The people who buy and sell stocks for a living seemed to panic in mid-June. The way they saw things, the Federal Reserve was suddenly signaling it might start raising interest rates again—at the end of 2022 instead of sometime in 2023.

Mind you, the Fed did not explicitly say it would raise rates. Only that some of the people who vote on rate changes thought rates might have to go up earlier than anticipated because of a stronger-than-expected rebound from the economic ravages wrought by the COVID-19 pandemic.

Investors didn't care. They started selling and—over a three-day period—knocked the S&P 500 Index down 2% and the Dow Jones Industrial Average down 3% from their June 15 closes. The NASDAQ Composite and NASDAQ 100 reacted less strongly, falling less than a half percentage point each.

But then, as quickly as the selling started, it stopped. The people who buy and sell stocks, it seemed, ceased worrying and bought stocks, especially technology shares.

Apple (NASDAQ:AAPL) rose about 6% in the last eight trading days of June. Microsoft (NASDAQ:MSFT) jumped about 5%; its market capitalization moved above $2 trillion, joining Apple.

Graphics chipmaker NVIDIA (NASDAQ:NVDA) shot up about 12.7% from a June 17 intraday low.

As a result, the S&P and Dow gained 3.2% and 3.6%, respectively after June 18 through the Wednesday, the final day of trading for the month, with the NASDAQ up 3.4% and the NASDAQ 100 rising 3.6% over the same period.

Decent But Not Spectacular

June 2021 proved a decent month, though not a spectacular one. The S&P 500 finished June up 2.2%, its fifth straight monthly gain, largely because of strength in technology, consumer discretionary, real estate and energy stocks. For the quarter, the index was up 8.2%, 14.4% for the year.

The Dow struggled for much of June, falling back a tiny 0.08% over the full month, its first decline after four up months.

The weakness came because gains for Nike (NYSE:NKE), Apple, Microsoft and Visa (NYSE:V), all listed on the 30-component index, were offset by weakness in Caterpillar (NYSE:CAT), Boeing (NYSE:BA), JPMorgan Chase (NYSE:JPM) and Travelers (NYSE:TRV).

Still, don't cry for the mega cap index. It rose 4.6% for the quarter and has gained 12.5% for the year.

Nevertheless, the real stars for the month were the NASDAQ and NASDAQ 100. The former jumped 5.5%, after hitting six new closing highs during June and has risen nearly 13% on the year.

The NASDAQ 100 Index rose 6.4%, its best monthly performance since November, as it hit seven new closing highs during the month. The benchmark was up 11.2% for the quarter and 12.9% for the year. It has surged thanks to new highs from the likes of Microsoft, Facebook (NASDAQ:FB) and NVIDIA.

What caused investor worries about the Fed to subside? There was enough chatter from Fed chairman Jerome Powell and others to ease worries that inflation was transitory and would moderate. So, the U.S. central bank would not have to engage in policy that would kill inflation. Rather, Powell said, the Fed is about putting people back to work as the threats from the pandemic seemed to be easing.

In fact, many states are lifting most—if not all—restrictions as more of the U.S. population gets vaccinated.

Bond markets took Powell's assurances to heart, and yields moved lower. In fact, the 10-year Treasury yield fell to 1.44% in June from 1.58% in May. The yield peaked at 1.77% in March.

The exercise did remind investors far and wide of a great reality: What the Fed says and what people think the Fed says may not always be the same thing.

The market's reaction to the Fed's pondering on how to bring rates back to more normal levels post- pandemic seemed to act as a brake on stocks in June and in the second quarter.

And bond yields suggest there are investors skeptical about how fast the economy can grow going forward. There was an expectation that much of President Joseph Biden's agenda would happen. But Democrats and Republicans, as usual, cannot get along.

There were other issues besides the Fed in June:

- Relative strength indexes for the NASDAQ and the NASDAQ 100 have been above 70 since Monday, a signal the indexes are getting overheated. RSI is a widely watched momentum indicator. Crossing 75 is a signal an index or stock is now vulnerable to a selloff.

- While the S&P 500 is positive for the month, fewer than 220 stocks out of 505 (accounting for companies with multiple share classes) were higher on the month. Thirteen of the 30 Dow stocks were higher. That suggests money may be heading only toward winners. Which can lead to market destabilization.

- Market exuberance has ebbed. On Mar. 12, according to Barchart.com, 823 stocks hit new 52-week highs with just one stock hitting a new 52-week low, for a net new high of 822. The gap has slowly narrowed since. Tuesday, there were 123 new highs and 26 new lows or 97 net new highs. Shares that made many appearances at new highs in June included Microsoft, Costco (NASDAQ:COST), Target (NYSE:TGT), NVIDIA, Facebook, Adobe Systems (NASDAQ:ADBE), coronavirus vaccine maker Moderna (NASDAQ:MRNA) and Smith & Wesson (NASDAQ:SWBI).

- Oil prices marched steadily higher with WTI closing up 10.8% for June, 24% for the second quarter and 50% for the first half of the year. The rise in fuel costs hit airline stocks as did the stresses carriers faced just getting staffed up to handle a reopened economy. Delta Air Lines (NYSE:DAL) fell 9.3% for the month (but is up 7.6% for the half-year). Other U.S. airlines shares are down similarly.

- Tight supplies in many markets sent home prices soaring to extraordinary levels this year, pushing materials prices, especially for lumber and other building materials. Lumber futures hit $1,700 per thousand board feet in May. Shawn Kelly, editor of Eugene, Ore.-based Random Lengths, said its composite measure of lumber prices peaked at $1,515 per thousand board feet in May. The price has fallen 44.6% in a little more than a month to $854. In 2019, the composite price was $319.

It's not clear why this unease has crept into markets or even if it's serious. It may be that the rapid re-opening of the U.S. economy has just been too big of a surprise, producing stresses no one had thought about.

That said, the underlying U.S. economy should strengthen as more people are vaccinated and others return to work.

But there are risks as well, including:

- The Delta variant of the virus and how fast it spreads and the seriousness of infections.

- Global tensions, particularly in the Middle East, Eastern Europe and around China.

- Domestic tensions, especially over former President Donald Trump supporters still unwilling to acknowledge his loss to President Biden.

- Weather-related events, including hurricanes and wildfires.

The June jobs report due Friday from the U.S. Labor Department could move markets up or down, depending on the numbers. Investing.com is projecting nonfarm payrolls will grow by 700,000 from May with the unemployment rate at 5.7%, down from May's 5.8% level.

What worked in June

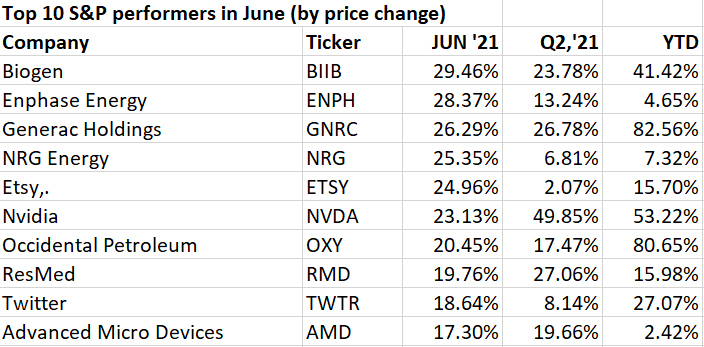

The broad, SPX benchmark had its winners... :

Source, next two charts: S&P Dow Jones Indices

And on the sector level:

Technology: Among the winners: Enphase (NASDAQ:ENPH), NVIDIA, Adobe and Advanced Micro Devices (NASDAQ:AMD), all up better than 16% for the month. Of interest: Cathie Wood's Ark Innovation ETF (NYSE:ARKK) was up 17.7% in June after sliding in May. Ark Innovation was hot in recent months because of bets Wood has made in what she calls disrupters. Tesla (NASDAQ:TSLA) has been a core holding.

Energy: Stocks in this sector include Occidental Petroleum (NYSE:OXY), up more than 21%; Diamondback Energy (NASDAQ:FANG), up 18%, and Marathon Oil (NYSE:MRO), up abut 12%. Higher oil prices will lift stocks, even if OPEC+ decides to boost production at this week's meeting. ETFs specializing in energy-related stocks have been strong, too.

Consumer Discretionary: Crafting vendor ETSY (NASDAQ:ETSY), eBay (NASDAQ:EBAY), CarMax (NYSE:KMX), Nike and Chipotle Mexican Grill (NYSE:CMG) led the pack. Tesla was up nearly 10%, and Amazon (NASDAQ:AMZN) added 7.4% but is up 6.4% on the year.

Communications Services: Twitter (NYSE:TWTR), up 18% was the leader here; other gainers included Facebook and Netflix (NASDAQ:NFLX), up about 6% each.

Health Care:Gainers here include biotechnology company Biogen (NASDAQ:BIIB), up 31% for June, medical-equipment maker ResMed (NYSE:RMD), up 19.8% and Moderna, up 19% for the month and 125% for the year.

What didn't work:

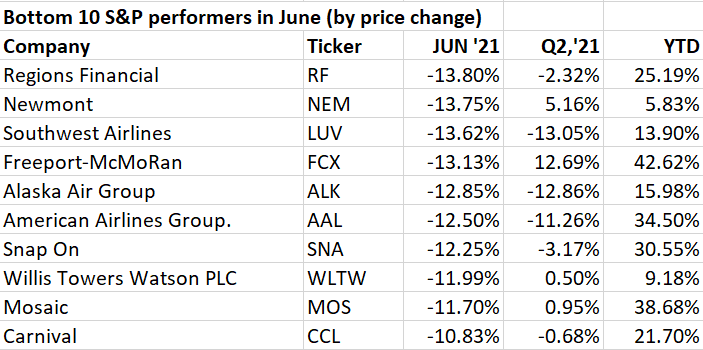

And its losers:

Home builders: This group includes D.R. Horton (NYSE:DHI), down more than 5.6% and PulteGroup (NYSE:PHM), down 5.7%. Interest rates aren't the problem. Available lots to build on are.

Banks: Citigroup (NYSE:C) and Huntington Bancshares (NASDAQ:HBAN) were both off 10%. Regions Financial (NYSE:RF) dropped 13.8%. Interest rates ARE the problem. They're too low and squeeze profits.

Materials: Freeport McMoRan Copper & Gold (NYSE:FCX), fertilizer maker Mosaic (NYSE:MOS) and gold producer Newmont Mining (NYSE:NEM) all dropped more than 12%. Even copper has fallen, a victim of a rising dollar. It is, however, up 22% for the year.