Insiders Step Up Buying Activity

The major equity indexes closed mostly higher Monday except for the DJI and RTY posting losses. As occurred last Friday, the advances were accompanied by negative breadth on the NYSE and NASDAQ that suggests an increase in selectivity among the issues able to participate with market strength.

While not dire, we remain of the opinion that poor breadth has the potential to prove problematic. Most of the indexes closed at or near their intraday highs with one chart closing above resistance and its 50 DMA. So, the near-term trends are now positive on all but two of the charts as breadth remains debatable.

The data dashboard continues to send a generally neutral message. However, there was a notable and welcome improvement in insider buying. While the overall tone has improved to some degree, we are maintaining our near-term “neutral” macro-outlook for equities as the market is becoming more selective as not all boats are rising with the tide.

On the charts, most of the major equity indexes close higher except the RTY and DJI posting losses.

- Internal breadth, however, was negative again on both the NYSE and NASDAQ.

- The one technical event of import registered yesterday was the NDX managing to close above resistance and its 50 DMA and is now near-term bullish. As such, only the COMPQX and RTY are neutral with the rest positive.

- Cumulative market breadth deteriorated on the All Exchange as it turned neutral from positive as is the NASDAQ cumulative A/D. The NYSE’s remains positive and above its 50 DMA.

- All stochastic levels are now overbought but no bearish crossover signals have been generated thus far.

The data finds the McClellan 1-Day OB/OS Oscillators are all in neutral territory (All Exchange: +30.18 NYSE: +48.05 NASDAQ: +17.06).

- The detrended Rydex Ratio (contrarian indicator) measuring the action of the leveraged ETF traders remains neutral but lifted to 0.89.

- Of note, the Open Insider Buy/Sell Ratio saw a sizable increase in insider buying activity as it rose from 28.6 to 50.8. While still neutral, it is an encouraging improvement.

- This week’s contrarian AAII Bear/Bull Ratio (36.43/30.5) remained mildly bullish as bears still outnumber bulls. The Investors Intelligence Bear/Bull Ratio (22.7/42.1) (contrary indicator) remains neutral.

- Valuation finds the forward 12-month consensus earnings estimate from Bloomberg lifting to $213.79 for the SPX. As such, the SPX forward multiple is 21.0 with the “rule of 20” finding fair value at approximately 18.4.

- The SPX forward earnings yield is 4.77%.

- The 10-year Treasury yield remained at 1.58%. We see resistance at 1.62% with support at 1.47%.

In conclusion, the primary issue for our keeping our near-term macro-outlook for equities at “neutral” is the increase in the level of selectivity for participants in market strength.

SPX: 4,384/4,488 DJI: 34,452/35,418 COMPQX: 14,479/15,000 NDX: 14,834/15,356

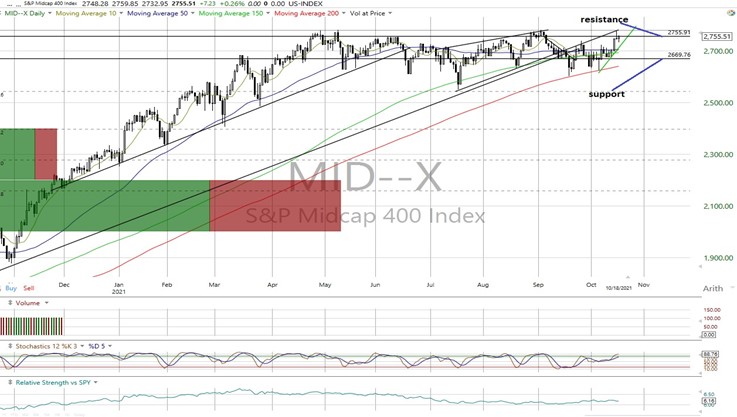

DJT: 14,600/15,304 MID: 2,670/2,756 RTY: 2,240/2,290 VALUA: 9,464/9,827

S&P 500

Dow Jones Industrials

NASDAQ Composite

NASDAQ 100

Dow Jones Transports

S&P Midcap 400

Russell 2000 Futures