Market Brief

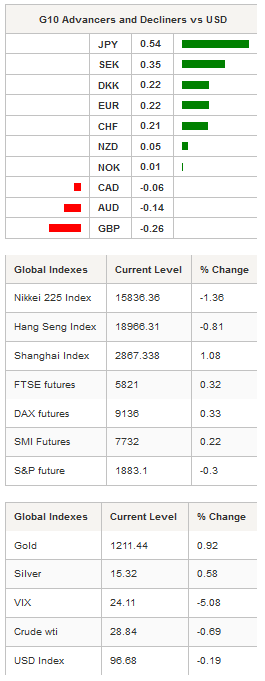

In spite of an improving risk environment, equity indices kept moving lower during the Asian session as the PBoC set the USD/CNY fixing higher to 6.5237, up 0.16% compared to yesterday. With the exception of mainland Chinese indices, Asian regional were broadly trading in negative territory as fears of another sell-off are still very much present. From our standpoint, the worst may be behind us as the market gradually realises that nothing justifies the sell-off, which started at the beginning of the year. Even if it is true that most developed economies send mixed signals, we are still far from being in a recession as it looks more like a temporary slowdown. In Japan, the Nikkei fell 1.36% and the Topix settled down 1.13%. In mainland China, equity indices reacted positively to the yuan’s devaluation as the Shanghai and Shenzhen Composite were up 1.08% and 1.42%, respectively. Offshore, Hong Kong’s Hang Seng slipped 0.81%, while in Singapore the STI fell 1.24%. Elsewhere, Thai shares were down 0.80%, in Taiwan the Taiex edged up 0.03%, while in India the Sensex fell 0.67%. European equity futures are mixed this morning as traders struggle to pick a side between bear and bull.

Overnight, the downward shift of the entire US yield curve weighted on the greenback. On the short end of the curve, the 2-year rates fell 2bps to below 0.70%, while on the long end the 10-year slid 3bps to below 1.75% as recession’s fears as still very much present. The US dollar index, which measures the dollar against a basket of currencies, was down 0.20%. The slide of the US index was limited by the fall of the commodity currencies. AUD/USD continued to move lower and stabilised around the $0.71 level, while the loonie fell as much as 0.35% before erasing early session’s losses. From our standpoint, the bias in AUD/USD remains on the downside as the US dollar appears to have been oversold over the past few weeks.

Safe haven currencies took advantage of this risk-off environment as both the Swiss franc and the Japanese yen appreciated against the greenback in overnight trading. USD/JPY continued to slide further, dropping below the 113.50 level, down 0.50%. USD/CHF fell 0.33% during the Asian session as the pair lack the strength to break the 0.99 resistance to the upside. We’ll need to see a significant improvement in the risk sentiment before we see USD/CHF trading higher.

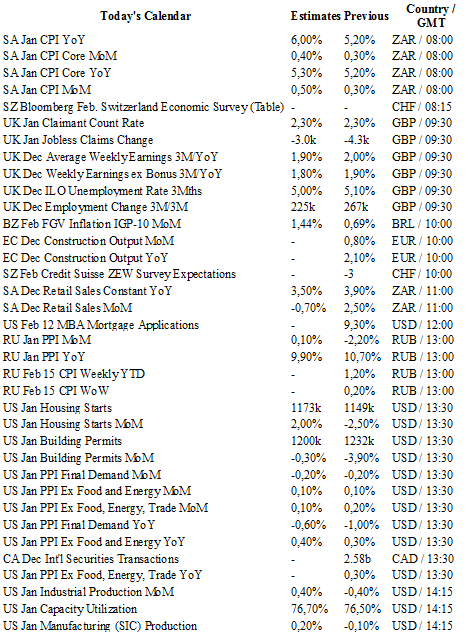

Today traders will be watching CPI report and retail sales from South Africa; jobless claims from the UK; ZEW survey from Switzerland; MBA mortgage application, housing starts, building permits, PPI, industrial production, capacity utilisation and the publication of the minutes of the last FOMC meeting from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1261

CURRENT: 1.1167

S 1: 1.1070

S 2: 1.0711

GBP/USD

R 2: 1.4668

R 1: 1.4591

CURRENT: 1.4272

S 1: 1.4150

S 2: 1.4081

USD/JPY

R 2: 123.76

R 1: 115.17

CURRENT: 113.72

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0328

R 1: 0.9985

CURRENT: 0.9863

S 1: 0.9661

S 2: 0.9476