Volume surged heading into Christmas week as Triple Witching for options expiration kicked in on Friday. Things are likely to grow quieter in the next couple of weeks as holiday season begins.

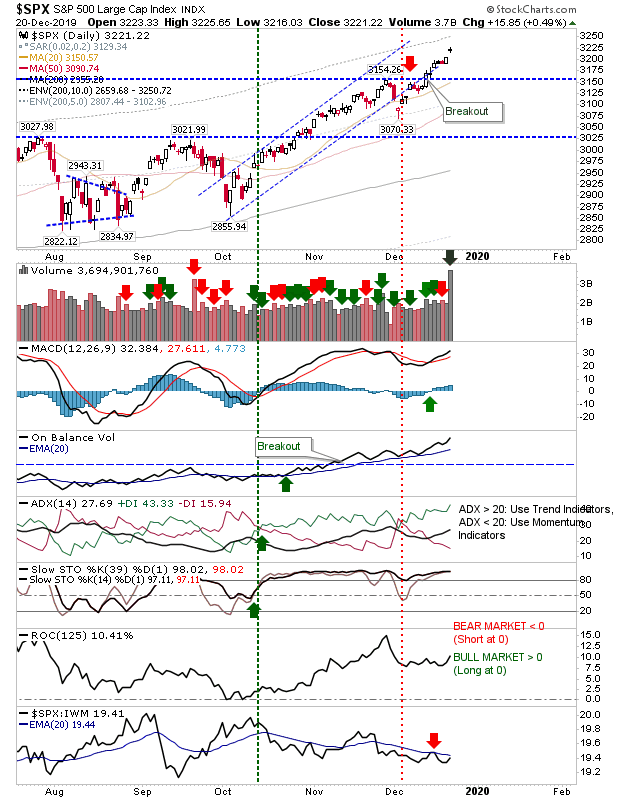

The S&P added less than 0.5% on Friday, but it did mean a new high for the index. The technical picture hasn't changed with all technicals, bar relative performance, in the green.

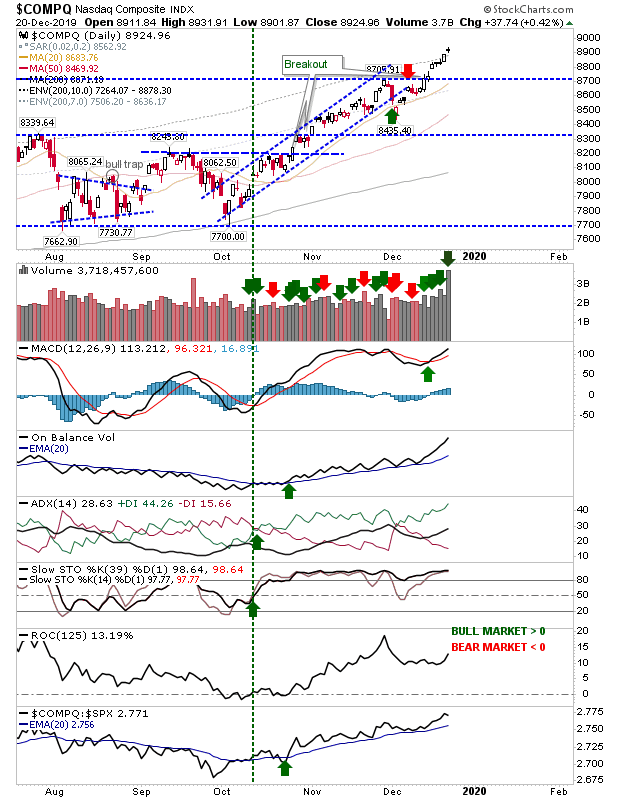

The NASDAQ kept its rally going with an over 1% gain. Unlike the S&P, technicals are all positive along with relative performance (vs the S&P).

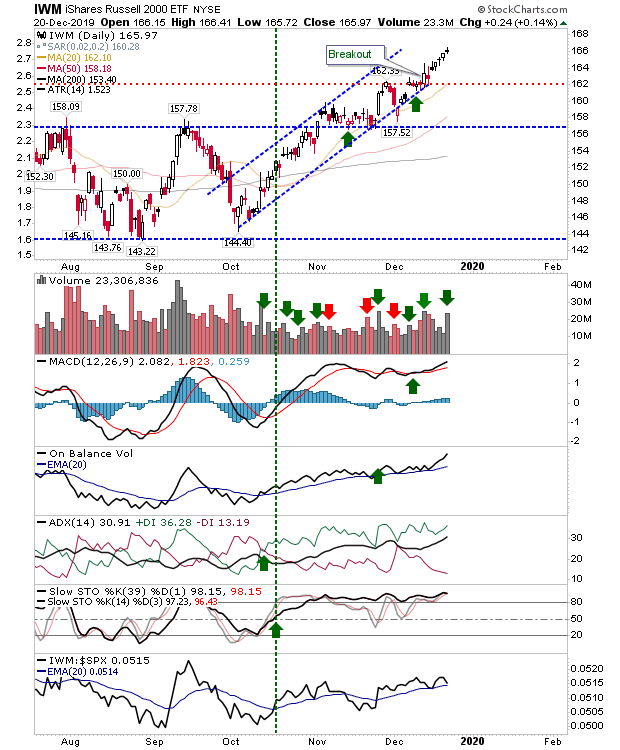

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) chugged along as it added new near term highs but hasn't yet made it to challenge 2018 highs. It doesn't look like it will do this before the year is out so this is something to look forward to for 2020.

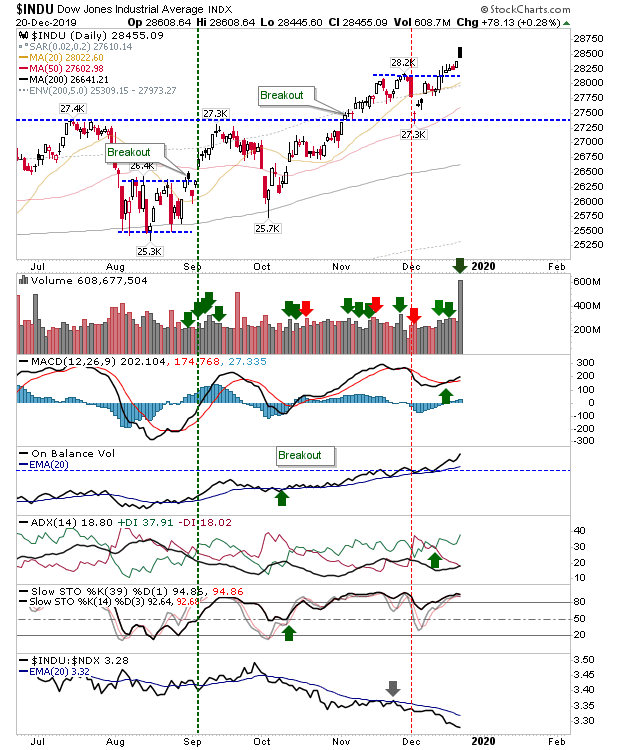

The Dow Jones has managed a little mini-breakout from the December consolidation. The only downside was the black candlestick, which is often a bearish marker at the top of a rally; for this to hold true we will need to see a gap down today.

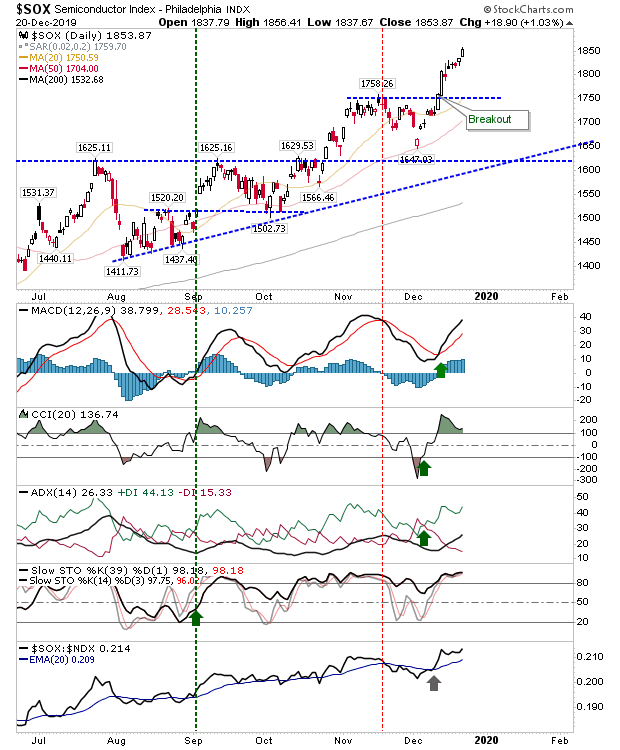

Semiconductors continue to trailblaze. It was the best performing index on Friday as it added 1%. Technicals are all positive and relative performance vs the NASDAQ 100 is still good, repeating the same story of the last couple of weeks.

For this coming week, look for rallies to at the very least hold—and maybe even build on the gains they have had to date.