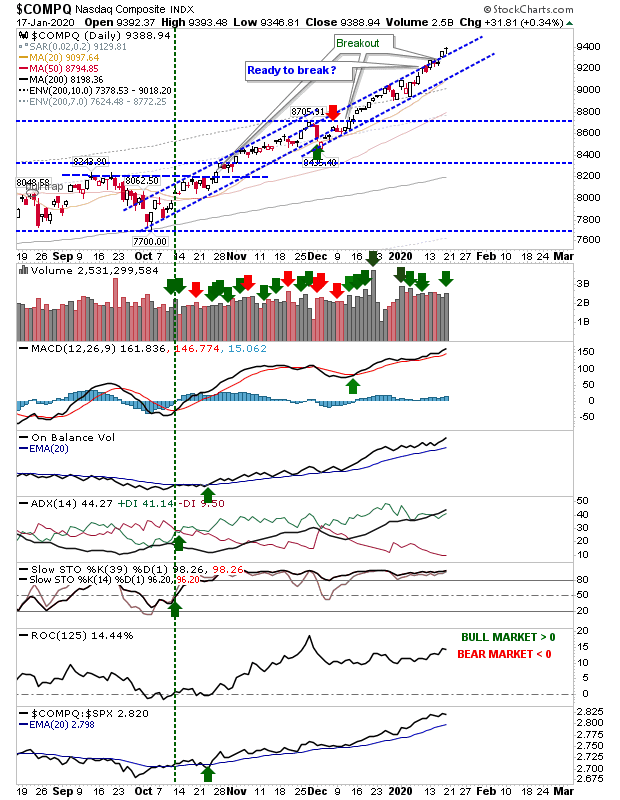

The NASDAQ is accelerating through channel resistance as relative performance continues its run of good form. Technicals are all good as Friday's action registered as accumulation.

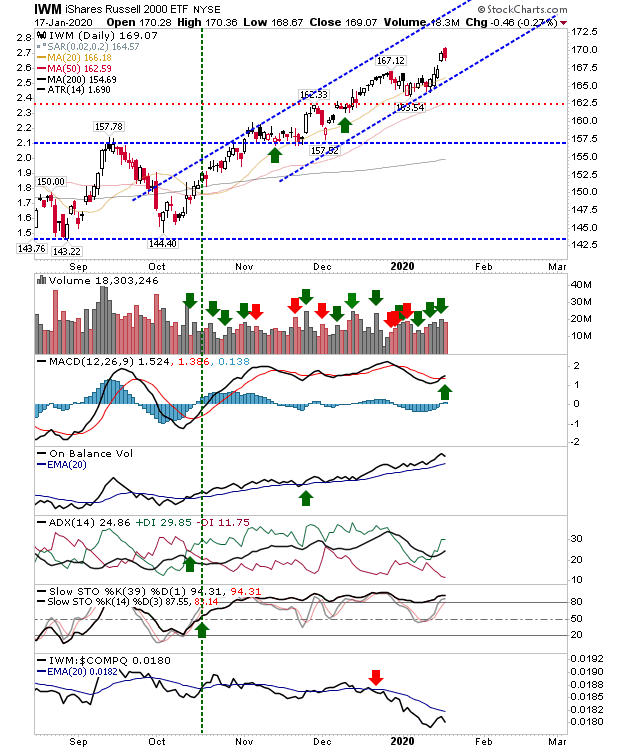

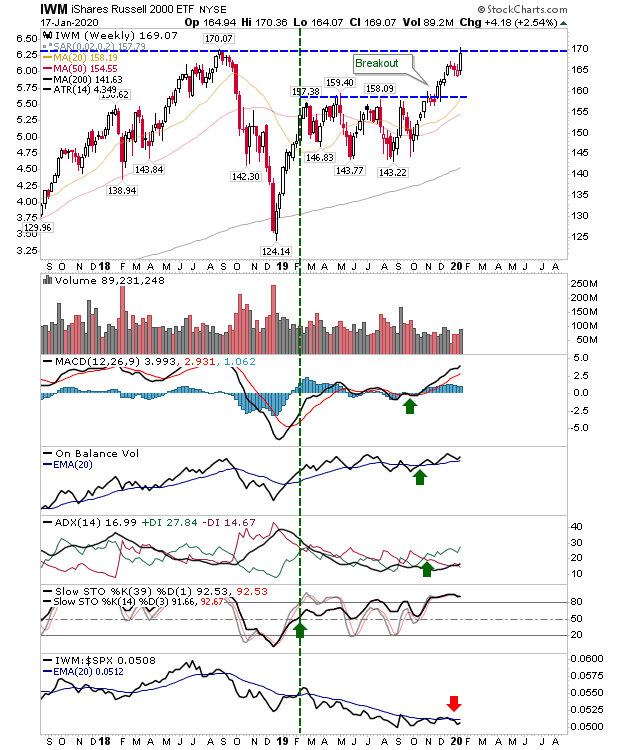

Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) actually registered a loss on Friday, but not before there was a MACD trigger 'buy.' Even with the selling, volume was light. And while relative performance has been falling off a cliff, the weekly chart is primed for a breakout.

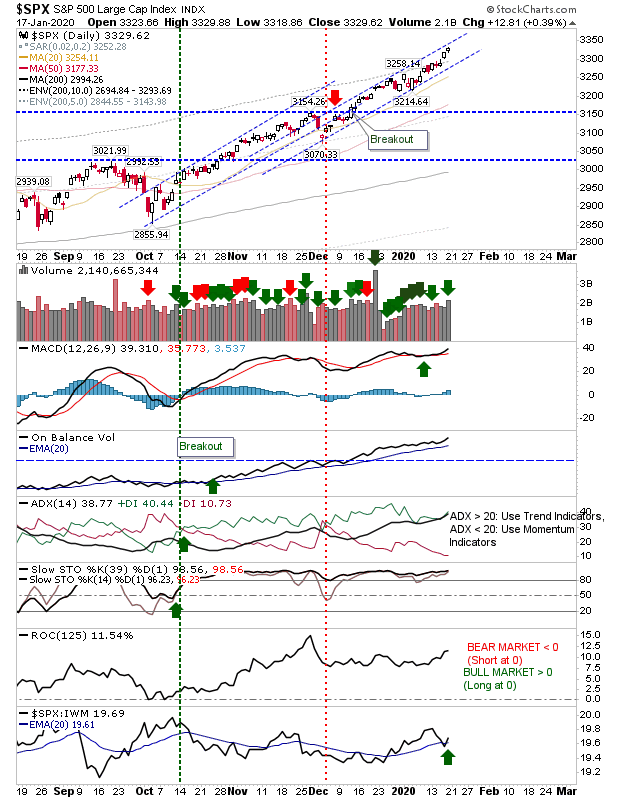

Large Caps enjoyed a middle-of-the-road finish to the week; a small gain, higher volume accumulation and an uptick in relative performance keep it on track for more gains. The trend in On-Balance-Volume is excellent and there isn't a whole lot to be concerned with here.

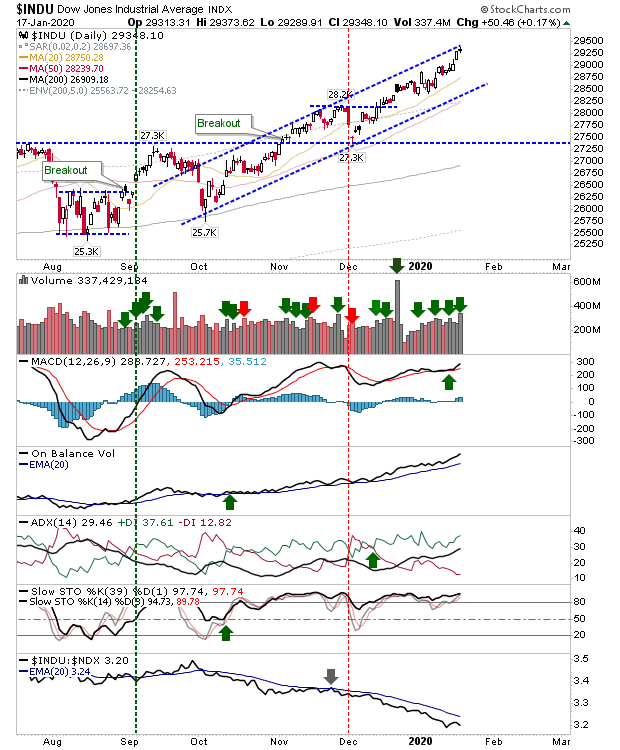

The Dow Jones may be a little different in that it is up against channel resistance but it has enjoyed a series of accumulation days on the back of a strong On-Balance-Volume trend.

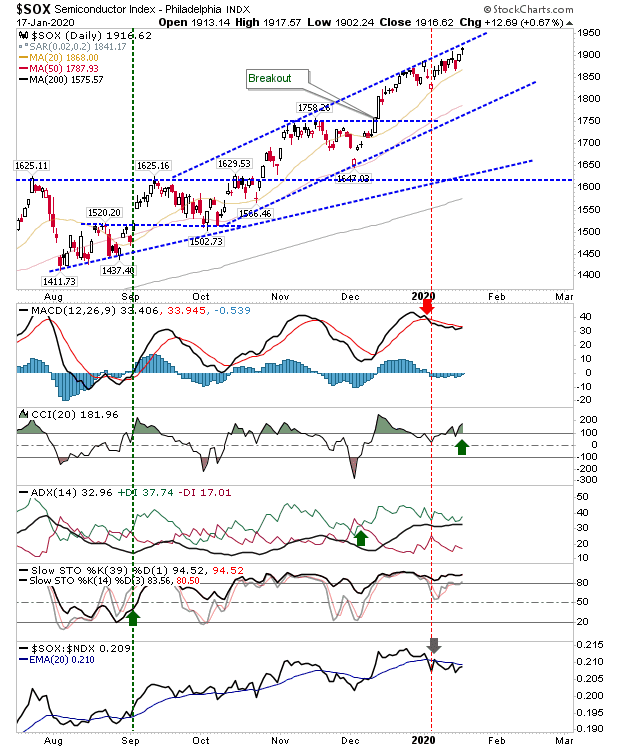

On a final note, the Semiconductor Index is up against resistance like Large Caps, although unlike the latter, there is a MACD trigger 'sell' to overcome along with relative under-performance against linked NASDAQ 100. Such a scenario is likely going to be bearish for Tech Averages should Semiconductors reverse off channel resistance—and runs a little counter to what we are seeing in the NASDAQ.

For now, watch what the Semiconductor Index does at resistance because what happens here will impact how the nascent channel breakout in the NASDAQ performs. I'm expecting the Semiconductor Index to run along channel resistance as the NASDAQ breakout continues; this should provide background support for a breakout in the Russell 2000 via the weekly chart.