Market Brief

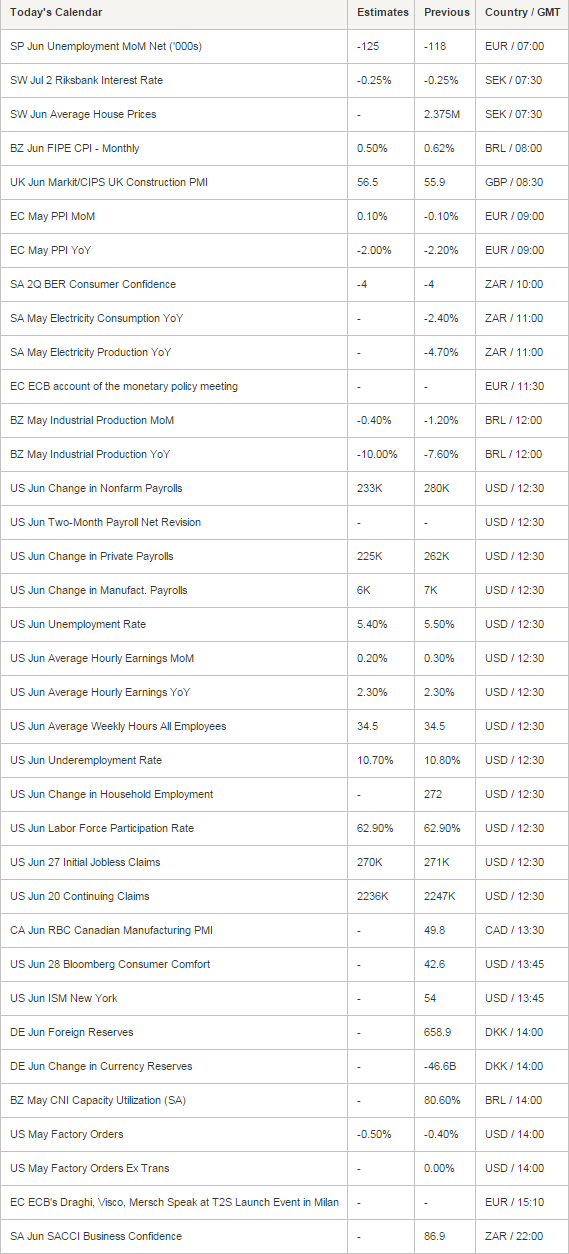

Markets are still focus on the Greek situation despite Eurozone finance ministers ruled out further talks with Greece’s government until the referendum that is scheduled to take place on Sunday. According to the latest GPO’s opinion poll published on Wednesday, 47.1% of voters will rather accept the term of the bailout while 43.2% will rather say “no”. The highly uncertain outcome is weighing on the single currency, dragging EUR/USD below the 1.11 threshold. EUR/USD has proven unable to break the strong support standing at 1.1067 (Fib 38.2% on May debasement). However, US June NFP are due this afternoon and will likely provide the small boost needed to break that support. The US economy is expected to have added 233k jobs during the month of June, while unemployment should print at 5.4%, according to the latest survey, from 5.5% a month earlier. However, given the current tense situation in Europe, we expect markets to show restraint in their reaction to upbeat data.

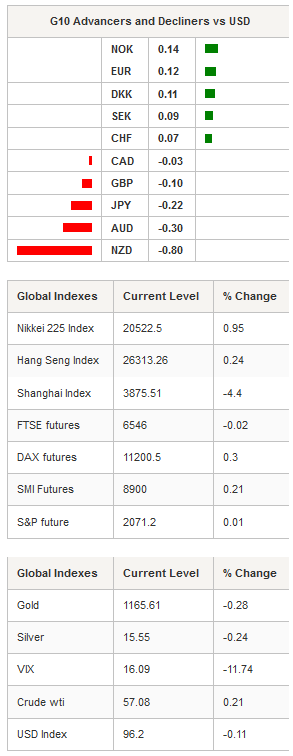

In the Asian session, equity returns are mixed this morning. South Korea’s KOSPI is taking advantage of a weaker KRW to add 0.45% while Japan’s Nikkei gained 0.95%. USD/JPY is gaining upside momentum and broke the 123.20 resistance (Fib 38.2% on May-June rally). However, the pair still needs to break the top of its declining channel (around 123.50-60) to validate a bullish momentum. In China, the stock market is going further south - the Shanghai Composite is down -4.40% and the Shenzhen Composite retreats -5.03% - despite regulator eases rules for brokerages margin trading in an attempt to end the “vicious cycle” of margin calls as falling prices are prompting more selling.

In Australia, the S&P/ASX is up 1.53% while AUD/USD is approaching the bottom of its 1-month range and remains in a short-term declining momentum. Fresh boost will be needed to break the strong resistance lying at 0.7587 (previous low). The kiwi pursues its free fall against the greenback and validated the break of the strong support standing at 0.6795. Next key support lies at 0.6561. New Zealand’s commodity prices continued to contract in June, however we may have reached the bottom as prices contracted -3.1% in June compared to -4.9% in May.

In Europe, regional equity markets edge up with Xetra DAX up 0.30%, CAC 40 up 0.31%, Euro Stoxx 50 up 0.34% and SMI up 0.21%. Only UK’s Footsie loses -0.02%. GBP/USD is finding strong support at 1.56 for the last 12 hours and currently sits on the level. The closest support stands at 1.5550 (Fib 50% on June rally) while the pair should find resistance slightly below 1.58. EUR/GBP is moving sideways for the last 2 days between 0.7060 and 0.7130.

Today traders will be watching the Riskbank’s interest rate decision and average house price from Sweden; Markit construction PMI from UK; May industrial production from Brazil; NFP, unemployment rate, wage growth, factory orders and Bloomberg consumer comfort from the US.

Currency Tech

EUR/USD

R 2: 1.1253

R 1: 1.1196

CURRENT: 1.1063

S 1: 1.0955

S 2: 1.0868

GBP/USD

R 2: 1.5930

R 1: 1.5715

CURRENT: 1.5598

S 1: 1.5501

S 2: 1.5369

USD/JPY

R 2: 125.86

R 1: 124.68

CURRENT: 123.44

S 1: 120.64

S 2: 118.33

USD/CHF

R 2: 0.9716

R 1: 0.9588

CURRENT: 0.9481

S 1: 0.9302

S 2: 0.9047