Market Brief

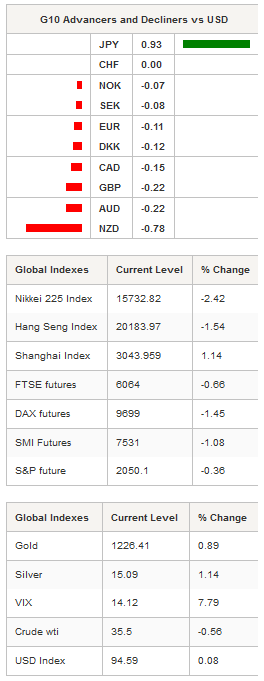

On Monday, the greenback continued to slide further amid disappointing economic data from the world’s largest economy. Factory orders contracted 1.7%m/m in February, matching expectations, while January’s increase was revised lower to 1.2% from 1.6%. Durable goods orders contraction for February was revised lower to -3.0%m/m from -2.8% consensus and first estimate. Since the beginning of the year, the US economy continues to send mixed signals as most sectors of the economy struggle in the strong dollar and weak global demand environment. As a result, investors continue to further delay the timing of the next rate hike, increasing pressure on US treasury rates. Monetary policy sensitive 2-Year yields fell to 0.72% yesterday, while the 5-Year yields slipped more than 5bps to 1.18%. As a result, the probabilities - extracted from the overnight index swap - of a rate hike in April have fallen to 1.2%, while the odds for a June hike currently stand at 18%. We therefore maintain our bearish view on the US dollar. EUR/USD continued to move sideways in Tokyo, moving within its weekly range between the 1.1335 support and the 1.1438 resistance.

As expected, the Reserve Bank of Australia left its benchmark rate at record low 2% but reiterated its view that a weaker Aussie was required to allow a smooth adjustment of the economy. Governor Stevens said that “under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy”. The Australian dollar jumped to 0.7632 after the release of the decision as investors were expecting more dovish comments from the RBA. However, AUD/USD progressively reversed gains, sliding to 0.7590.

In Japan, equities fell sharply amid the release of disappointing PMI figures and faltering confidence in the BoJ’s ability to address disinflationary pressures. The Nikkei 225 was off 2.42%, while the broader Topix index slid 2.64% to 20,184 points. The Japanese yen rose strongly against the US dollar, up 0.93% in Tokyo. USD/JPY broke the 110.67 support and is now heading towards the next one, which lies at 110 (psychological level and previous resistance). Further south, a support can be found at 105.23.

Elsewhere, with the exception of mainland Chinese equity markets, which re-opened after a long weekend, Asian shares are blinking red across the screen. Hong Kong’s Hang Seng was off 1.54%, while in Singapore the STI slid 1.28%. The Shenzhen and Shanghai Composites were up 1.46% and 2.61% respectively. European futures are pointing to a lower open with futures on the Euro Stoxx 600 down 1.54%.

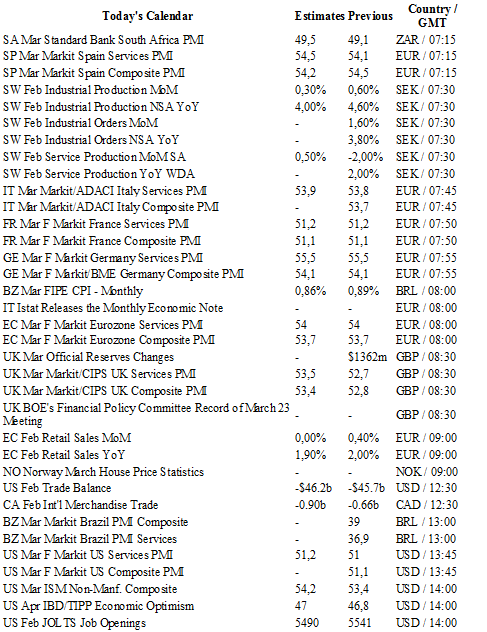

Today traders will be watching Markit PMIs from Brazil, Spain, Italy, France, Germany, the UK and the euro zone; industrial production from Sweden; retail sales from the euro zone; Markit PMIs, trade balance, ISM non-manufacturing and JOLTS opening from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1495

CURRENT: 1.1359

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4591

R 1: 1.4459

CURRENT: 1.4226

S 1: 1.4033

S 2: 1.3836

USD/JPY

R 2: 113.80

R 1: 112.68

CURRENT: 110.60

S 1: 110.00

S 2: 107.61

USD/CHF

R 2: 0.9913

R 1: 0.9788

CURRENT: 0.9595

S 1: 0.9476

S 2: 0.9259