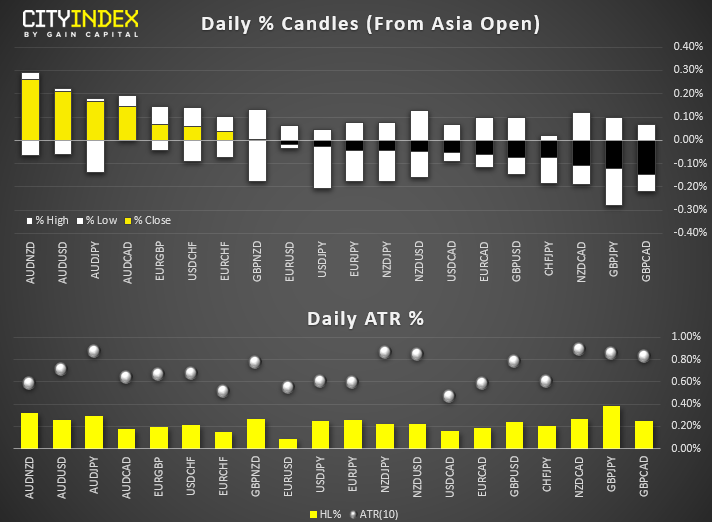

FX Brief:

The U.S. are to hit Europe with a 10% tariff on European-made Airbus plan and 25% on French wine, Scotch and Irish Whiskey and continental cheese.

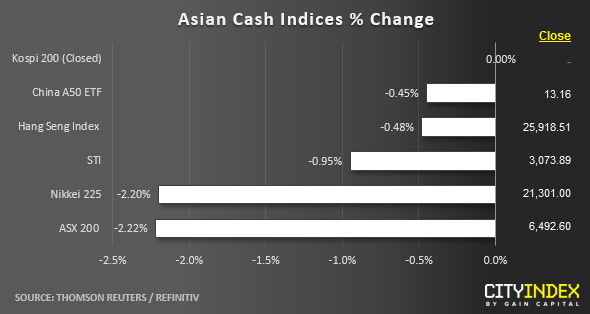

Equity Brief:

- Asian stock markets have continued to see further downside, taking the cue from another bloodbath seen overnight in the U.S. stock markets. In additional, the U.S. benchmark stock index, S&P 500 has seen its first back to back drop of more than 1% in 2019. South Korea’s KOSPI 200 has managed to “escape” the bleeding as its stock exchange is closed today for a public holiday.

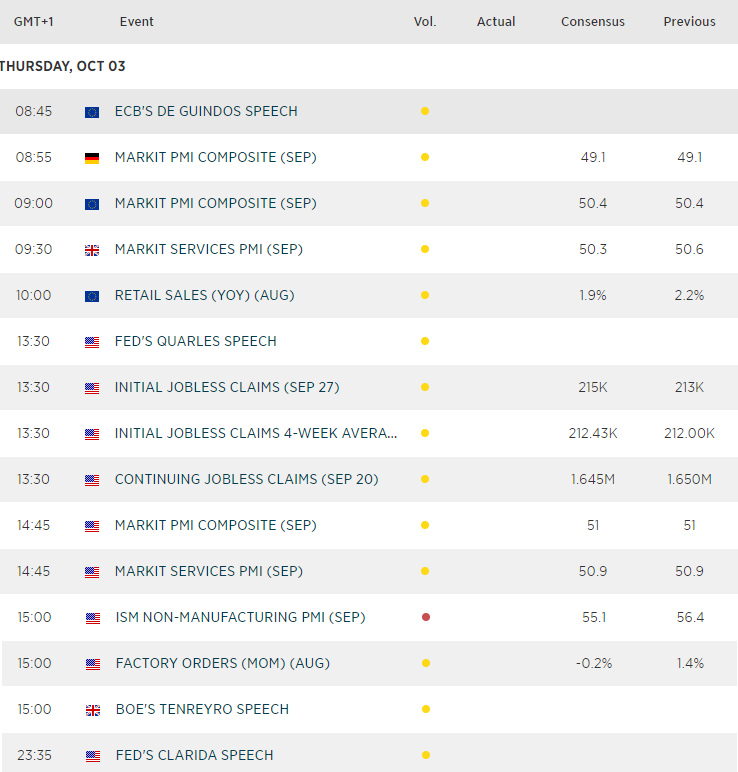

Up Next

- Final PMI reads for France, Germany and the Eurozone are released early in the European session. Major revisions aren’t expected but if they are lowered, it simply feeds into the negative sentiment regarding global growth. Keep Euro crosses and DAX on your radar.

- However, the highlight could be ISM’s non-manufacturing PMI for the U.S. Given we saw ISM manufacturing tank to a 10-year low this week, Non-manufacturing (NM PMI) could receive extra scrutiny. Although NM PMI has remained expansive since the GFC, a slower rate of expansion points towards a broader slowdown and could exacerbate risk-ff sentiment if it slows enough later today. Therefor a weak print could weigh on USD and U.S. indices.