After weeks of relatively tight trading markets stretched their legs today.

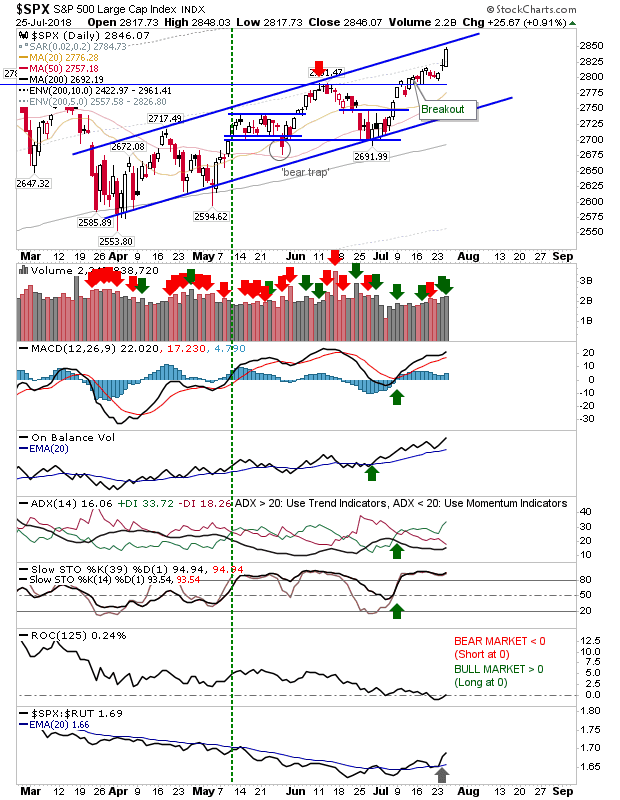

The S&P 500 took advantage of yesterday's gap to squeeze shorts on higher volume accumulation. Today's gain hasn't quite tagged channel resistance but did register as accumulation. Technicals are all bullish along with an acceleration in relative performance over Small Caps. Large Caps to lead into the Fall?

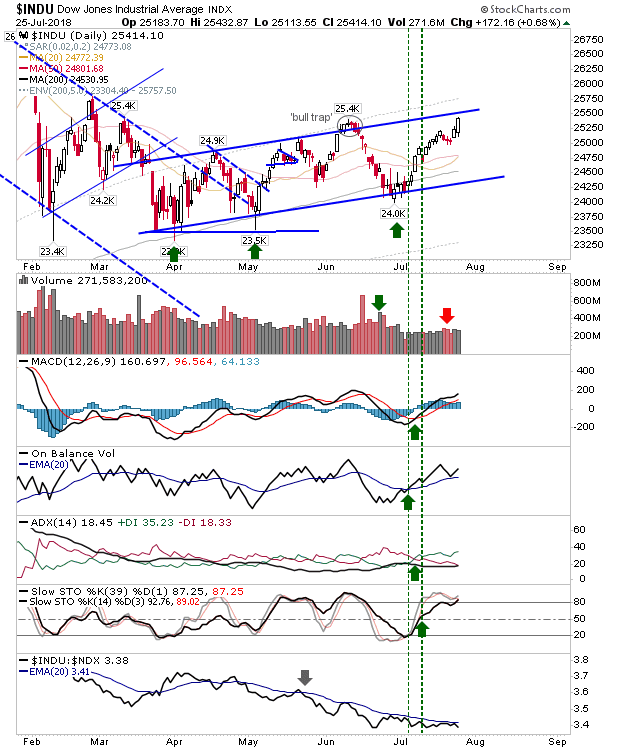

The Dow Jones is also coming up against channel resistance. Technicals are positive but it hasn't yet reached a point of relative outperformance against the Nasdaq.

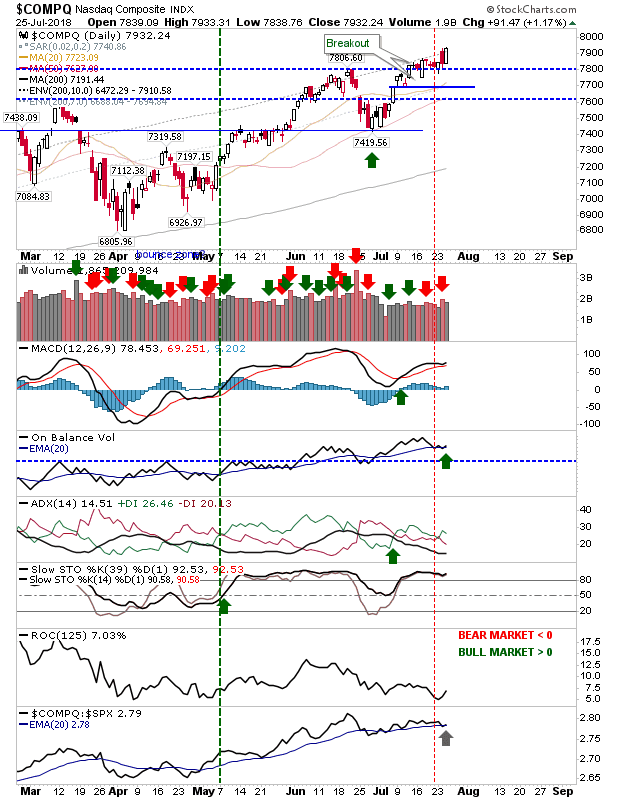

Tech indices did not disappoint, the Nasdaq was able to return yesterday's losses as it closed at a new all-time high. However, the Nasdaq is losing some ground against the S&P which may represent into s rotation into less speculative Large Caps.

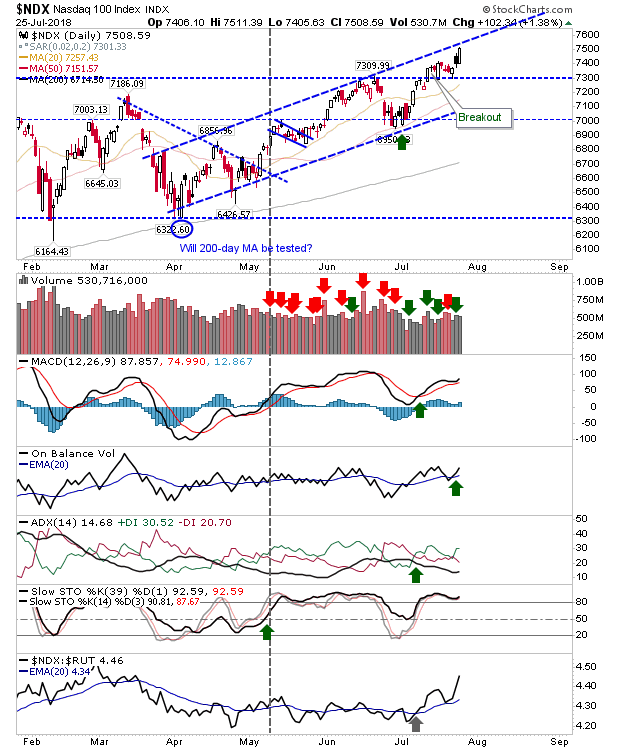

The Nasdaq 100 is in a little better shape but will soon find itself challenging channel resistance. Relative performance has moved markedly in Tech favor (against Small Caps). Other technicals are strong.

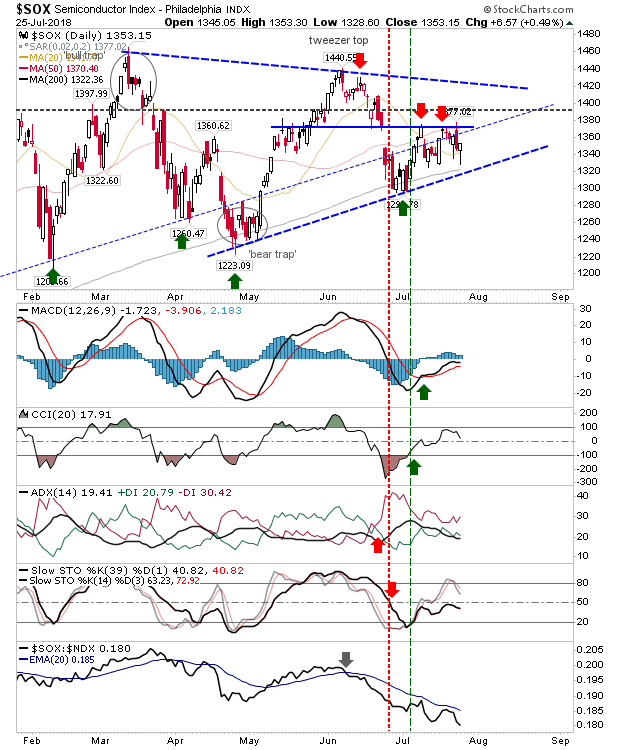

Helped by a resilient Philadelphia Semiconductor Index which finished with a second bullish hammer in three days; this is an index to be respected and shorts should probably cover if not already.

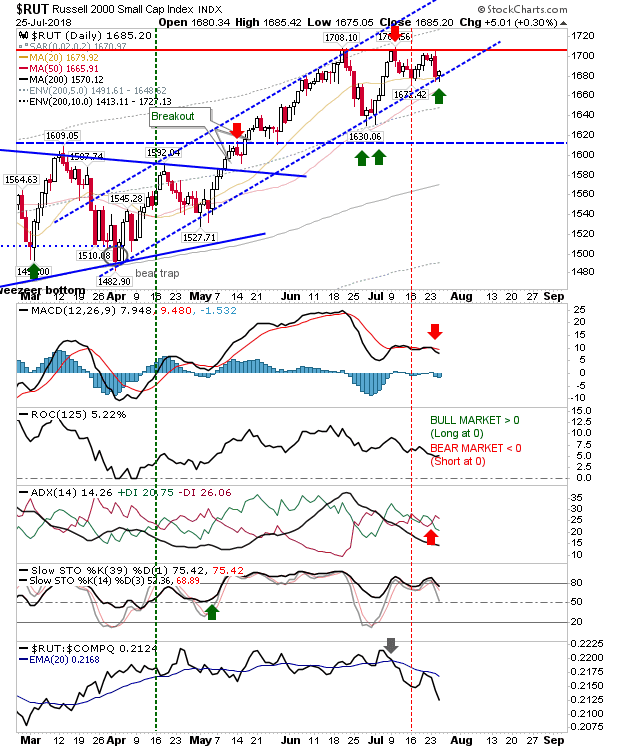

The Russell 2000 was the only disappointment; it lost ground yesterday and failed to make much of an impression in recovering those losses today. However, the tight action at channel support and converged 20-day / 50-day MA is an ideal, low-risk buying opportunity.

For tomorrow, the Russell 2000 is the long play of choice but only if other indices look likely to add to their gains. While Small Caps are experiencing a period of underperformance (as marked by weak relative performance) the risk:reward as of today's close looks worthy of an opportunity.