US stocks poised to advance after Senate tax bill approval

US stocks ended lower on Friday on political uncertainty concerns after President Trump’s former adviser Flynn pleaded guilty to lying to the Federal Bureau of Investigation. The dollar weakening continued: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.2% to 92.894. S&P 500 lost 0.2% to 2642.22. The US broad market index gained 1.5% for the week. Dow Jones industrial average slipped 0.2% to 24231.59. The NASDAQ Composite fell 0.4% to 6847.59. Futures indicate higher market openings after Senate passed republican’s tax bill early Saturday.

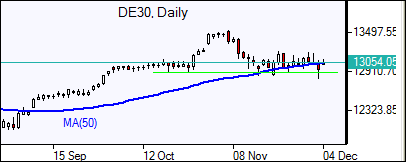

European stocks end week lower

European stocks extended losses on Friday on increasing US political uncertainty after Flynn’s guilty plea. The euro edged higher against the dollar while British Pound retreated. The Stoxx Europe 600 index ended the session down 0.7% posting 0.7% loss for the week. The DAX 30 was the worst performer down 1.3% to 12861.49. France’s CAC 40 fell 1% and UK’s FTSE 100 lost 0.4% to 7300.49. Indices opened 0.9%-1.5% higher today.

Asian markets mixed

Asian stock indices are mixed today. Nikkei ended 0.5% lower at 22707.16 despite yen resumed weakness against the dollar. Chinese stocks are higher: the Shanghai Composite Index is up 0.6% and Hong Kong’s Hang Seng Index is 0.02% higher. Australia’s ASX All Ordinaries is down 0.1% despite a decline in the Australian dollar against the greenback.

Oil lower

Oil futures prices are lower today on increasing US output concerns as Baker Hughes reported active US oil rigs count rose last week. Prices rose Friday on news OPEC and major producers agreed to extend their oil output cut deal to the end of December 2018. February Brent rose 1.8% to $63.73 a barrel on Friday.