Market Brief

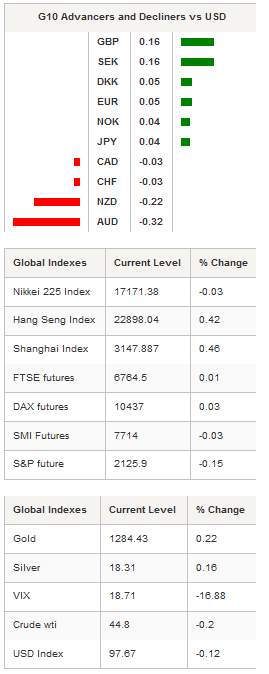

FX market stabilised during the Asian session as investors grew more cautious as we head into election day in the US. The dollar index moved between a very narrow range (97.70 - 97.83) in Tokyo as volatility eased across a range of asset classes. After falling to 1.1028 on Monday, EUR/USD consolidated slightly higher at around 1.1040. The 25 delta 1-week risk reversal measure, which jumped to 2.30% from 0.25% a week ago, suggests that investors are aggressively buying protection against a surprise debasement of the USD.

The move has been similar in USD/JPY and USD/CHF with investors aggressively buying downside protection. The 1-week 25 delta risk reversal measure fell to -3.74% and -2.30% respectively. Just like the single currency, USD/JPY treaded water in Asia and traded at around 104.50. USD/CHF moved between 0.9740 and 0.9753.

Safe haven currencies such as the Swiss franc and Japanese yen are significantly exposed to upside risk as investors have become prone to taking shelter in safe haven assets. After testing 1.0755 in the US session yesterday, EUR/CHF recovered slightly this morning, up 0.15% to 1.0772. The weak Swiss inflation figures released yesterday failed to reduce the strong CHF buying pressures. EUR/CHF is down 2% in October.

In the equity market, the relief rally is running out of steam as investors across the globe awaiting the outcome of the US election. The Japanese Nikkei was left unchanged at 17,171 points, while the broader Topix index rose 0.05%. In mainland China, the weak trade figures - exports were down 7.3%y/y in October, while imports fell 1.4%y/y in dollar terms - have had no effect on investor mood. The Shanghai and Shenzhen Composites were up 0.46% and 0.66% respectively. In Europe, futures are mixed this morning as investors consolidated their positions. The FTSE 100 was unchanged, the DAX edged up 0.03% and the SMI slid 0.03%. US futures were also mixed with the S&P 500 down 0.15%, the Nasdaq down 0.16% and the Dow Jones up 0.61%.

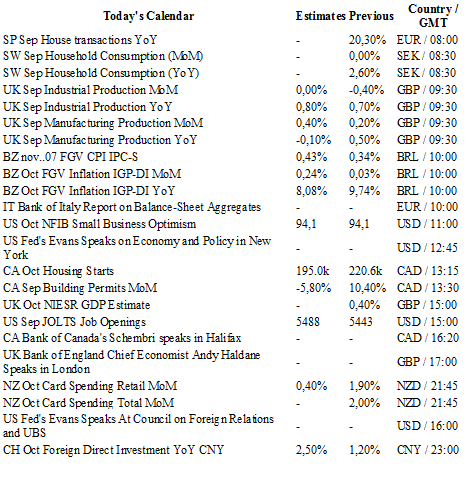

Today traders will be watching industrial and manufacturing productions from the UK; NFIB small business outlook, housing starts, JOLTS opening and Fed’s Evans’ speech in the US.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1210

CURRENT: 1.1061

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2557

CURRENT: 1.2430

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 107.49

R 1: 105.53

CURRENT: 104.46

S 1: 102.55

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9742

S 1: 0.9632

S 2: 0.3954