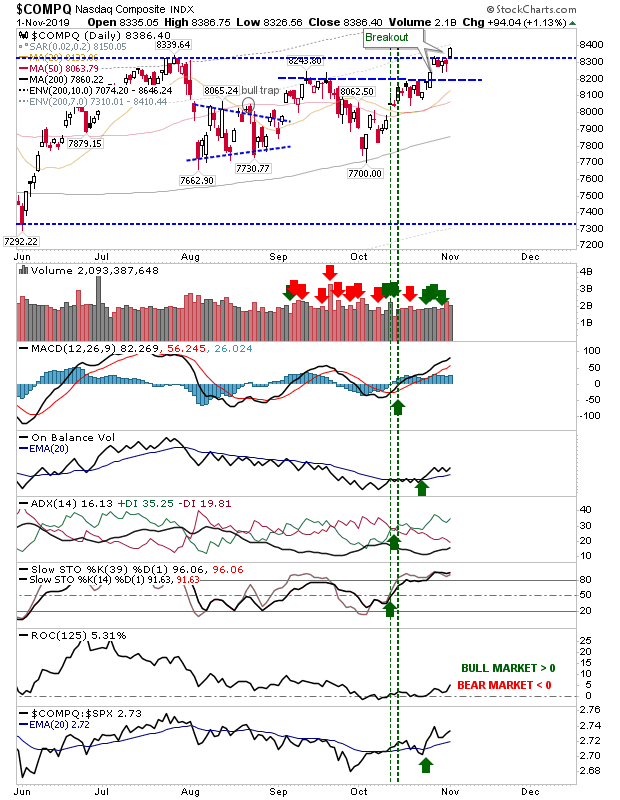

After the success of the S&P and Semiconductor Index, on Friday it was the turn of the NASDAQ to follow the lead action.

The NASDAQ pushed above 8,330 resistance on lighter volume but net bullish technicals.

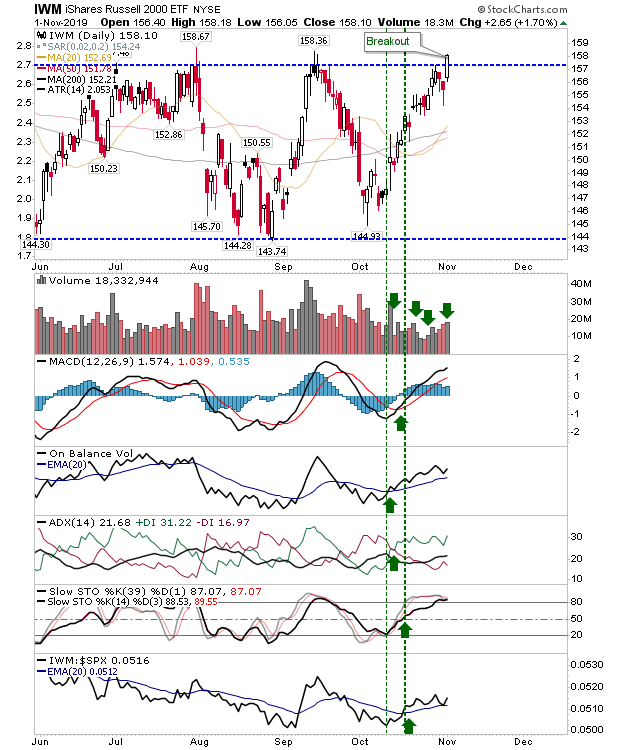

Small Caps also enjoyed a breakout after a strong recovery throughout October. Buying volume continued to fuel the rally in On-Balance-Volume—although no technical has yet to support price by posting a swing high of its own. There is at least a relative performance gain against the S&P to ride.

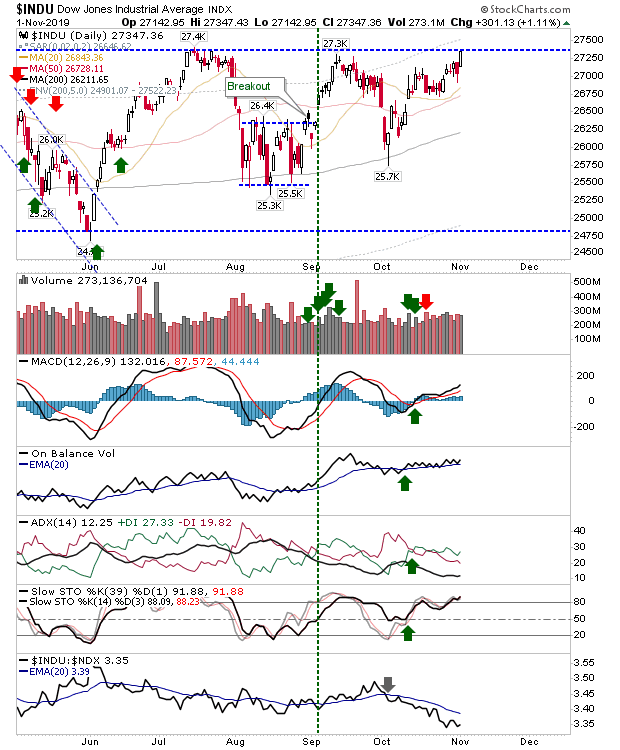

The Dow Jones Industrial Average is awaiting its breakout as it finished Friday nestled against resistance. It's suffering a relative performance loss against the NASDAQ 100, but On-Balance-Volume is primed for a breakout which may lead price higher.

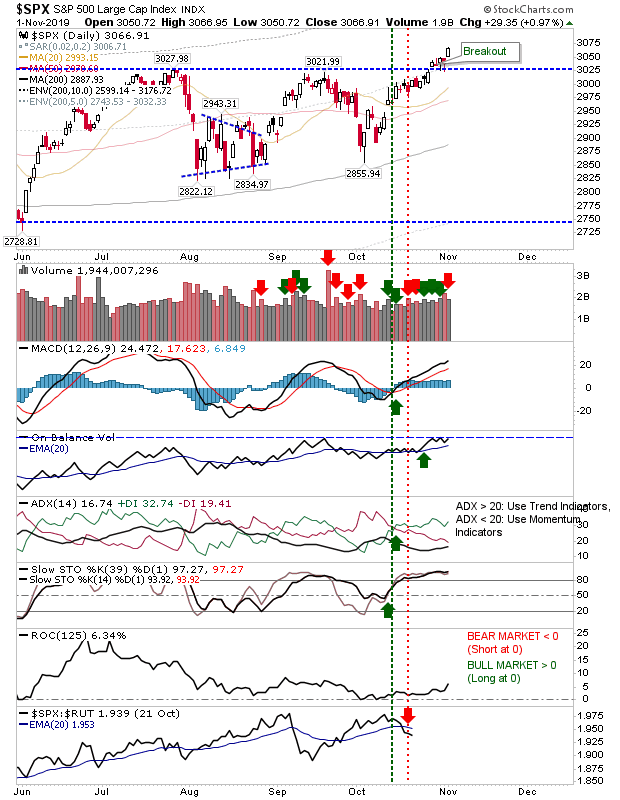

The S&P continued its advance after leading markets higher earlier in the week. There hasn't yet been a supporting breakout in On-Balance-Volume.

Markets are nearly all aligned with new highs and are well set up for end-of-year rallies. For this week it will be about defending breakouts and avoiding 'bull traps.'